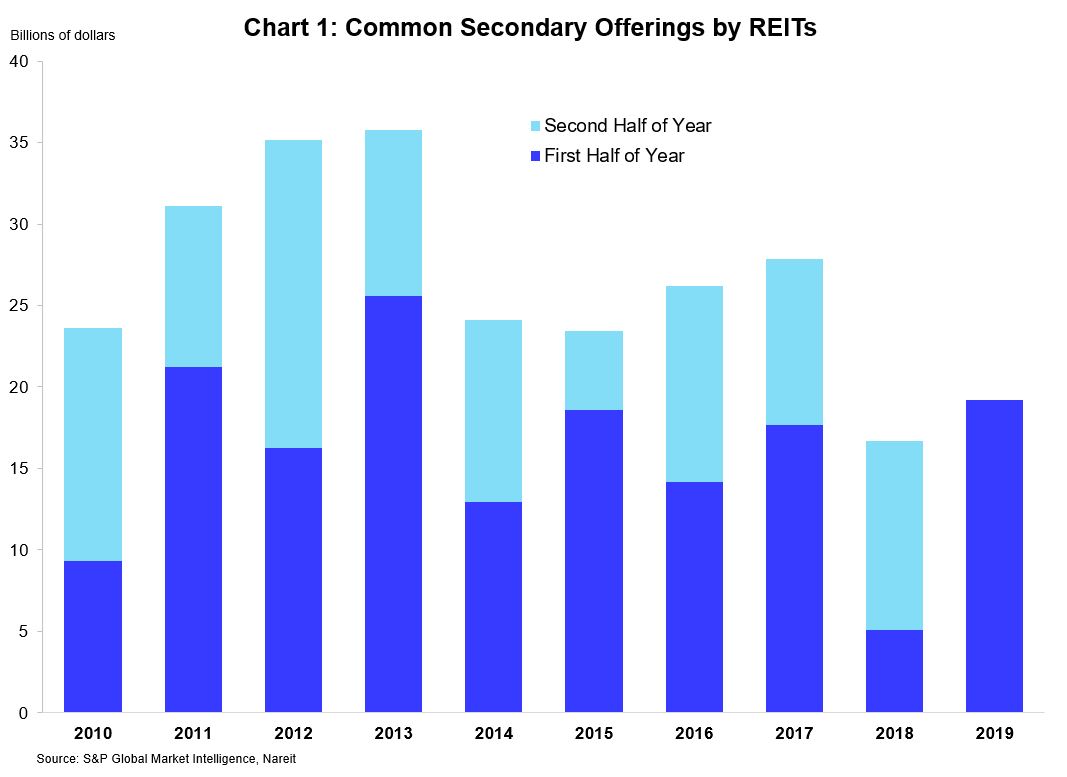

REITs issued $19.2 billion in secondary offerings of common equity during the first half of 2019, which is more than they raised during the entire year of 2018. Indeed, if REITs maintain this pace in the second half, total issuance could approach a new record for the sector. REIT share prices rose to an 11.9% premium over NAV, estimated by Green Street Advisors, the highest since 2013 and following a long period where share prices had been at a discount. Higher share prices lowered REITs cost of capital making it an opportune time to raise equity.

