In late May, Nareit marked the passage of 15 months of financial market response to the global spread of COVID-19, social distancing measures, and more recently, here in the U.S., the reopening recovery.

As with any event that has such a broad and dramatic impact, compounded with the devastating losses of life and livelihoods occurring in this pandemic, the inevitable long-lasting changes—to society, the economy, commercial real estate and REITs—will only be understood over time.

It is important to take note of the REIT resilience through the crisis and their ongoing recovery. The year-to-date total return of the FTSE Nareit All Equity REITs index at the end of May was 18.1% and the index is 4.3% above its pre-pandemic high. Capital markets are open and we are observing growth oriented M&A transactions that reflect confidence in business models and the sector outlooks. Operationally, REIT earnings are recovering quickly, with aggregate FFO now at 85% of its pre-pandemic level.

In this midyear outlook, Nareit’s research team provides their perspectives on the past 15 months and a look ahead at the next 12 to 18 months. Nareit believes this will be a period of robust economic growth that will drive recovery across a broad range of real estate and REIT sectors. As Calvin Schnure notes, “a robust recovery is no longer a question of ‘if’, but rather, ‘when’.”

REITs are well positioned to take advantage of a growing economy because they entered the crisis with historically strong balance sheets and access to credit and liquidity. Nevertheless, uncertainties remain. Most critically, how will the future of office use evolve as firms return to the office and experiment with hybrid and work from home arrangements.

Another topic of widespread discussion is the potential threat of inflationary pressures as the economy reopens. Nicole Funari explains that recent inflationary signals reflect transitory items, and significant inflation fears may be premature or unfounded; nevertheless, REITs may perform well if inflation should increase. She finds that historically, REITs outperformed in periods of moderate and high inflation, while providing competitive returns in periods of low inflation.

A key lesson of the past 15 months is the continued digitization of the economy. As real estate has evolved to house the modern economy, REITs have been at the forefront of these changes. John Barwick reviews changes in the index composition over the past decade and discusses how Nareit is keeping pace by updating and expanding the index series it produces in partnership with FTSE Russell and EPRA.

Heading into the second half of 2022, Nareit is optimistic about the effect widespread vaccination in the U.S. is having in reducing COVID-19 cases, encouraging reopening and propelling economic growth.

- John Worth, EVP, Research & Investor Outreach

Commercial Real Estate and REITs: A Robust Recovery Ahead, Uneven Across Sectors and with Lags

Today the issue of a robust recovery is no longer a question of “if”, but rather, “when”. Vigorous growth over the remainder of this year and next year will spur the demand for all types of commercial real estate, and help stimulate a stronger recovery for REITs.

Macroeconomic Conditions

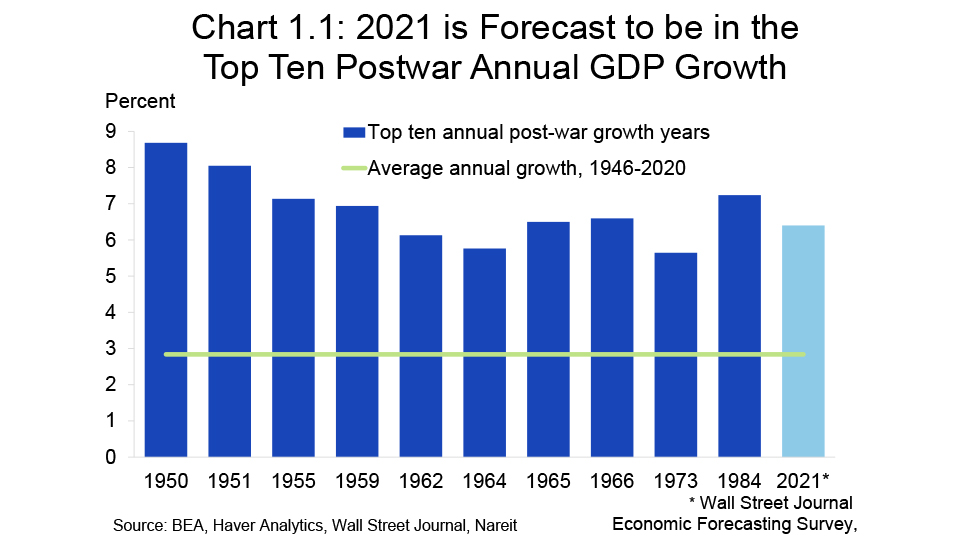

The U.S. economy is growing again after large parts of the country had been shut down for much of 2020. Real GDP rose at a 6.4% annual rate in the first quarter, and economists surveyed by the Wall Street Journal expect growth for the full year 2021 to match this 6.4% pace. Such growth would place 2021 in the top ten years during the post-WWII period, and would be the fastest growth since 1984, more than twice the average growth rate since 1946 (chart 1.1).

