In 2020 REITs’ ESG journey advanced even further, including the integration of ESG issues into corporate strategies, an increased focus on addressing climate change risks and opportunities, and the prioritization of “S” impacts—intensifying in the face of a global pandemic and amidst heightened social consciousness.

ESG is Evolving

Nareit defines ESG as the environmental stewardship, social responsibility, and good governance practices that, when actively and holistically measured, managed, and disclosed, ensure sustainable business performance and accountability to the industry’s investors, tenants, workforce, and communities. This report highlights common elements of REITs’ ESG commitments, policies, practices, and disclosures in the context of the past year.

As the field of sustainability evolves and E, S, and G become increasingly dynamic, integrated, and interdependent, the REIT industry is prioritizing responsible management of these pillars, collectively, to help drive return on investment for shareholders and ensure long-term value for all stakeholders.

The real estate sector has long been an early adopter of ESG practices to build resilience, manage risk, strengthen financial performance, meet stakeholder and community needs, and develop and retain diverse talent. As investor demand for disclosure of ESG performance heightens and government agencies are planning for a more active role in climate change disclosures and DEI matters, REITs are positioned to thrive in an evolving regulatory environment.

Today, ESG is increasingly and proactively integrated into REITs’ DNA, as the sections below underscore.

The advancement of sustainability in all of its facets, including environmental stewardship, social responsibility and good governance is a core component of the REIT approach to real estate investment.

Leading the Way

How REITs are institutionalizing ESG within their business management and operations, and how sustainability practices are increasingly integrated into REITs’ corporate strategies and elevated in governance frameworks.

Embedding ESG into Corporate Strategy and Business Operations

ESG matters are not new to REIT CEOs and boards. However, as climate risks and social issues become priority policy issues under the Biden Administration and investor demand for ESG performance increases, the business imperrative surrounding sustainability has evolved from a “nice-to-have” expectation to a “have-to-have” priority.

REITs are positioning sustainability issues as central to corporate strategy and at the forefront of long-term business planning, with 77% of survey respondents reporting that ESG risks and opportunities, such as climate change, health and safety, or regulatory compliance, are integrated into strategic and financial planning.

REITs are also increasingly making public commitments toward meeting ESG goals and targets—amplifying their transparency around and accountability for taking concrete, tangible sustainability action.

Responding to Demands for ESG Transparency and Accountability

As the connection between ESG management and business performance becomes clearer and more widely understood, ESG issues continue to attract greater investor interest, which, in turn, has elevated expectations for transparent, regular, and standardized disclosure.

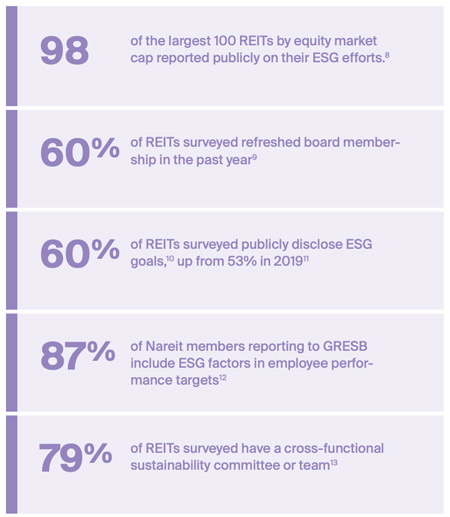

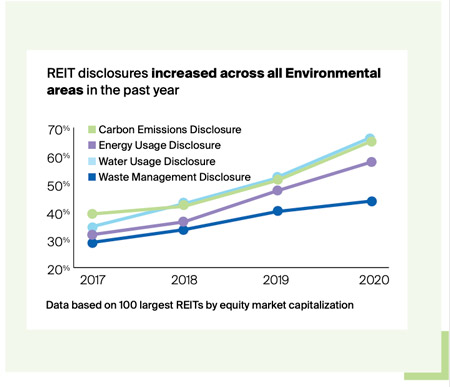

REITs are responding to these ESG demands from investors, with the percentage of REITs publicly reporting their sustainability efforts continuing to improve year-over-year.

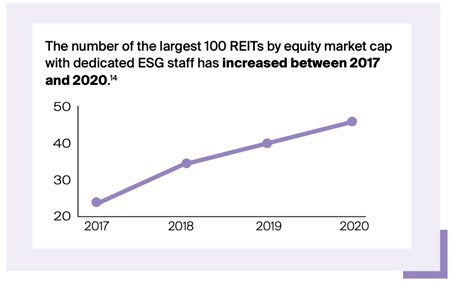

Today, nearly all of the largest 100 REITs by equity market cap disclose ESG activities publicly via company websites, annual reports, and/or proxy statements. Of the largest 100 REITs by equity market cap, the number that issued a stand-alone sustainability report increased from 49 in 2019 to 66 in 2020.