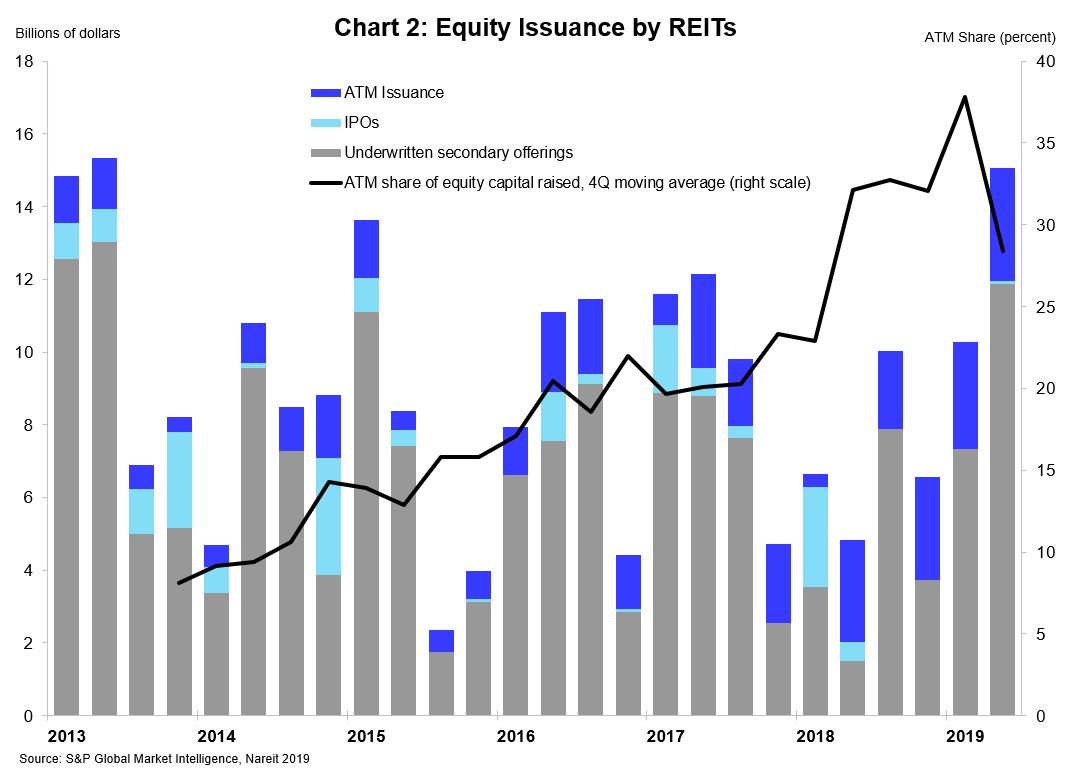

At-the-market (ATM) issuance has become an increasingly important part of raising equity in a low-cost and flexible manner. Equity raised through ATM programs topped $3 billion in Q2 for the first time and represented 28% of total equity raised over the past four quarters. REITs have been steadily increasing the amount of equity they gather from ATM programs versus traditional underwritten offerings over the past couple of years. Issuance in the past year and a half has been particularly robust with REITs raising over $2 billion in four out of the previous five quarters. Higher equity issuance reflects a strong outlook for the sector and will help fund new opportunities for REIT investors.

