How do I invest in a REIT?

- Open a brokerage account and purchase REIT shares, either individually or via a REIT mutual fund or exchange-traded fund.

- Contribute to a 401(k) plan, individual retirement account (IRA), Thrift Savings Plan (TSP), or other pension plan.

Once you invest in REITs, you will be among the approximately 170 million Americans that live in households invested in real estate through REITs. Nearly 100% of target date funds, which are prevalent in 401(k) plans, have REIT allocations, and a majority of pension plans, including those for teachers, firefighters, nurses, state government employees and others, gain real estate exposure through REITs.

A broker, investment advisor or financial planner can help analyze an investor’s financial objectives and recommend appropriate REIT investments. According to a 2024 NMG Consulting study, 78% of financial advisors recommend REITs to their clients.

Investors also have the ability to invest in public non-listed REITs and private REITs.

Can I invest in REITs through a retirement account (IRA, 401(k), etc.)?

REITs are an excellent choice for a retirement account because they provide income, capital appreciation, diversification, and inflation protection. You can invest in REITs through retirement accounts, including traditional and Roth IRAs. With a traditional IRA, contributions are deducted now, and taxes are paid later when withdrawals are made. A Roth IRA involves paying taxes on current contributions and receiving tax-free withdrawals later. Meanwhile, not all 401(k) plans allow you to invest in REITs so you should check with your company’s benefits department for more information.

What is an appropriate allocation to REITs?

The answer will vary based on each investor’s goals, risk tolerance and investment horizon, but here are some key insights that can help:

Multiple studies have found that the optimal REIT portfolio allocation may be between 5% and 15%, depending on an investor’s risk tolerance and investment timeline.

An allocation to REITs provides portfolio diversification, given the low correlation REITs have had with the broad stock market over the past 25 years.

Further insight comes from Chatham Partners' research which found that advisors recommend allocations to REITs in the range of 4% to 13% – irrespective of the client's age – from early career to within retirement.

How does lifestage affect the optimal allocation to REITs?

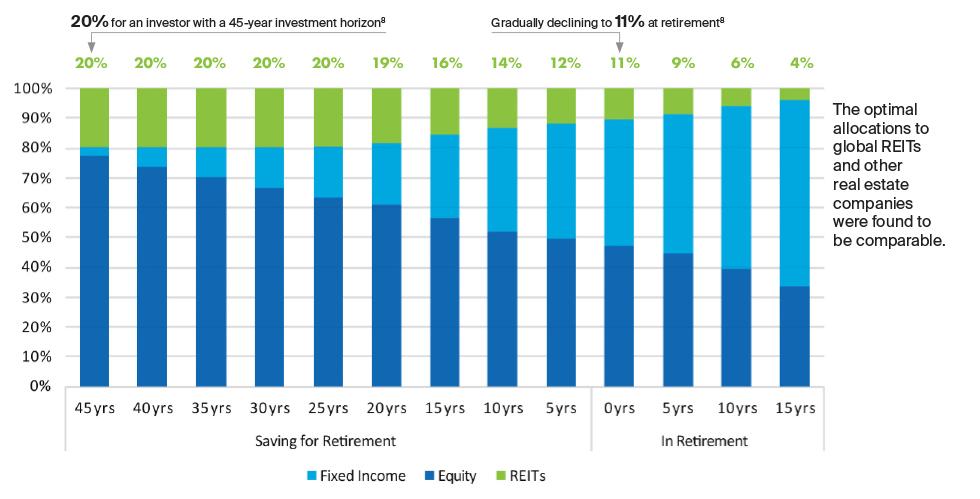

As this Morningstar Glide Path Model shows, an optimal allocation for certain investors could start at 20% for an investor with a 45-year investment horizon, gradually declining to 11% at retirement and 4% after 15 years in retirement.

How can I track the performance of REITs on an ongoing basis?

View the FTSE Nareit U.S. Real Estate Index Series and the FTSE EPRA/Nareit Global Real Estate Index Series Daily Returns and subscribe for updates.

REITs are generally considered reliable investments that offer investors the benefits of capital appreciation through share price gains and steady dividend income when they are held over the long term.

What are the liquidity options for REIT investments—how easily can I sell my shares?

REITs are bought and sold on major U.S. stock exchanges in the same way that other stocks are transacted. REITs can be sold at market value via a brokerage account, with market liquidity typically ample to ensure a fast transaction. Public non-listed REITs and private REITs are more complex when it comes time to sell and are not as liquid as listed REITs. Often, investors in private REITs have to hold the investment for a set period. Redemption programs for public non-listed REIT shares vary by company and may be limited, non-existent, and/or subject to change.