Elevating ESG Leadership, Oversight, and Management

In recent years, ESG has earned a position as a board-level priority across the REIT industry, with 85% of REITs reporting ESG performance to their board of directors at least annually, and 42% doing so quarterly.

Not only are boards engaged in ESG, but they increasingly go through a “refreshment” cycle, leading by example when it comes to good governance. Board refreshment is the process of continually replacing board members in an effort to ensure an independent and diverse perspective for organizational management. In doing so, REITs are also strengthening diversity and representation across their leadership bodies. Data has shown that companies with a balanced board composition relative to direct tenure achieve better financial results and have a lower risk profile compared to their peers.

Case studies:

- Healthpeak Properties is Aligning ESG Reporting Initiatives with Stakeholder Interests

- Host Hotels & Resorts is Managing and Maintaining Operations by Preserving and Protecting Assets

- Kilroy Realty is Engaging in Research-Driven Supply Chain Optimization Initiatives to Improve ESG Performance and Reduce Embodied Carbon

- Physicians Realty Trust Is Fortifying Board Sustainability Commitments through Certification and Executive Accountability

- Ventas Is Expanding DEI Through Governance and Employee Engagement to Work Toward Change

Putting People First

Doing the right thing for stakeholders while maintaining business continuity and profitability, and how REITs have prioritized the health, safety, and wellbeing of tenants, communities, employees, and other critical stakeholders.

Investing in Human Capital

For REITs, investing in human capital includes employee health and wellness, education and training, and personal and professional develop- ment. REITs also recognize that building thriving communities drives good business, as evidenced through a long history of creating lasting social impact to meet the needs of the tenants and communities that REITs serve. By continually strengthening their health, safety, and wellness practices and promoting safe and secure work environments, REITs reinforced their contributions to UN SDG Goal 3, Good Health and Wellbeing, and 8, Decent Work and Economic Growth.

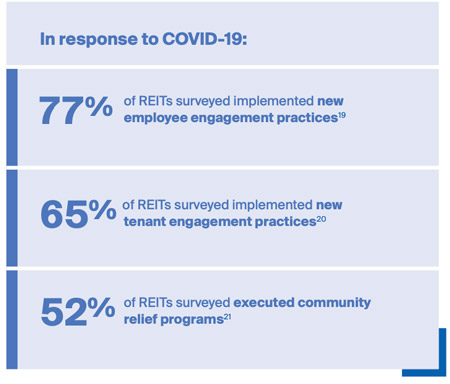

Recognizing the intensified need to support employees’ mental health and physical wellbeing during the COVID-19 pandemic, REITs expanded initiatives to grow, develop, and maintain a healthy and engaged workforce. According to the 2020 Nareit Member Survey, 75% of REITs offered flexible employee work programs in the last year, compared to 63% in 2019. Furthermore, 77% of REITs surveyed offered new engagement mechanisms such as virtual events to promote connectivity and overall wellbeing among employees via game nights, happy hours, exercise, or cooking classes.

Meeting Community Needs

REITs strive to be a good and welcoming neighbor through initiatives that deliver value and impact to the communities they serve. REITs engage with their communities to support effective partnerships that drive value for their industry stakeholders and company shareholders, in alignment with UN SDG 17, Partnerships for the Goals.

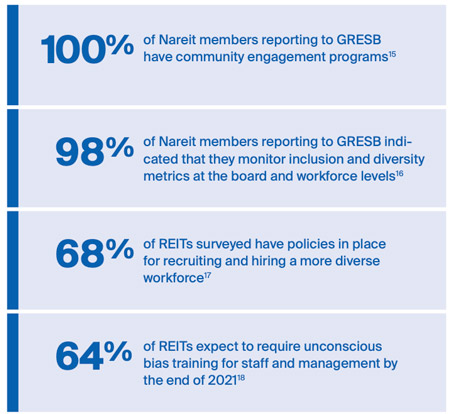

Programming around community outreach and development is widely reported across the industry and growing in prevalence year-over-year. In 2020, 100% of Nareit members participating in the GRESB survey reported having community engagement programs, compared to 98% in 2019. These efforts primarily took the form of financial or in-kind support of local non-profits, engagement with local students, and knowledge-sharing with local businesses.

Committing to Diversity, Equity, and Inclusion

Most REITs have strengthened initiatives to grow and retain a diverse workforce through enhanced recruitment and retention practices—practices which significantly contribute to UN SDGs 5, Gender Equality, and 10, Reduced Inequalities, and include:

- Reviewing application processes to eliminate unconscious or adverse biases

- Recruiting qualified candidates from outside of the commercial real estate industry

- Ensuring a diverse candidate pool before making a hiring decision

- Providing clear criteria for promotions to ensure transparency and consistency across all levels of the organization

Some REITs have also made significant progress at the leadership level through the expansion of DEI-related responsibilities for senior executives and by diversifying Board composition.

