Although recent bank failures are turning the screws further on the availability of capital for commercial real estate, most publicly listed REITs are well positioned to navigate in a more capital constrained marketplace.

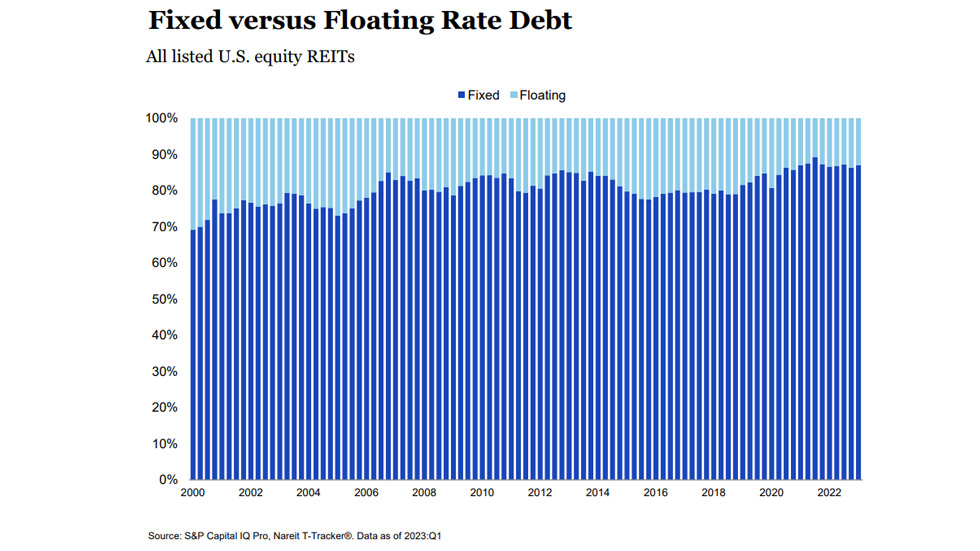

REITs are sitting on stronger balance sheets as compared to where they were in 2008—and the financing landscape is by no means as dire as what existed when capital dried up during the global financial crisis (GFC). Management teams have laddered out maturities and reduced their leverage with less exposure to floating rate debt.

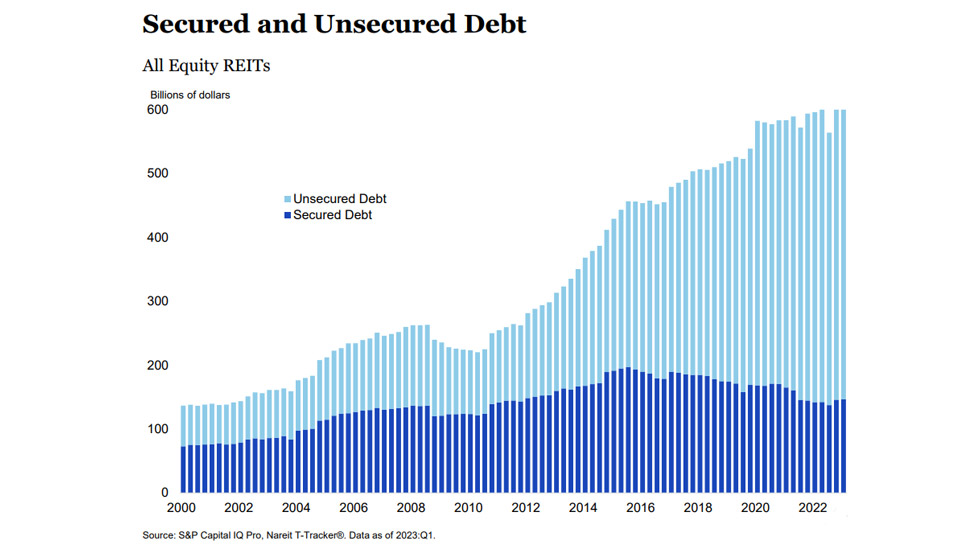

REIT management teams also had the foresight to take advantage of the low interest rate environment that existed prior to the start of the Federal Reserve rate hiking cycle in March 2022 to issue record amounts of unsecured public debt at low rates.

