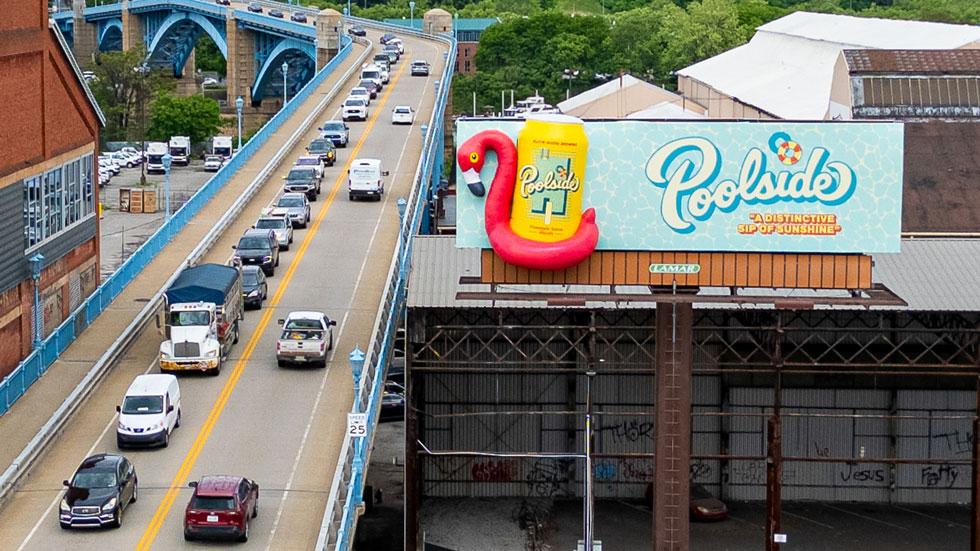

Lamar Advertising Co. (Nasdaq: LAMR), founded in 1902, is both a pioneer and powerhouse in the outdoor advertising industry. The Baton Rouge, Louisiana-based company’s approach to growth is straightforward: construct more billboards; convert static, or traditional, billboards to digital; and acquire the competition. That strategy is working.

Next year marks Lamar’s 20th year operating as a REIT. Lamar is a modern economy REIT that generates revenues by leasing advertising space on billboards, buses, shelters, benches, logo plates, and in airport terminals.

Lamar has grown to become one of the largest out of home (OOH) advertising companies in the world, with more than 360,000 displays across the United States and Canada. The OOH industry refers to any paid media reaching people outside of their homes. The OOH industry’s revenue surpassed $9 billion in 2024, the highest volume to date, according to the Out of Home Advertising Association of America (OAAA).

Lamar says it owns about 25% of the OOH market and boasts a diversified base of advertisers in the services, health care, restaurant, retail, automotive, insurance, and gaming categories.

Lamar’s largest revenue driver by far are its towering roadside billboards, strategically located along high-traffic expressways, highways, interstates, and primary arteries. These billboards account for around 88% of the company’s revenues. Smaller portions come from interstate logo advertising (4% to 6%) and transit advertising (7%).

Lamar purchases or leases the real estate beneath its roadside billboards. It has nearly 60,000 landowner partners across the country and thousands of billboard permits.

Keeping it local

Also setting Lamar apart is its strong concentration of billboards in small and mid-size U.S. markets.

“When you talk about ad spend, 80% of our tenant base is local businesses,” says Sean Reilly, president and CEO of Lamar, which was founded by his maternal great-grandfather.

Local media, Reilly notes, is increasingly fragmented, and audiences are shrinking for newspapers, TV, and radio. “A lot of local customers that used to use those media forms are coming to us because our audience, being the driving public, is actually growing,” he says.

Jason Bazinet, managing director at Citi Research, points out that Lamar generally stays outside of the top 20 markets. “Its sweet spots are areas like Austin, Texas; Tallahassee, Florida; and Chattanooga, Tennessee,” he says.

“Lamar has much lower operating costs, because they're not concentrated in big cities like New York or Los Angeles where labor is expensive, insurance is expensive, electricity is expensive. Even the lease payment you pay to the dirt owner will be more muted if you're in a sprawling suburb of Tallahassee versus buying billboard space over the Lincoln Tunnel,” Bazinet adds.

Lamar is targeting $150 million in acquisitions in 2025, focusing on smaller, high-quality deals. “It looks to me like we'll exceed that pretty easily,” Reilly says. “There’s a lot of activity.” Lamar has a history of acquiring other outdoor ad companies to expand its reach and market share. “It’s in our DNA to expand through M&A deals,” he says.

Reilly says the company’s M&A activity is primarily funded through free cash flow. Typically, Lamar has around $150 million available annually after interest payments, capital expenditures, and distributions to expand its footprint through M&A.

Expanding its digital footprint

Reilly points out that the fastest-growing segment of the business is the digital platform.

With advanced technology, the transformation from static to digital billboard advertising is revolutionizing the industry, with the ability to update content in real-time and display bright, colorful, eye-catching graphics. Digital billboards also provide enhanced targeting and interactive, engaging features.

Unlike static billboards, digital billboards display advertising messages that rotate every six to eight seconds like a slideshow, with typically six to eight advertisers sharing the same billboard at any given time.

