The global standards organization ASTM International recently announced the publication of ASTM E3429-24 Standard Guide for Property Resilience Assessments (PRAs). Developed by a diverse group of commercial real estate owners, investors, lenders, architects, engineers, climate scientists, insurers and property consultants, the PRA is intended for voluntary use by those who wish to better understand the physical climate risks that may affect a property. PRAs are designed to be performed alongside other common ASTM standards, such as E1527 Phase I Environmental Site Assessment and E2018 Property Condition Assessment.

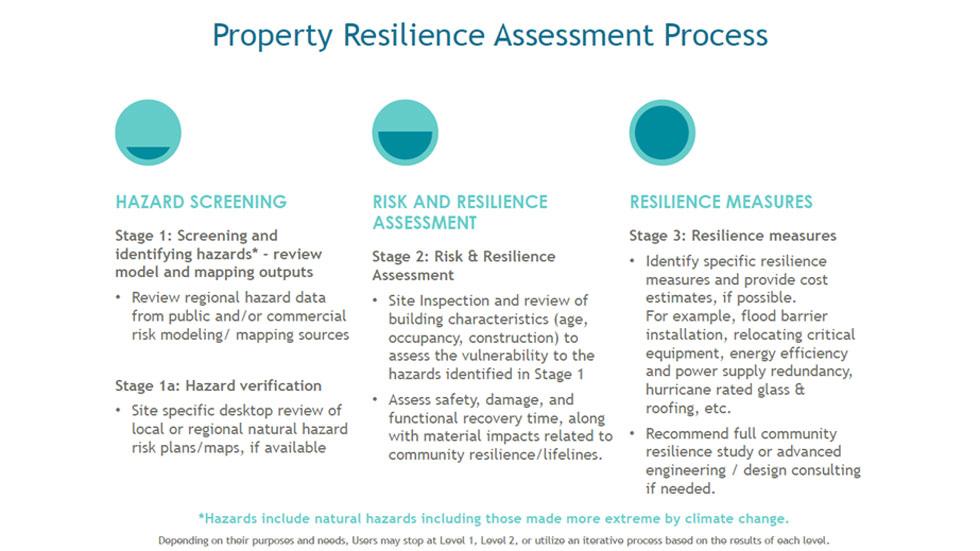

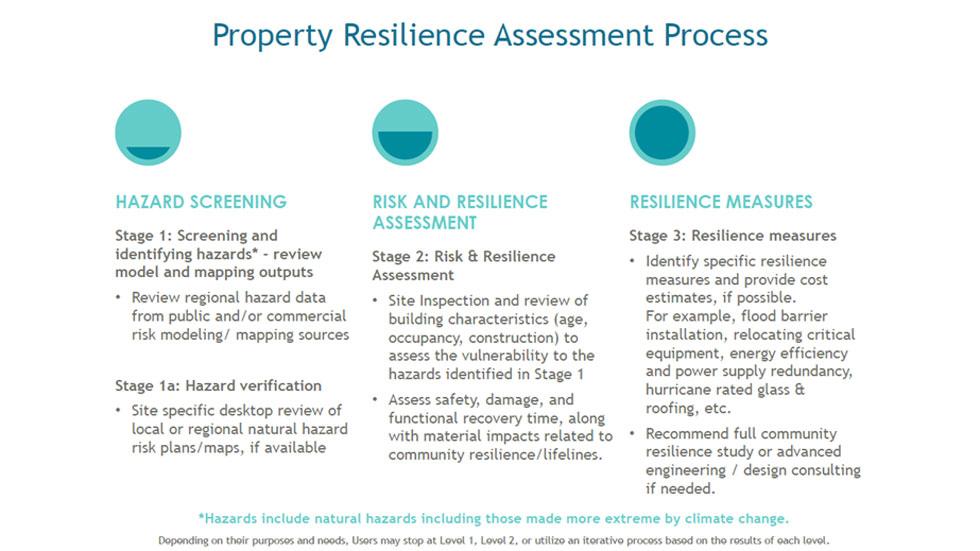

Modeling and understanding the potential financial and operational impacts of physical climate risk is becoming commonplace across all aspects of commercial real estate including: risk management, due diligence, acquisition and disposition strategy, property management, and insurance strategies. The PRA, which includes an on-site visit by an engineer or architect, provides a way to evaluate the physical risks identified during initial climate risk screening with site-specific characteristics and conditions in mind. The PRA also supports building stakeholders to document existing resilience measures or to make recommendations for potential resilience measures, if needed, that may need to be included in the capital plan and/or operating budget.

ASTM Task Group Chair Holly Neber with AEI Consultants, indicated there were over 180 people involved with the development of the standard, and she expects continued improvements as the standard is used in the market in the years to come. Those interested in participating in or providing feedback to the task group can contact her at hneber@aeiconsultants.com.

“A thriving commercial real estate market depends on reliable and actionable information about the property to be readily available to those responsible for financing, owning, developing, operating and insuring buildings. The ASTM Guide is a tool that buyers and sellers of real estate can use to enhance the due diligence and transaction process and support companies to consider the impact of natural hazards on investments,” shares Jessica Long, Nareit, senior vice president of environmental stewardship & sustainability.