By John Worth, Executive Vice President, Research & Investor Outreach, Nareit

July 2022

At mid-year, both the economy and commercial real estate markets are in a state of transition. As we see increasing signs of a slowing economy and investor pessimism has become pervasive, REITs have experienced disappointing stock performance despite continuing to post impressive operational results with record high earnings in the first quarter and extremely resilient balance sheets.

Heading into a period of slower growth, high inflation, and significantly higher interest rates, we see REITs as well positioned for strong relative performance and stability. While slower growth and higher interest rates are a net negative for real estate performance generally, REITs are well positioned by virtue of their robust and well managed balance sheets, and REITs, like other forms of real estate, have historically outperformed during periods of moderate and high inflation.

As we look ahead to the second half of 2022 and into 2023, we expect to see continuing inflation, mostly driven by energy and food prices, the Federal Reserve continuing to raise rates in an attempt to deal with inflation, and a slowing economy reflecting the changing rate environment, the end of government stimulus, and households stressed by higher food and energy prices. Over the past six months, observers have become increasingly pessimistic resulting in lower consensus growth forecasts for 2022 and 2033 and sharply higher consensus recession risks. However, the continuing strength of labor markets – with more than 2.7 million jobs created in the first half of the year and 1.7 job openings per unemployed worker suggest that increased labor force participation may provide a buffer for consumer spending that can bolster economic growth.

We will be watching the strength of labor markets and retail sales for signs of weakness or strength as key measures in our macroeconomic outlook. In commercial real estate markets, we will be tracking the level of transactions and effective cap rates as measures of the impact of higher rates and spreads, and in REITs, we expect strong second quarter operating performance and will be closely tracking management commentary around what they are seeing in their sectors and markets.

Over the coming months we expect pricing and cap rates to adjust.

In the commercial real estate space, performance metrics from the first quarter suggest that market fundamentals have remained firm, with strong demand for leased space pushing down vacancy rates and driving rent growth higher, even as supply remains at historically high levels in some sectors. At the same time, higher interest rates and spreads have severely impacted transactions as buyers and sellers adjust to the new rate environment. There are continuing concerns about potential longer-lasting effects of the pandemic on how people use commercial real estate, especially due to work-from-home trends impacting overall demand for office space.

In REITs, we expect strong second quarter operating performance.