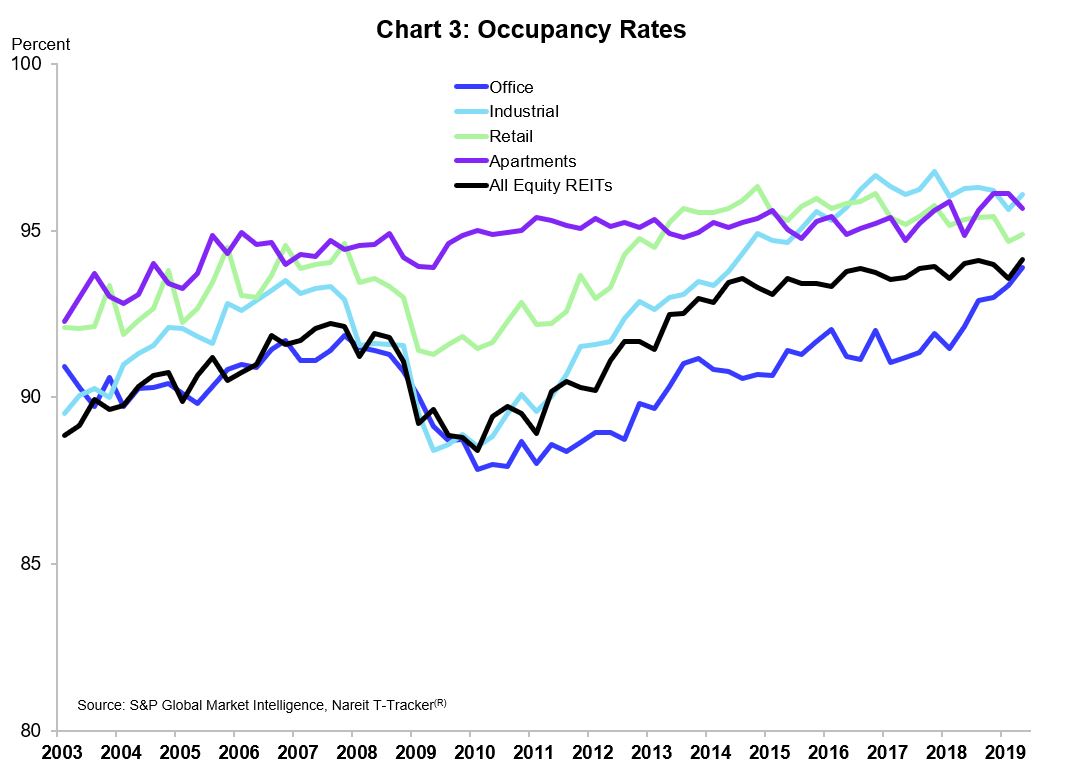

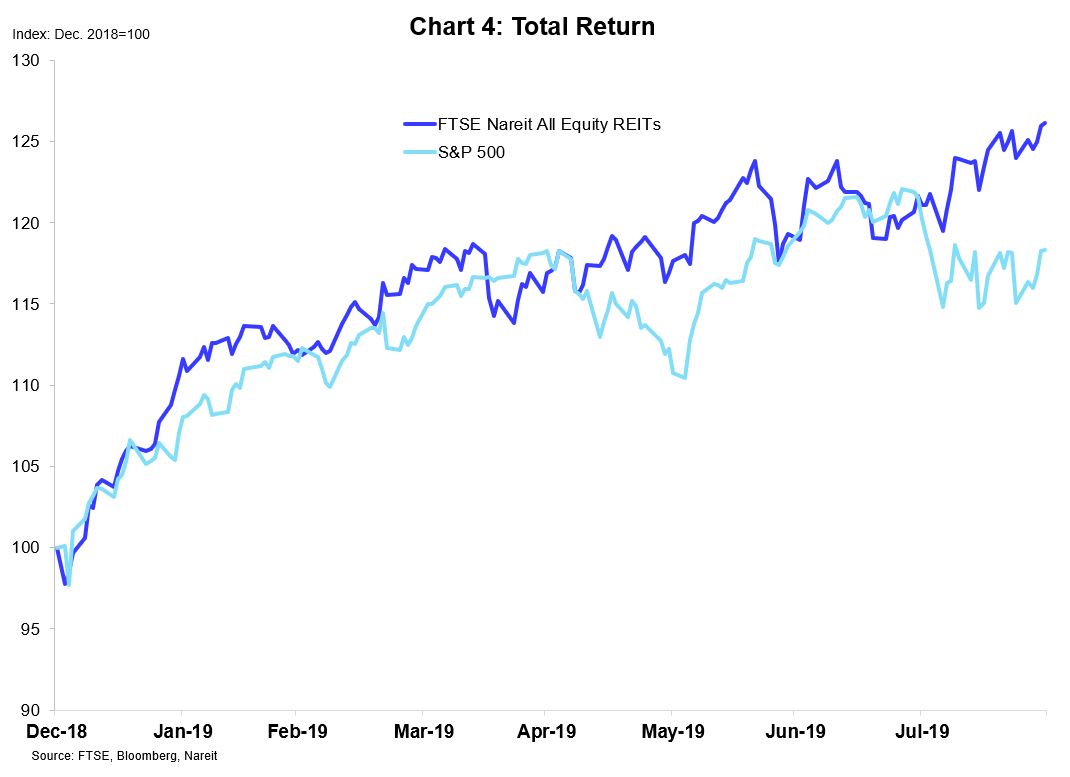

The favorable outlook for REITs is supported by solid fundamentals and strong returns. FFO and dividends paid continue to grow as occupancy rates rose to record highs in the second quarter (see Nareit T-Tracker for more performance data on REITs). REITs also lead U.S. equity markets in 2019 with a 26% total return year-to-date, far ahead of the 18% posted by the S&P 500. Strong earnings and returns means good news for the company, investors, and outlook for the sector.