“A lot of REITs have really cleared their debt maturity decks, particularly in 2019, 2020, and 2021 in the low yield environment,” says Mark Streeter, managing director and team leader in North American credit research at J.P. Morgan. During that three-year period, core property REITs (office, industrial, retail, residential, self-storage, health care, triple net) alone issued $115 billion in bonds, according to J.P. Morgan. A lot of REITs have not only addressed their 2023 maturities but also their 2024 maturities.

Debt maturities for the universe of rated core property REITs that issued bonds that expire in 2023 and 2024 were at $20 billion and $40 billion, respectively. Maturities climb to $50 billion in 2025 and $70 billion in 2026. “The point is that debt maturities are very manageable in 2023 and 2024 and start to step up after 2024. In addition, the majority of bank lines of credit held by REITs are undrawn,” Streeter says. “So, there is plenty of capacity for most REITs to wait out this environment if necessary.”

“There were some lessons learned from the GFC where REITs did a better job of terming out their debt,” adds Rick Romano, a managing director at PGIM Real Estate and head of Global Real Estate Securities. Just as homeowners took advantage of the ability to refinance their homes at a lower rate, REITs recognized the opportunity to lock in low rates over a longer term. “They also didn’t really reach for the low-hanging fruit of variable interest rate debt as much, although some companies did that,” he says.

Nareit data shows leverage remained modest with a weighted average of debt-to-market assets at 33.9% for equity REITs as of the 2023 first quarter. In addition, 87% of the debt REITs were carrying was fixed rate, with a weighted average term to maturity of 82 months or nearly seven years. In addition, debt to EBITDA ratios averaged 5.9x for all equity REITs as compared to levels of 8x during the GFC, according to Nareit.

“Those metrics are pretty good given an environment with tighter liquidity and higher rates,” Romano says. REITs also have the advantage of having access to a lot of different sources of capital. “When you look at their ability to generate liquidity, it’s a lot different than a private real estate company.”

Strategies for Raising Capital

Many REITs have taken a proactive approach to refinancing over the last several years, locking in lower rates and building some cushion in their credit metrics. “We think the U.S. REIT sector is well positioned to absorb higher rates and tighter access to capital, although we are seeing some pressure building in certain property types, especially office and the lower rated credits,” says Ana Lai, real estate senior director at S&P Global Ratings.

As of May 3, the Fed has raised interest rates at 10 consecutive meetings for a total of 500 basis points since March 2022. Refinancing even through 2024 could prove to be challenging due to higher interest rates. REITs can still access capital, but maybe not at the rate that they would like, Lai adds. “I think it really comes down to what refinancing needs they have, and what debt maturities they have coming up in the near term,” she says.

For REITs that do need to raise capital, they still have plenty of options. On the debt side, REITs can issue bonds and borrow money with unsecured and secured loans, as well as access capital through revolving lines of credit.

Today, unsecured debt comprises 75% of total REIT debt. “Many REITs, and especially the bigger REITs, do utilize the unsecured market pretty heavily, which is a real advantage to being a REIT,” says Michael Knott, managing director and head of U.S. REIT research at Green Street.

Although rates in the bond market do ebb and flow depending on market conditions, those rates for bond issuance are competitive, and in some cases, more attractive than mortgage rates. “We always think it is wise to have as broad of a menu as you possibly can on your sources of capital,” Knott says.

New market issuance is still somewhat muted given the rate environment, but REITs are continuing to tap the bond market, albeit at higher rates. For example, Crown Castle Inc. (NYSE: CCI) did a bond issuance on April 24, raising $600 million on five-year debt and $750 million of 10-year debt. The unsecured senior bonds priced at 4.8% and 5.1%, respectively.

Relatively speaking, those are good rates in the current market, although higher compared to recent history. “The bond market can be a really great tool. It’s important for companies to have leverage metrics that give it access to a broad array of financing choices and rates that are attractive,” Knott says.