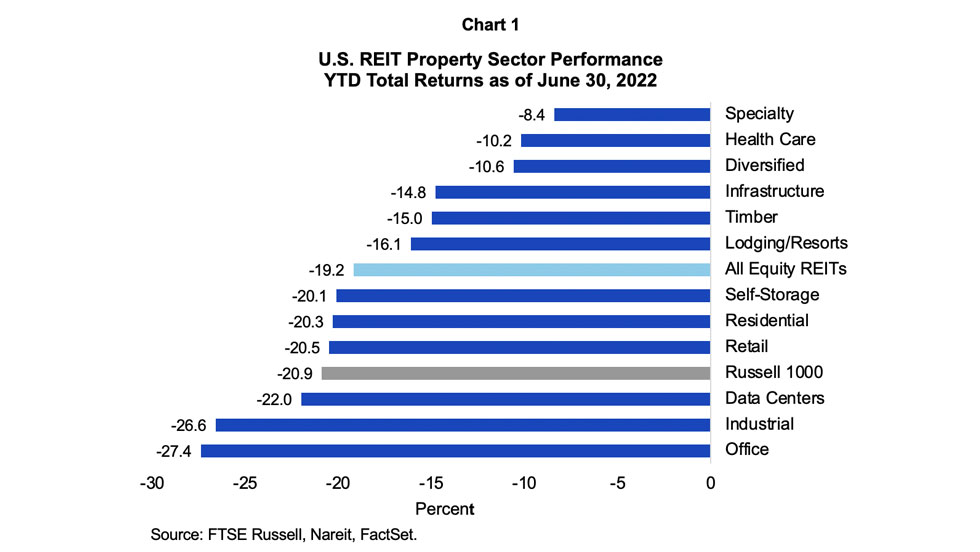

As is typical in times of change, REIT share prices are reflecting the uncertain economic outlook well ahead of private real estate markets. As shown in Chart 1, through mid-year, REITs have a total return of -19.2%. In part, these returns reflect broader market volatility and REITs are outperforming the broader market represented by the Russell 1000 by over 175 bps. As the chart shows, the pullback has been broad-based with all REIT sectors in the red for the year. June returns suggest that the largest selloffs have been in sectors experience leasing activity and earnings decline during an economic slowdown, including office and lodging/resorts.

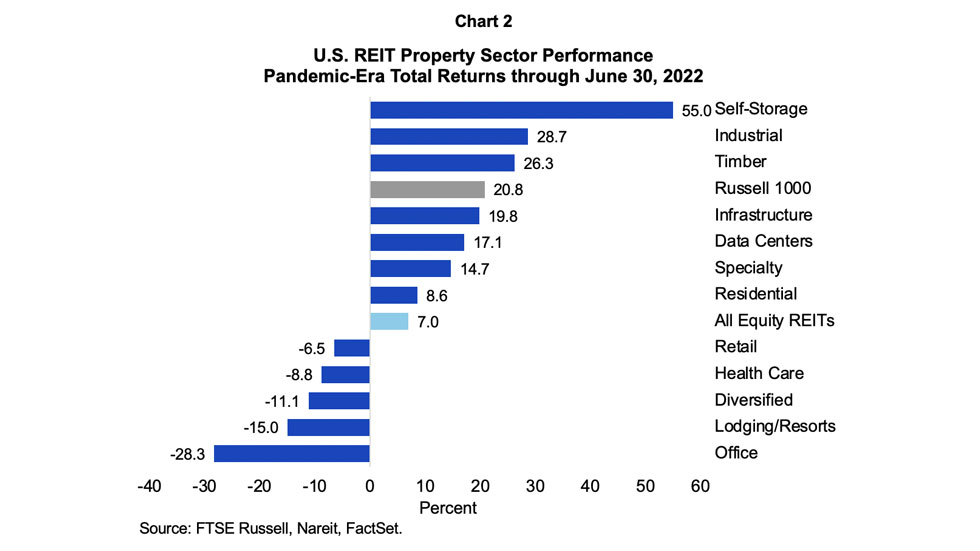

Chart 2 reports total returns for U.S. REITs by sector over the COVID-19 period, which began in February 2020, through mid-year 2022. As the chart shows, self-storage leads all sectors with a total return of 55.0% over the pandemic period, followed by industrial at 28.7%.

REIT operating performance has been in stark contrast to the stock market performance and the speed of the recovery of the REIT industry from COVID-19 induced shutdowns has demonstrated both the flexibility of REIT management teams as well as the resilience of the industry.

