Physicians Realty Trust (NYSE: DOC) sees outpatient medical facilities, and their ability to provide high-quality care at a lower price point than a hospital setting, as the growth spot of medical delivery today. A niche segment of the health care real estate market, it’s where the REIT has almost entirely focused its efforts for the past decade.

John Thomas, president and CEO of Physicians Realty, says, “Our providers, particularly physicians, have moved away from hospital facilities that are difficult to access. It’s not clinically necessary for physicians to be in a hospital for most services delivered today. That trend continues to grow every year as technological advancements allow for higher acuity procedures to be performed on an outpatient basis.”

With patient volumes in its buildings above pre-pandemic levels, rising national health care expenditures, and a continued transition to outpatient care, Physicians Realty is anticipating outsized returns for the foreseeable future.

At the same time, Thomas says, Physicians Realty will continue to be guided by its core values. Represented by the acronym C.A.R.E., those values are: Communicate and collaborate, Act with integrity, Respect the relationship, and Execute consistently. “I think we’ve proven over the past 10 years that we do just that,” he says.

Health Care Credentials

Milwaukee-based Physicians Realty was founded in 2013. Co-founders included John Sweet, the company’s initial executive vice president and chief investment officer who has since retired, Mark Theine, the current executive vice president of asset management, and Thomas, the current president and CEO who had served as general counsel for several health care systems, and was executive vice president of the medical facilities group at Welltower, Inc. (NYSE: WELL) – then known as Health Care REIT, Inc. At the time, DOC owned 19 outpatient facilities, which were immediately transferred into the new public REIT. Today, outpatient medical is 97% of the portfolio, totaling 288 properties spanning 36 states as of March 31.

Thomas says what set the REIT apart was its creation by “health care people who got into real estate, not real estate people who got into health care.” Sweet came from the health care finance world, while Theine’s background was in health care real estate asset management. As part of the IPO, Governor Tommy Thompson, who served as the U.S. Secretary of Health and Human Services from 2001-2005 under President George W. Bush, following his fourth term as Governor of Wisconsin, joined DOC as chairman of the board of trustees.

In addition to the health care expertise of its executives, the new REIT offered an attractive financial prospect for investors, Thomas says, given the lack of available yield in the market 10 years ago. “Financially, we thought there was an opportunity to create an organization focused on outpatient medical services that could attract a higher yield from our tenants, which could then generate a higher yield for our shareholders.” While it took a few years to produce that yield, the REIT has paid a dividend every quarter of its existence and has also never cut its dividend, he notes.

According to Thomas, another distinguishing factor for Physicians Realty early on was its focus on transactions in the $20 million range that were too small to attract the attention of larger, diversified health care REITs.

“We could come in under the radar, and a $20 million transaction for us was a big deal and a lot of growth. Every transaction we did grew the organization by 10% or 20%. Nobody could do that, so it was an opportunity for rapid growth. There’s still a lot of fragmentation in the outpatient medical real estate world that we’re trying to consolidate,” Thomas says.

Relationship Building

From the outset, Physician Realty’s strategy was to build relationships with physicians and health care systems and acquire buildings largely one asset at a time, says chief financial officer Jeff Theiler.

“We’re working directly with health care systems and developing trust with them so that they feel comfortable selling their assets to us. And then once we purchase the asset, we work hand in hand with the health systems on the property management side, making sure that we’re meeting the health system’s needs,” Theiler says. That, in turn, has led to many repeat opportunities for Physicians Realty with health care systems.

Theiler says the REIT has a direct pipeline with some of the nation’s largest health care systems, which has enabled it to book 67% of revenue from investment-grade quality tenants.

Thomas adds that from an underwriting perspective, it’s all about understanding the types of services and where they need to be located to be successful, understanding the trends in health care, both in policy and reimbursement, as well as the clinical trends. “We make investments for the long term,” he says.

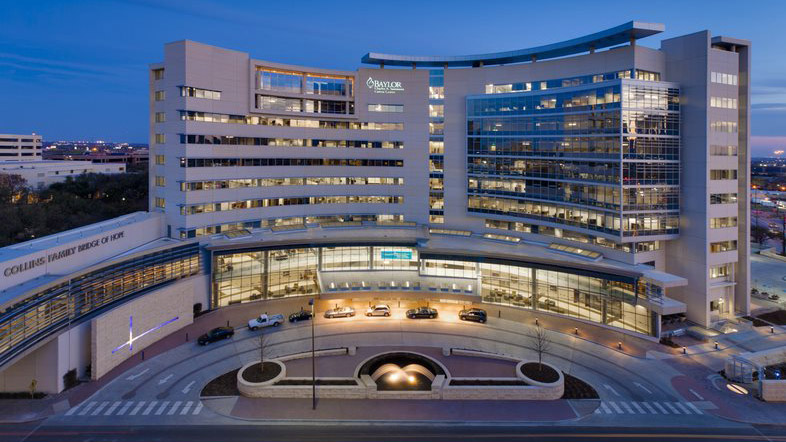

While Physicians Realty has grown alongside its health care system partners, resulting in concentrations in areas including Atlanta and Dallas, Theiler notes that the company doesn’t limit itself to certain states. “We would expect to be in all 50 states eventually, as there are really great medical submarkets to be found everywhere,” he says.

Major Transactions

While a majority of the company’s transactions have been in the $20 million range, two deals have been considerably higher and have provided a significant boost to Physician Realty’s portfolio. The first deal, completed in 2016 and 2017, was with the health care system Catholic Health Initiatives, now known as CommonSpirit, where DOC acquired 50 outpatient medical assets for a total investment of $688 million.

Thomas describes the deal as the industry’s largest monetization of health care real estate to a REIT at that time. He notes that, according to CommonSpirit, Physicians Realty didn’t offer the highest price but was the best fit for them, and DOC has since expanded the relationship.

“Having that relationship with CommonSpirit, both nationally and in each region where they’re located, has been a huge part of the growth of our organization and has led to growth with other health systems as well,” Thomas says.

Mark Theine says the 2021 deal with Landmark Healthcare Facilities LLC was similarly transformational and particularly exciting because it involved two Milwaukee-based companies working together. The portfolio was 95% leased overall and 75% leased to 10 different investment-grade health systems when Physicians Realty acquired it, delivering 10 new hospital relationships in the process.

“We’d worked with Landmark previously, and the key to getting this deal done was continually being persistent and ultimately creating a partnership where they could sell their buildings in a tax efficient structure,” Theine says. Rather than taking cash out of the deal, Landmark opted for operating partnership units in DOC’s limited partnership, “which we took as a great sign of their confidence in us to manage these buildings for the long term and to continue to be good stewards to the hospital systems,” he adds.

Landmark’s owners are now one of the company’s largest individual shareholders. Thomas notes that Physicians Realty currently has relationships with about 100 physicians who have traded buildings for partnership units in the company. “It’s been a major part of our strategy.”

John Pawlowski, an analyst at Green Street, noted recently that Physician Realty’s small size at its IPO allowed it to “more easily move the net asset value needle in its early days as a public company. While more time is needed to fully judge the outcome of large acquisitions in recent years (once leases expire), the scorecard thus far is favorable.”

He added that the REIT’s strategy of focusing acquisitions in off-campus assets “in metros less inundated by institutional capital allowed Physicians Realty to acquire higher cap rate assets with a similar growth profile. Eschewing large, complicated portfolio transactions has also benefited Physician Realty’s total return track record relative to peers.”

Michael Carroll, managing director and head of US real estate research with RBC Capital Markets, shared, “DOC has successfully partnered with top health systems and built a high-quality MOB portfolio. We expect management will utilize these relationships going forward, helping its partners extend their reach and methodically grow its own business.”

Meanwhile, Thomas adds that financing new development is also a growing part of its strategy. He says that many health systems and physician groups discovered during the pandemic that they didn’t have enough outpatient medical space and are starting to execute a strategy to ensure they have more space going forward. “This new space is designed for a flow of efficiency, for patients who don’t want to encounter other patients coming or going. It’s been an important part of the evolution of outpatient medical services,” he says.

Sustainability Efforts

One of the hallmarks of the past decade at Physicians Realty has been a focus on sustainability, resulting in recognition as a 2021 and 2023 U.S. Environmental Protection Agency (EPA) ENERGY STAR ® Partner of the Year Award winner and a 2022-2023 Green Lease Leaders Platinum Designation by the U.S. Department of Energy’s (DOE) Better Buildings Alliance and the Institute for Market Transformation (IMT).

“Our sustainability efforts and strategy have been grounded in the financial responsibility to our tenants and shareholders. We’ve always tried to make intelligent investments into the buildings that make them more efficient and lower operating expenses, ultimately improving the patient experience as well,” Theine says.

The company’s largest goal is a 40% reduction in greenhouse gas emissions by 2030, and last year it invested just over $5 million into sustainability-driven capital expenditure projects. “As long-term real estate owners, we’re going to continue to make those types of investments, not just in the first 10 years but in the next decade,” Theine says.

Impact of Innovation

As it looks ahead, Physicians Realty sees innovation continuing to drive more care into the outpatient sector. “It’s increased the value of our buildings and the building’s importance to the health care systems,” Theiler says.

Outpatient surgeons and oncologists are increasingly using telehealth, which was accelerated during the pandemic and is now being used to streamline follow-up visits, Theiler notes. “That enables them to increase the overall volume of patients they see.”

Thomas stresses that outpatient medical serves the entire population. For example, during the pandemic, just a handful of buildings were temporarily closed during a period when widespread shutdowns occurred across the rest of the economy. “We collected 99% of our rent during the pandemic because people needed access to health care services.”

And with U.S. overall health care spending expected to grow by 5% this year, Thomas says, and inflation adjustments for medical reimbursements likely to kick in, the signals continue to look positive for outpatient medical.

“Our strategy has been proven through COVID and economic challenges. We have the right approach and the right team to continue to grow this company for the next 10 years,” Thomas says.