The unsecured financing market does come with some risks. For example, it is a claim on the entire enterprise and not a mortgage on a single asset in the portfolio. “At the same leverage levels, we tend to think secured financing is less risky, but there are other really important considerations to take into account when a company is formulating their capital strategy,” Knott says.

Range of Capital Options

As for other capital options, “accessing the revolver could be an interim step until market conditions stabilize,” Lai notes. Another positive for REITs, she said, is that they have largely unencumbered their balance sheets. So, the potential for REITs to refinance with secured debt in the future could increase.

For example, in March Highwoods Properties, Inc. (NYSE: HIW) put a mortgage on one of their better assets in Charlotte with a loan from a life insurance company at a rate of 5.69%. “There could be more of that activity as a lot of REITs have large, unencumbered asset pools,” Streeter notes. Banks aren’t necessarily thrilled with doing term loans right now, but that is an option for some of the better credits, he adds.

Although REITs also have the potential to issue equity, there are few REITs in the current market that can do so accretively. The decline in REIT stock prices has meant that issuing new equity is very expensive and dilutive to current owners. Another option on the equity side is to sell assets or bring in a JV partner.

“Because a lot of REIT assets are top quartile assets, sovereign wealth funds and other discerning buyers very much like to do deals with REITs because it’s a way to get access to iconic assets,” Streeter says. However, price discovery in this market is the real issue given very limited transaction volumes, he adds.

It is also important to note that even REITs with higher debt to enterprise values still have access to capital. “They are perceived as good owners, good operators, and good sponsors. So, they should still have access to debt,” Knott says. “So, we don’t anticipate any sort of real distress, but it is a challenging environment to be a company with a high leverage level and therefore a need to either issue new debt or refinance existing debt maturities while the cost of equity is expensive.”

Adapting to Higher Rates

A bigger issue for REITs in the current market is adjusting to higher capital costs. “We’ve normalized from what was virtually free money and free access to money to something that is a bit more normal in terms of access to capital and having a real cost associated with debt you’re raising,” Knott says.

The broader real estate market hasn’t yet fully absorbed that reality in terms of property values and pricing. Green Street’s CPPI is down about 15% versus the peak in early 2022. The REIT market is pricing in another 5% to 10% of value declines, whereas the private market has been slow to adjust to the 25% reduction in value seen in the REIT market since the beginning of 2022.

While cap rates do not move in lockstep with interest rates, the public real estate market had a meaningful reaction to the recent surge in the 10-year Treasury yield, while the private market response was more measured. At the end of 2022, the difference between the public and private cap rates stood near 100 basis points. All else equal, this spread suggests that the public real estate market is priced more than 15% below the private market.

Inflation, in theory, should lead to higher rents. This may serve as the offset to rising cap rates in most property sectors where rents and NOI continue to grow. However, a slowing economy may restrain demand and rent growth. The problem is that many investors believe that office portfolio NOI will decline, some believe significantly, given the secular work-from-home impact on demand and the recessionary impact of a slowing economy. Office REITs, therefore, are experiencing the “double whammy” of lower cash flow projections and higher capital costs, which is why the office sector is being treated most punitively by investors, Streeter notes.

Following the GFC, a common strategy among REITs was to delever balance sheets so they would be in a better position to take advantage of growth opportunities that emerge in market downturns. Now those strategies are paying off.

“There are plenty of REITs that did exactly that and are now in good shape to go out and play offense and make accretive investments and find opportunistic deals,” Romano says. Those opportunities include M&A deals, with examples that have already emerged, such as with Extra Space Storage Inc.’s (NYSE: EXR) bid to acquire Life Storage, Inc. (NYSE: LSI).

“As relatively low leverage market participants with access to multiple sources of financing, we may see REITs being active in acquisition markets later this year and into 2024, as they often are early in CRE recoveries. That ability to step into the market when other potential buyers are limited by credit availability is a unique REIT advantage,” says John Worth, Nareit executive vice president, research and investor outreach.