FFO increased 2.0% in Q1, with wide variation across property types; REITs maintain strong balance sheets, low leverage ratios

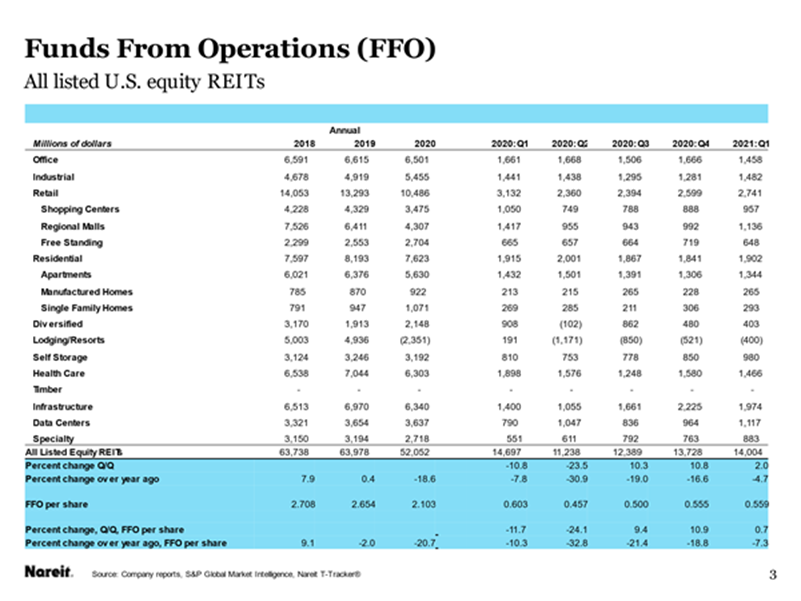

WASHINGTON, D.C., (May 21, 2021) – After two consecutive quarters of double-digit growth, REIT earnings recovery slowed in the first quarter of 2021. According to the Nareit Total REIT Industry Tracker Series (T-Tracker®) report released today, FFO for all equity REITS rose 2.0% to $14.0 billion.

“Different parts of the economy are reopening at different speeds, and REIT performance by property sector reflects this variation,” said Calvin Schnure, Nareit senior economist. “The recovery is broadening with the vaccine rollout, however, and prospects for improvement have gone from ‘if’ to ‘when’."

First quarter REIT earnings performance varied significantly by sector:

Digital economy sectors maintained their strong performances in first quarter of 2021.

- Data centers saw a 15.8% rise in FFO to a record high of $1.1 billion

- FFO for industrial rose 15.7% to$1.5 billion, also a record high

- FFO of Infrastructure REITs declined 11.3% from the record level in the prior quarter. Even with this decline, FFO for the sector was the second-highest level ever.

The Retail sector – one of the sectors hardest hit by the pandemic – reported a 5.5% rise in FFO, and has recovered more than a third of the decline in FFO that occurred during the 2020 spring economic shutdowns.

- Regional malls saw the greatest increase in FFO, up 14.5%

- FFO for shopping Centers rose 7.8%

- FFO for free standing fell 9.9%

Office and diversified sectors showed continued declines in the first quarter of 2021, while lodging/resorts reported negative FFO for the fourth consecutive quarter, although these losses are diminishing as travel resumes and people return to work.

- FFO for lodging/resorts went from negative $$521 million in the fourth quarter of 2020 to negative $400 million in the first quarter of 2021

- FFO for diversified fell 16.0% in the first quarter of 2021,and was 55.6% lower than one year earlier

- FFO for office fell 12.5% and was 12.2% below the first quarter of 2020

Residential REITs reported a 5.5% increase in FFO following declines in three of the four quarters of last year.

- Manufactured home REITs reported the largest percentage increase among residential subsectors with a gain of 16.0% over the prior quarter. FFO of manufactured home REITs was 24.1% higher than one year ago

- FFO for apartment REITs rose 2.9% after declining the prior two quarters. FFO remained 6.2% below year-ago

- Single Family REITs reported a 4.4% decline in FFO from the record level in the fourth quarter of 2020. FFO of $293 million was 9.0% higher than one year earlier and was the second-highest value for single family REITs

“Despite the pause in recovery, REITs entered the pandemic with strong balance sheets and low leverage ratios and have maintained them throughout economic shutdowns and uncertainty,” said “REIT said Nareit President and CEO Steven A. Wechsler. “As the vaccine rollout continues and life slowly begins to return to normal, we believe we will continue to see recovery in the sectors most heavily impacted by the pandemic and REITs will continue to preserve their solid financial fundamentals.”

Several factors monitored by the T-Tracker demonstrate the resilience of the REIT sector, including:

- Leverage ratios edged lower, with the weighted average debt-to-total book assets ratio declining 120 bps, to 50.3%. The debt-to-market assets ratio declined 100 bps, to 32.8%.

- Interest expense as a percentage of NOI declined 150 bps, to 21.6%. This is a record low interest expense relative to NOI for REITs.

- Weighted average term to maturing of REIT debt lengthened further, to 87.4 months in the first quarter of 2021, from 84.0 months in the fourth quarter of 2020. Debt maturities are significantly longer than the average of less than 60 months in the Great Financial Crisis of 2008, reducing the need to refinance debt during the pandemic.

- Interest coverage ratios rose, with the weighted average ratio of 4.5x, after 4.1x in the prior quarter. More than 80% of REITs had a coverage ratio greater than 3x, compared to only 40% of REITs in the fourth quarter of 2007.

- Liquid resources (cash, securities and undrawn lines of credit) were 8.1x annual interest expense, up from 7.7x in the fourth quarter of 2021.

Overall occupancy rates changed very little from the previous quarter, declining only 20 bps to 90.6%. Occupancy rates in the office REIT sector declined 85 bps, to 90.4%, while most sectors saw small declines in occupancy rates. Apartment REITs, in contrast, saw a 60 bp increase in occupancy rates, to 95.0%.

Read the complete Q1 2021 Nareit T-Tracker results