Case studies:

- AvalonBay Communities is Expanding DEI Programming to Empower and Equip Employees to Thrive in the Workplace

- Brandywine Realty Trust is Reinforcing Community Commitments through Employee-Driven COVID-19 Relief Efforts

- Brixmor Property Group is Empowering Employees to Maximize Their Health, Connectivity, Growth, and Engagement

- Brookfield Properties is Championing DEI through Employee and Community Investments

- Equity Residential Is Taking a Structured Approach by Elevating Employee Voices to Strengthen Inclusion

- Essex Property Trust is Institutionalizing DEI Commitments Through Robust Management and Concrete Actions

- Hersha Hospitality Trust is Promoting Health and Safety Through Rest Assured™

- Kimco Realty is Expanding Engagement and Support Services to Meet Stakeholder Needs

- Prologis Is Developing the Next Generation of Logistics Talent

- Washington Prime Group Is Embracing a Role as Community Ambassador

Building Resilience

Approaches to proactively manage the industry’s environmental footprint and address the long-term risks and opportunities associated with climate change, and the tested approaches and technological innovations REITs are deploying to minimize environmental impact and drive efficiencies across their portfolio.

Mitigating Climate Risks and Impacts

Demands for companies to provide greater transparency with respect to climate change and related financial consequences in their corporate strategies, reporting, and disclosures are steadily growing—and being further bolstered by political shifts that have elevated environmental issues to the forefront of the U.S. policy agenda.

In response to mounting climate urgency, climate-related risk and opportunity assessments are playing a central role in REITs’ strategic and property-level planning, enabling REITs to make smart investments that protect their assets, improve resilience, and reduce their environmental impact.

According to Nareit’s Member Survey, one third of respondents conducted a climate change risk assessment in 2020. These assessments are typically conducted annually, or every two to three years, and are used to inform corporate reporting, resiliency planning, financial planning, and due diligence for acquisitions or development.

Managing Sustainable Buildings

Pursuing healthy building certifications, such as FitWel, became a particular focus for REITs. The FitWel certification, originally created by the U.S. Centers for Disease Control and Prevention (CDC) and U.S. General Services Administration,104 helps building managers integrate science-based strategies to optimize health within a building or community.105 Features of FitWel certified buildings include enhanced air ventilation systems, con- tactless entry points, and elevated provisions for improved comfort and walkability.

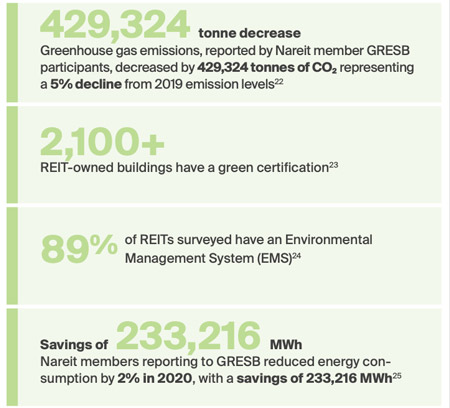

As an industry, U.S. listed REITs are a driving force behind the movement to make the global building portfolio healthier and greener, with 2,100 REITs owning buildings with a green certification—and growing.

Leveraging Technology to Advance Environmental Performance

Machine learning, advanced data analytics, and Artificial Intelligence (AI) are transforming the way business is conducted across all industries. As wireless connectivity in buildings becomes more prevalent, the integration of AI and the Internet of Things (IoT) into standard operating processes has the potential to improve nearly all aspects of building management. With AI, data from sensors and meters is collected and automatically ana- lyzed to identify areas of operational improvement, which can not only detect—but also predict and respond to—anomalies. This creates a significant opportunity for REITs to leverage technology to advance environmental performance, as well as create efficiencies across other elements of their business.

Today, REITs are starting to embrace these cutting-edge innovations to create “smart assets” that leverage data to inform decision-making and improve overall quality of life for tenants and communities.120 With real time data, REITs can see changes in the use of resources like energy, water, or waste, and then take quick, informed action to avoid overconsumption or improve management processes.

Case studies:

- Boston Properties is Aligning Emissions Reduction Targets with Climate Science to Achieve SBTi Approval

- Duke Realty Is Integrating and Scaling Solar Projects Across the Portfolio

- Equity LifeStyle Properties Is Maintaining Biodiversity and Benefiting Residents through Restoration and Conservation Projects

- Federal Realty Investment Trust Is Reinforcing Health and Wellness Commitments through Healthy Building Investments and Fitwel Certification

- Healthcare Realty Trust is Incorporating Renewable Energy Across the Portfolio to Maximize Long-Term Value

- JBG SMITH is Building Smart Cities and Innovating Sustainability Practices Through Digitization

- Regency Centers Is Planning for the Future through Proactive Climate Risk Management

- Vornado Realty Trust Is Managing Healthy Buildings through Crisis with the Fitwel Viral Response Module

Download a PDF of the 2021 REIT Industry ESG Report

Archives: