Highlights

- The Morningstar analysis shows that the inclusion of REITs in a portfolio increases the return for a given level of risk.

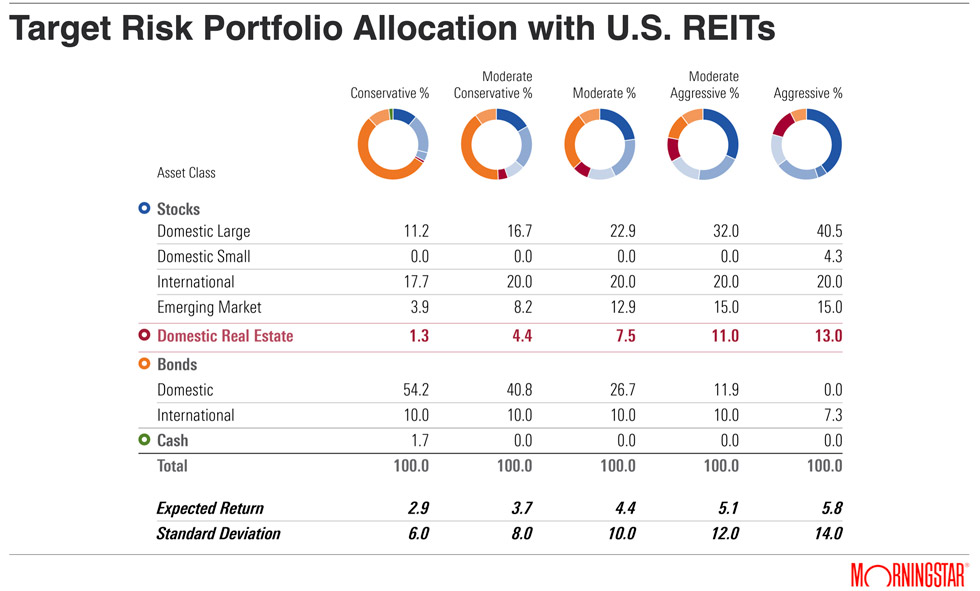

- Analysis finds REITs are included in an optimal portfolio across risk levels. The aggressive portfolio targeting a 14% standard deviation and 5.8% return is estimated to have a 13% REIT allocation.

A new Morningstar analysis shows that the inclusion of REITs in a portfolio increases the return for a given level of risk. The following table depicts five portfolios targeting increasing levels of risk. At every level of risk, REITs are included in the portfolio. As the expected level of return and risk rise, so to do optimal allocations to REITs. For example, a moderate portfolio targeting a 10% standard deviation and a 4.4% return allocates 7.5% to REITs and an aggressive portfolio targeting a 14% standard deviation and a 5.8% return is estimated to have a 13% REIT allocation.

In this analysis, Morningstar used Black-Litterman, a mean-optimization methodology well respected by the institutional investment community. Portfolio managers use this methodology as a tool to understand how to optimally allocate investments across different asset classes. The Black-Litterman model is an extension mean-variance optimization, which asserts that an investment’s risk and return characteristics should not be viewed alone but be considered based on how the investment impacts the overall portfolio’s risk and return. Black-Litterman seeks to avoid the often extreme unconstrained portfolio allocations that result from mean-variance optimization. The Black-Litterman approach results in stable, optimal portfolios based on an investor’s insights. Using the Black-Litterman mean-variance optimization, the table identifies efficient asset mixes that provide the greatest expected return for a given amount of expected risk. The inputs used are based on Morningstar Investment Management’s assumptions.