Lamar launched the industry’s first large-format digital billboard in 2001. Of Lamar’s 159,000 billboards today, 5,000 (or roughly 3%) are digital. However, digital billboards accounted for 32% of the company’s annual revenue in 2024, so there’s significant potential for growth through conversions, Reilly says.

Lamar is targeting 350 digital conversions in 2025, potentially reaching 375. These conversions cost about $200,000 each, but because changing a static billboard to digital adds seven new faces and allows up to eight advertisers to occupy the space at one time, they provide a significant revenue boost, he notes.

“Typically, when we do a conversion, the same advertising face that was generating $3,000 a month will now generate $15,000 to $18,000 a month. The lift is really incredible,” he says.

Social media’s impact

Another exciting feature is the integration of digital billboards with social media, allowing advertisers to incorporate copy with social, mobile, and search. Brands can create campaigns that begin online and extend to the physical world, which drives more content sharing and user participation.

“Our customers love it because of what they can do with it,” Reilly says. “They can use digital billboards to turbo charge whatever they're doing on social, mobile, or search. If something's trending on their social platform, it can also inform what the copy is up on the digital billboard and change it automatically. And if it hits the right buzz and goes viral, suddenly it's all over social media, and you get a tremendous amplification.”

As part of its digitization, Lamar launched a programmatic advertising platform, enabling clients to buy billboard space using demographic data and algorithms. The platform, Reilly notes, helps advertisers target specific audiences.

Programmatic ad campaigns work by allowing a company to adapt its advertising on the fly by running different variations of its messaging based on time of day, demographics, location, movement patterns, venue types, weather conditions, and more.

Also, with programmatic buying, advertisers can track the performance of their campaigns in real-time to determine who is engaging with the billboards and in what locations they are most effective.

While Lamar’s programmatic channel is relatively new and accounts for just 2% of its business, Reilly says it’s a major growth area. The company’s programmatic channel is growing 15% to 20% annually.

The tech platform that enables programmatic buying for Lamar is Vistar Media. Lamar invested $30 million in Vistar in July 2021.

“Because we have the largest large-format digital footprint, Vistar came to us and asked us to make an investment in them. We did and we owned 20% of the company, and it was a great investment,” Reilly says.

Recently, T-Mobile purchased Vistar for $600 million, and Lamar’s 20% share of the sale price came to about $130 million, providing a large infusion of capital. But Reilly also says the acquisition is a big deal for Lamar and the OOH industry.

“I'm excited about T-Mobile buying Vistar because T-Mobile is a really savvy company,” Reilly explains. “They're very entrepreneurial, and they’re the primary source of this rich data that can be used by our clients to help them more effectively buy our space.”

Robust environmental record

Meanwhile, Lamar has led the industry in innovation in energy efficiency, lighting control, renewable energy, and recycling.

“We have really paced the industry in sustainability practices and getting a good return for our shareholders by deploying capital in many different ways,” Reilly notes.

For example, Lamar spearheaded the development of super-efficient LED lighting to replace the inefficient incandescent lighting on digital billboards. Reilly says that move knocked roughly $15 million off Lamar’s electrical bill, and the rest of the industry has followed.

Additionally, Lamar is committed to giving billboards a second life and ensuring that no billboard ends up in a landfill. For example, the company repurposes its large billboard vinyls for emergency roofing for storm victims. In 2024, its Tarp Team program provided immediate help for the victims of Hurricane Helene in Georgia.

Lamar also partners with Los Angeles-based outdoor gear manufacturer Rareform to repurpose large vinyl billboards into surfboard bags, backpacks, duffel bags, and other travel accessories.

In addition, Lamar led the industry in a move away from using poster paper to a recyclable polyethylene substrate on its poster billboards. These polyethylene billboards can be recycled into plastic resins and molded into new products like nursery pots or shipping pallets.

IT conversion underway

Lamar is also in the midst of a major enterprise IT conversion to boost the company’s efficiency, productivity, and client engagement, and prepare for AI initiatives in 2027.

“It's going to touch every aspect of our business, in particular, the sales and creative process,” Reilly explains.

The project, which encompasses 1,000 account executives and more than 200 graphic artists nationally, aims to make the sales and creative process more efficient and proficient.

“The first step is creating a state-of-the-art IT backbone with clean data, which will provide insights into customer contracting information, customer buying habits, and more,” Reilly notes. “After we lay the foundation, the next step will be to implement AI initiatives that make the sales process more efficient.

“What I like to say about AI, is AI at its best, is about words and pictures,” he continues. “And that’s what we do at Lamar.”

Employee-first culture

While innovation and growth are key to Lamar’s strategy, a strong corporate culture underlies all its achievements to date. Lamar has been recognized as one of the best companies to work for by U.S. News & World Report’s annual ranking and named a best company to work for in the South, and in the media industry.

“We have won a lot of awards pertaining to how our corporate culture reinforces a sense of belonging amongst our employees,” Reilly explains. “We're a large public company, but we have a family feel about us. There’s just a sense that we take care of each other, and it shows up in our Glassdoor scores.”

He says Lamar operates by giving a lot of autonomy and authority to local managers and general managers around the country.

“Our local offices are the face of Lamar in our local communities,” Reilly says. “They turn on the lights, turn off the lights, they hire, they fire, they have complete control of their business. And when you treat people like complete businesspeople, you get complete businesspeople running your profit centers. Business school professors would call our organizational structure flat and decentralized. I just call it treating people respectfully and as complete businesspeople.”