Like a machine that has been idled for too long, though, the economic engine is not running smoothly. In part this is a carryover from 2020, as the sectors that have borne a higher risk of exposure to COVID-19 have only recently begun to shift into higher gears. These sectors, which include travel, leisure and hospitality, entertainment, and retail trade, are beginning to have a more robust recovery as the vaccine rollout proceeds and reduces the headwinds from social distancing measures related to risks of exposure to COVID-19.

There is a new source of unevenness in the post-vaccine economy, as it is harder to start everything back up again than it was to shut it down in the first place. The sudden restart caught many businesses off guard, and economic activity that may require months of planning and preparation—ordering parts and supplies, completing applications and permits, zoning requests, production plans, and finding and hiring suitable labor—cannot happen all at once.

Many businesses are reporting difficulties resuming operations as some parts of the supply chain lag the demand for the products and materials in which they are used. For example, the global shortage of microchips is hindering not only auto production but also a wide range of other products using smart technologies. This is just one example of the bottlenecks present in many parts of the economy that are preventing the economy from getting up to speed more quickly. These bottlenecks are also generating price pressures that in turn have fed fears of rising inflation. Price increases resulting from supply shortages are generally a benign occurrence in a free market economy, as higher prices are both a signal of scarcity and also an incentive for suppliers to ramp up production more rapidly.

Such price spikes in the past have typically been scattered across just a few markets at any given time, and have been short-lived until production increases to eliminate the bottleneck. Today’s price pressures are somewhat more widespread, and appeared suddenly after a period during which inflation had been running below the Federal Reserve’s inflation target. The economy, however, has room to grow without “overheating” in the traditional sense. There appears to be significant labor market slack and manufacturing capacity utilization was 74.1% in April, 2021, according to the Federal Reserve, well below the 78.1% average between 1972-2020. This excess capacity suggests it is just a matter of time before production increases to meet demand, and price pressures dissipate. [See discussion of inflation and REITs]

We expect the strong fiscal stimulus and low interest rates to continue to support economic growth this year and in 2022. In addition, the pent-up demand from last year and spare capacity in most parts of the economy will make it easier for the economy to grow at a 6% rate or faster until it is fully recovered from the shutdowns, store closures, and job losses during the pandemic.

Commercial Real Estate Markets and REIT Performance

The recovery in commercial real estate, like much of the rest of the economy, is likely to be uneven across sectors and subject to various lags and delays. Indeed, commercial real estate recoveries in the past have often lagged the turning points in the macroeconomy. For example, following the Dot.com bust and recession in 2001, real GDP began rising again in 2002. Payroll employment continued to decline a bit longer, falling for six quarters, into early 2003. The office market, however, continued to weaken into 2004, with vacancy rates rising and rents falling for 12 to 14 quarters.

Commercial real estate markets lagged the macroeconomy again after the financial crisis of 2008-2009, with rents declining and vacancy rates rising in the office, retail, and industrial sectors for 10 to 16 quarters—well after GDP and employment had reached bottom and begun rising again.

There are, however, some important parts of the commercial real estate market and REIT universe that are not trailing the macroeconomy during this recovery. Sectors that support the digital economy have enjoyed booming demand over the past year as social distancing requirements prompted many types of economic activity to shift from in-person interactions into the digital realm. These markets include industrial properties, dominated by the logistic facilities that are critical for the fulfillment of goods bought on the internet; data centers, which house the servers that host websites and route data communications from their source to final destination; and cell tower infrastructure, which own the structures that house equipment used to transmit wireless voice and data communications. The demand for digital real estate appears to remain robust even as the pandemic wanes. [See discussion of the evolving REIT landscape]

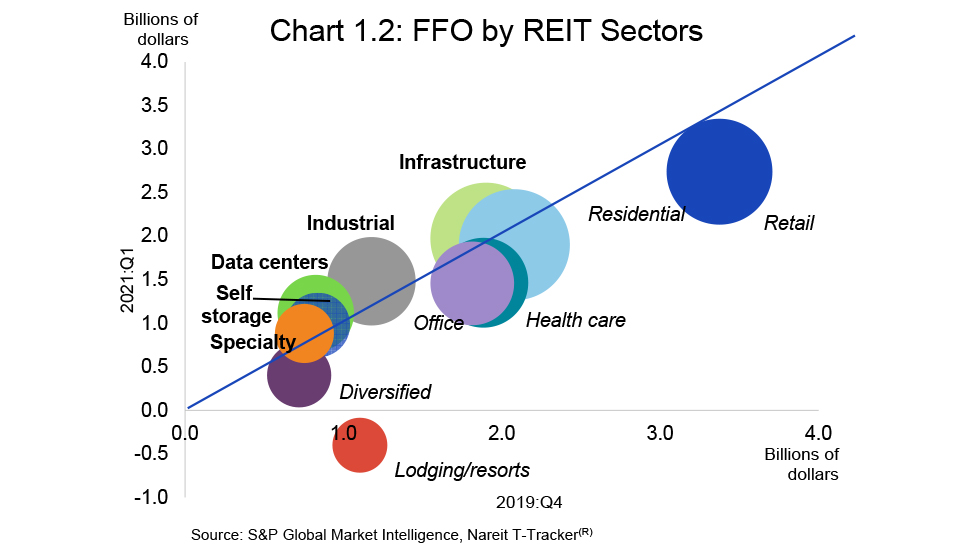

Funds from operations (FFO) of these digital real estate sectors was at or near record highs in the first quarter of 2021, according to the Nareit T-Tracker®. Other sectors with FFO above pre-pandemic levels include self storage REITs and specialty REITs. Chart 1.2 compares FFO of REIT property sectors in 2019:Q4 and 2021:Q1. Bubbles that are above the line, and with bold labels, had an increase in FFO over this period, while those below the line with italicized labels had a decline in FFO. The size of the bubble is proportional to sector equity market capitalization in 2019:Q4.

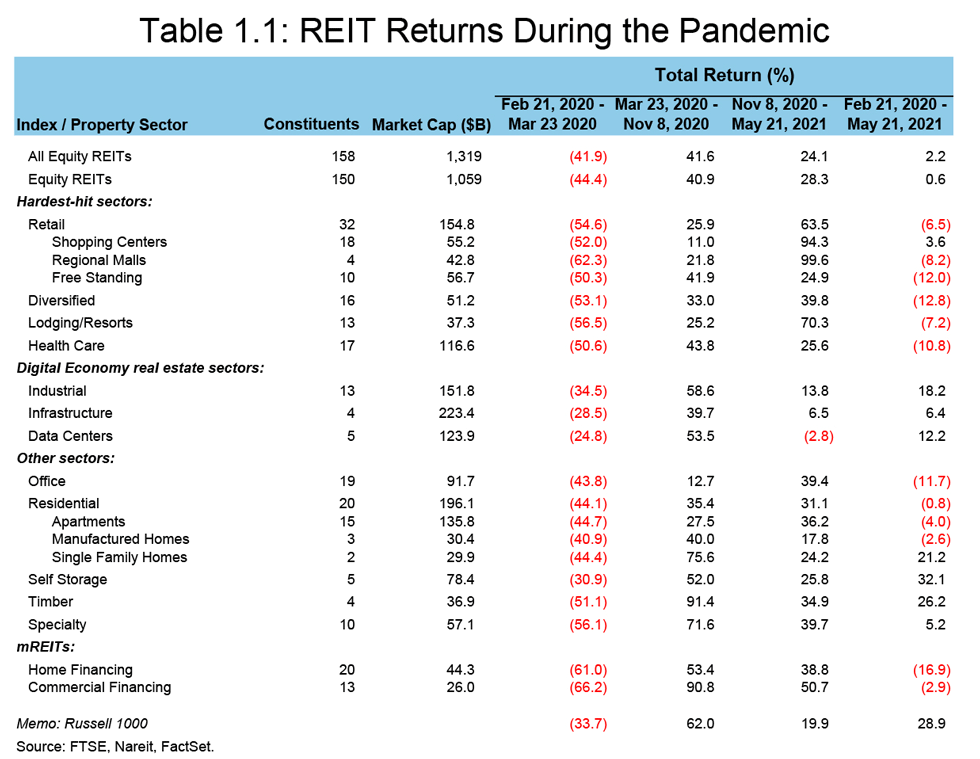

These digital real estate sectors had strong stock market total returns during the period from the market bottom in late March of last year until the announcement of a successful vaccine last November, and more modest returns over the past six months. As of May 21st, which marks 15 months since the REIT stock market peak just prior to the pandemic, these sectors have had total returns ranging from 6.4% to 18.2% since the pandemic began.

Other sectors of commercial real estate will likely lag the overall economy. Lodging/resorts and retail property markets have stabilized, but are unlikely to see significant improvement until travel volumes and shopping patterns get much closer to pre-pandemic patterns. Travel volumes and foot traffic in stores have been picking up this spring, but a full recovery is unlikely to be completed until 2022. Senior housing properties within the health care sector have experienced a drop in occupancy due to a hesitancy to move in during the pandemic, and higher costs for personnel, PPE, and cleaning supplies.

Lodging/resort REITs continued to report negative FFO through the first quarter as low travel volumes, both business and leisure, have depressed hotel occupancy. FFO of the retail REIT sector, however, rose 5.5% in the first quarter. FFO of retail REITs has a significant ways to go for a more complete recovery, though, as first quarter FFO was 81.2% of its level in 2019:Q4. Within retail REITs, the free standing retail subsector did not experience major declines in 2020, and FFO in the first quarter was in line with pre-pandemic levels. FFO of health care REITs continued to decline through the first quarter.

These hard-hit sectors—lodging/resorts, retail, health care, and also diversified REITs—had the largest initial stock market declines early in the pandemic, but staged a vigorous recovery following the announcement of successful tests of vaccines against COVID-19. These sectors nevertheless generally remain below pre-pandemic prices.

Office markets face both short-term issues from a delay in workers’ return to office, and also possible longer-term structural issues caused by permanent shifts in demand for office space due to work from home (WFH). Many places of employment plan to reopen gradually in the months ahead, with the pace of return contingent on local containment of COVID-19 infections. Office occupancy and rents are likely to stabilize and begin to recover later this year or early next year.

There is greater uncertainty about the longer-term impacts of WFH on the demand for office space, as none of the prior office market downturns had such a dramatic shift in how and where employees got their work done. On the one hand, offices tend to be highly productive work environments that foster collaboration, training, and mentoring, and are critical for tasks like negotiating a deal or hiring a new worker. An online meeting is a poor substitute for face-to-face contact for meetings like these.

The past 15 months have demonstrated, to some firms, that many tasks can be carried out working from home—or virtually anywhere else—without compromising quality or productivity. This experience raises the possibility that WFH may have permanently altered the office work environment in a way that could reduce long-term demand for office space.

There are several possible models for the office work environment ahead. One extreme would be a complete return to the office full time for all workers at most employers. The opposite extreme would be a large share of the office workforce continuing to work from home for all but essential meetings. A possible intermediate outcome would be a hybrid model that allows for flexibility depending on the work functions being completed, with most workers in the office on a regular basis, but not necessarily full time. This hybrid model would allow employers and employees to gain as many benefits of in-person collaboration as possible, but for certain tasks that can be completed independently, employees may work from home part days or full days one or more days per week.

These tensions between forces driving return-to-office versus work-from-home will not be resolved in the immediate future. Several major firms have announced plans to return to the office by summertime, or September, or later this year, while others have embraced a more flexible, hybrid model. It will be difficult to determine the extent of any longer-term impacts of WFH on the demand for office space until the immediate return to office has run its course, suggesting that the office market will face continued uncertainty at least through the end of this year.

WFH related uncertainty has lowered office occupancy and rent growth, contributing to a 12.5% decline in FFO of office REITs in the first quarter, according to the Nareit T-Tracker. Total returns of office REITs were negative 11.7% in the fifteen months through May 21, 2021.

Other parts of the commercial real estate universe are showing a quicker recovery. Apartment markets weakened in 2020, especially in larger metro areas with higher rents. There is some evidence of a net migration from expensive urban cores to more distant suburbs and to smaller regional cities, especially by workers in jobs and industries that are more open to WFH. San Francisco and San Jose, with high concentration of tech workers, experienced larger increases in vacancy rates than most other metros.

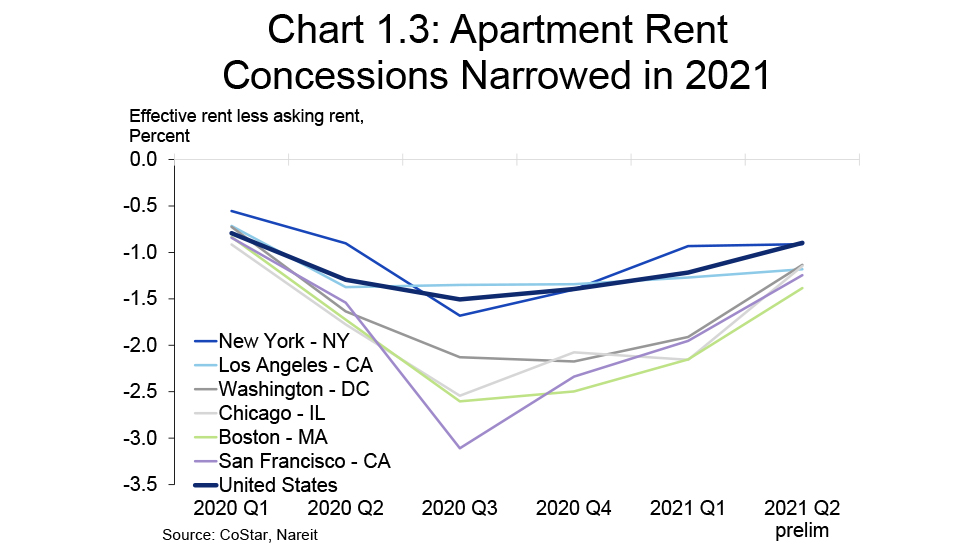

Demand for apartments rebounded quickly in the first quarter of 2021, with falling vacancy rates and an acceleration in rent growth across most metro areas. Landlords had offered concessions on rents to attract tenants during the downturn, especially in San Francisco and other high-rent Gateway cities (chart 1.3). These concessions were most significant in the third quarter of 2020, and have narrowed or disappeared in early 2021. There is an abundance of anecdotal reports that demand has strengthened even further during the second quarter, the traditional spring leasing season that generally enjoys the strongest demand growth and largest rent increases of the year. The spring leasing season often sets the tone for the market for the whole year, and the gathering strength in markets across the country bodes well for a full recovery this year.

Apartment REITs posted a 2.9% increase in FFO in Q1, but FFO is still just 83.2% of pre-pandemic levels. Total returns of apartment REITs were negative 4.0% over the pandemic as of May 21.

Overall REIT Earnings Recovery, Stock Performance, and Financial Resilience

The recovery of earnings of the REIT sector as a whole continued during the first quarter of 2021, but at a slower pace than the rapid recovery during the initial phase of reopening in the second half of last year. Funds from operations (FFO) of all equity REITs rose 2.0% in Q1, according to the Nareit T-Tracker, after having grown more than 10% in each of the prior two quarters. In large part, this deceleration reflects the wide range of outcomes across different property types discussed above.

The underlying economic fundamentals for commercial real estate are gaining more momentum with a higher level of vaccine coverage, which is likely to boost REIT earnings growth over the remainder of this year.

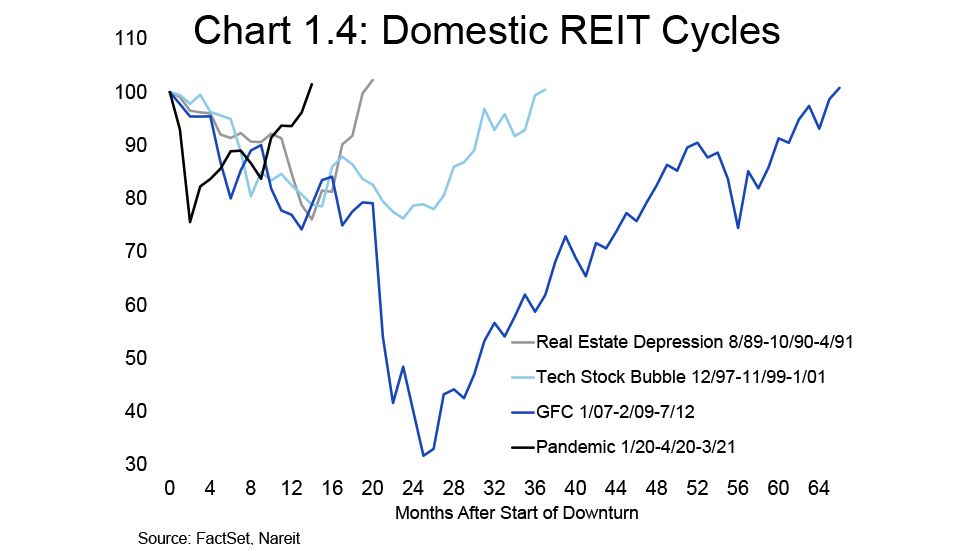

REIT stock market performance has continued to rebound from the declines during the shutdowns in the early months of the pandemic. REIT total returns at the one year mark had remained more than 8% below the pre-pandemic high. As of May 21, which marks 15 months since the market peak prior to the pandemic, REIT total returns have fully recovered from the initial losses in early 2020 (chart 1.4).

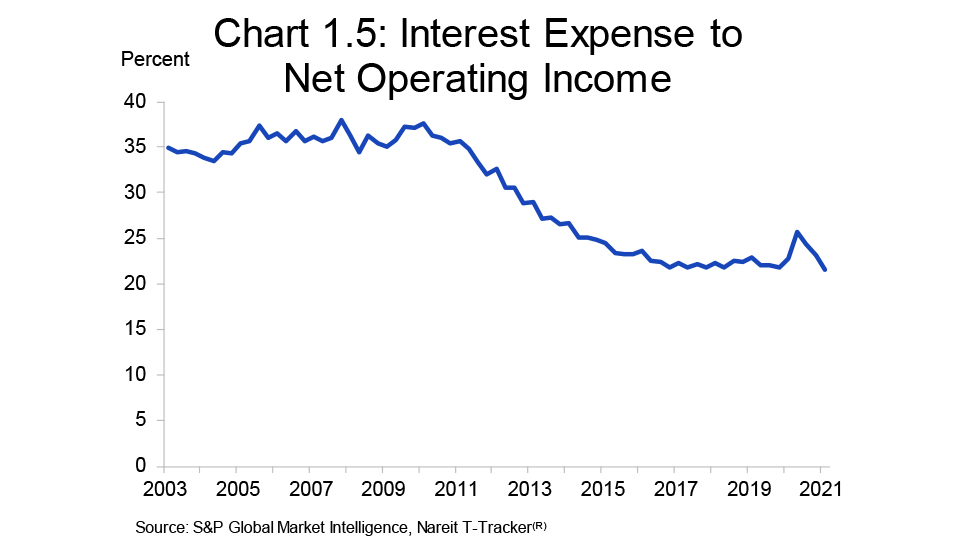

An important factor in the recovery of REIT FFO and stock market returns has been the high degree of resilience through the recession. REITs in general had a strong financial position on the eve of the pandemic, as they had raised nearly $400 billion of common equity from 2009 through 2019, reducing the weighted average book leverage ratio from 58.3% in 2008 to 50.3% today. Leverage ratios have remained low during the pandemic despite some interruptions to cash flows. This low leverage combined with low interest rates resulted in REIT net interest expense falling to its lowest level on record in relation to net operating income (chart 1.5). Strong REIT balance sheets have reduced the risks of financial distress, and also reduced further their possible sensitivity to interest rate movements.

- Calvin Schnure, Senior Economist and SVP, Research & Economic Analysis

FFO of these digital real estate REIT sectors was at or near record highs in the first quarter of 2021, according to the Nareit T-Tracker.

REITs and Inflation

April’s record jump in annualized inflation to 4.2% has raised concerns about inflationary pressures as the economy recovers from the pandemic. This rate may seem alarming since for the past several years the U.S. has been experiencing historically low inflation levels (below even the Fed target rate). The denominator for the number is April 2020, when prices were falling due to the onset of major economic shutdowns. This “base-year effect” makes the current annual number seem larger.

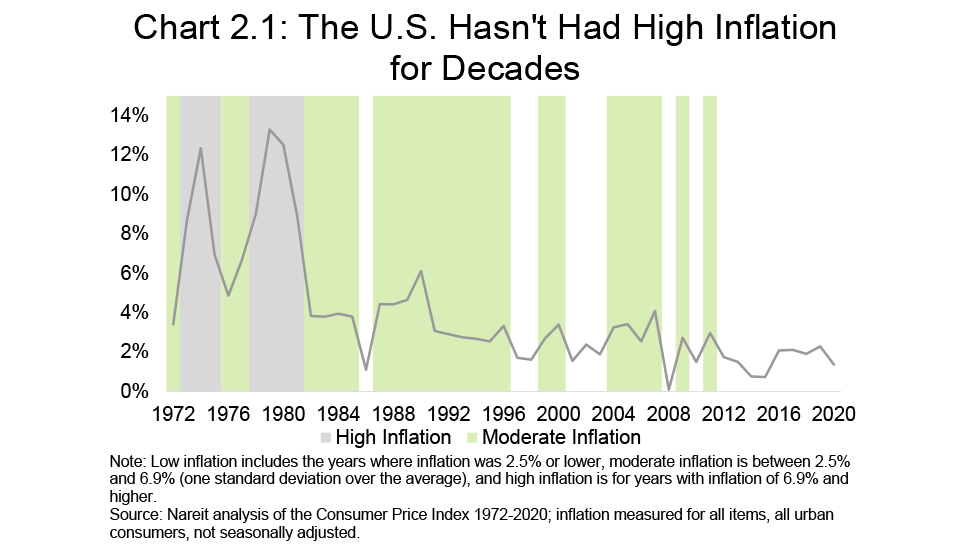

The U.S. hasn’t had high inflation since the early 1980s when annual rates averaged almost 11% (chart 2.1). Inflation is unlikely to return to the double-digit rates experienced in the 1970s and 1980s for several reasons. First, economic conditions are considerably different from the economy of the 1970s that got hit with an oil supply shock. Labor markets still have slack and structural changes in the U.S. economy away from manufacturing to service-based industries point to an economy that is less likely to overheat. Additionally, the Federal Reserve has revised its policies and tools since the early 1980s to be more proactive in controlling inflation. While there will be a transition period of higher growth as the economy comes back online and unemployment recovers, sustained high inflation is unlikely.

Nareit expects transitory upticks in prices due to supply-chain and reopening issues as the economy recovers. During this transition period, inflation may stay in the headlines and on the minds of investors. Real estate and REITs have historically been resilient during periods of inflation. Historically, both rents and real estate values tend to increase along with broader price levels, providing real estate owners with higher nominal revenues, albeit in inflated dollars.

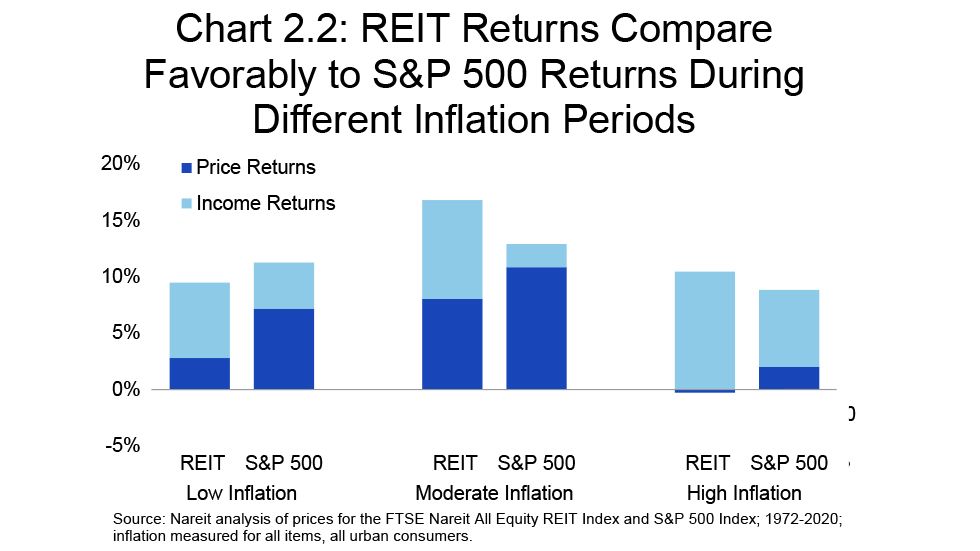

Historical data for REIT returns supports this view. As shown in chart 2.2, REITs have outperformed the S&P 500 during periods of both high and moderate inflation, while slightly underperforming during low inflation periods. Over the full sample, REITs outperform the S&P 500 in 56% of twelve-month periods with high inflation and over 80% of twelve-month periods when inflation is high and rising.

There are two major periods of high inflation in the sample, highlighted in grey in chart 2.1. As chart 2.2 shows, on average, REITs outperformed the broader stock market during these periods. During the oil shock driven stagflation of 1973-1975, annual inflation averaged 9.3%. During this period, REIT annual total returns averaged -2.8%, lagging the S&P 500’s 2.0% average return. However, from 1978-1981, robust REIT income returns supported average annual total returns of 19.9% for REITs versus just 14.0% for the broader stock market.

REITs have also outperformed the broader stock market during periods of moderate inflation. Chart 2.2 shows REIT dividends more than compensated for the higher price returns on the S&P 500 during periods of moderate inflation (highlighted in green in chart 2.1), leading total returns on REITs to exceed the S&P by 3.9 percentage points. In periods of low inflation, REIT returns lagged the broader stock market as higher REIT income returns did not make up for S&P 500’s higher price returns. While past returns are no guarantee of future performance, REIT returns have been resilient through many separate periods of high and moderate inflation.

- Nicole Funari, VP, Research

The Evolving Real Estate Landscape and REIT Indexes

In the 21st century, real estate has been shaped by technological advancements which have changed the economy and introduced new property sectors for investment. Real estate houses the modern economy, from cell towers facilitating wireless communications, to data centers storing the data being communicated, to logistics facilities that serve as the backbone of e-commerce fulfillment.

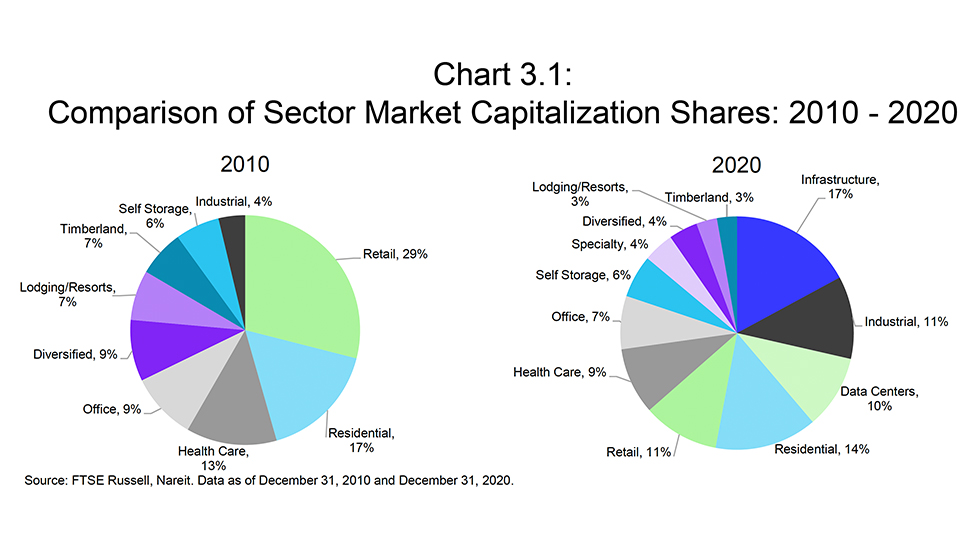

Over the past 10 years, we have seen dramatic changes in the composition of REIT equity market capitalization. As chart 3.1 shows, in 2010 industrial accounted for just 4% ($12 billion) of equity REIT market cap, while cell towers had not been introduced into the index series, and data centers were not broken out into a stand-alone sector. At the end of 2020, these sectors accounted for 39% ($460 billion) of equity REIT market cap.

While much of the expansion of the real estate sector has been driven by technological advancement, the introduction of new property sectors unconnected to technology have played an important role as well.

The growing importance of these new property sectors has fueled investor demand for products that accommodate these new investment propositions. Over the past 18 months, Nareit, along with its index partners FTSE Russell and EPRA, have updated and expanded the FTSE Nareit and FTSE EPRA Nareit indexes to better reflect the evolving real estate landscape. The changes include introducing a new U.S. tech focused index (the FTSE Nareit New Economy Index), introducing a new global index with a broadened scope that includes cell phone towers and timberland (the FTSE EPRA Nareit Global Extended Index series), and updating the rules for the existing global index so all data centers are eligible.

- John Barwick, VP, Index Management & Industry Information