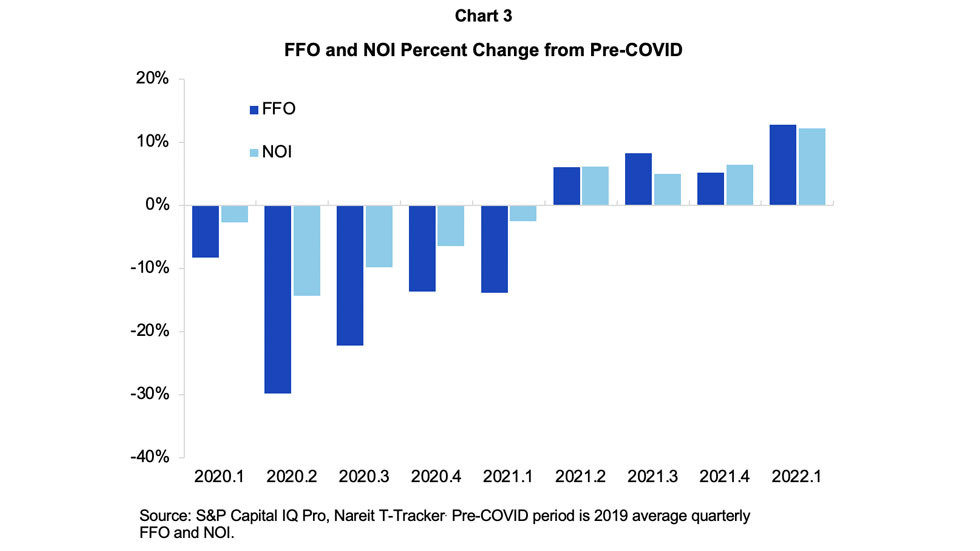

Chart 3 shows the trajectory of REIT income and earnings represented by funds from operations (FFO) and net operating income (NOI) compared with the pre-COVID performance. As the chart shows, REIT earnings have recovered and both FFO and NOI are more than 12% above pre-COVID levels.

There are, of course, significant differences in the pace and trajectory of the recovery across property sectors. For example, across the twelve top-line REIT sectors, eight had 2022 first quarter FFO that exceeded the pre-pandemic level, including three sectors with FFO 50%+ higher than pre-COVID levels, including industrial, infrastructure, and self-storage.

REIT resiliency is expected with flexibility due to balance sheet strength.

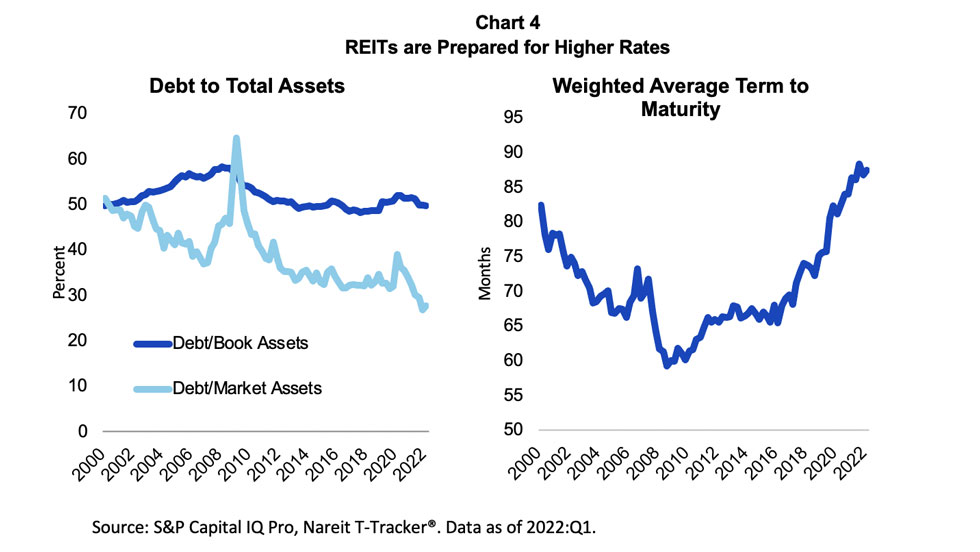

One recent measure of this flexibility has been the low level of debt and equity issuance by REITs in 2022 generally, and in particular in the second quarter. The lack of activity reflects the flexibility REITs have due to the strength of their balance sheets: they are not in a position of needing to issue equity at unfavorable valuations or refinance debt during a period of high-rates and widened spreads.

As illustrated in Chart 4, REITs have effectively managed both the amount of debt they have outstanding as well as the structure of the debt outstanding. As the chart on the left-hand side shows, the debt-to-book and debt-to-market assets ratios of REITs have declined substantially since the financial crisis in 2008-2009. Both book and market leverage of the REIT industry are near their lowest point on record. The chart on the right-hand-side shows how REITs have locked in low interest rates and created near-term flexibility. The weighted average maturity of outstanding debt has lengthened in recent years, from 60 months or shorter in 2009 to more than 87 months today. During this same period, we have seen interest expense as a share of NOI drop to all-time lows.