REITs are heading into 2025 with an appetite to grow their portfolio and the liquidity to support deal-making. The big question ahead is whether they will find accretive opportunities in a market where interest rates are likely to remain higher for longer.

Major deals completed in the past 12 months show that REITs have the ability and desire to make big moves. Among the largest transactions:

- CareTrust REIT, Inc. (NYSE: CTRE) closed on two deals totaling $1.3 billion.

- Equity Residential (NYSE: EQR) acquired nearly $1 billion in apartments from three different Blackstone entities.

- Equinix, Inc. (Nasdaq: EQIX) formed a joint venture with GIC and the Canada Pension Plan Investment Board with the goal of raising more than $15 billion in capital.

- Lineage, Inc. (Nasdaq: LINE) raised $5.1 billion in its IPO.

- Ventas, Inc. (NYSE: VTR) closed more than $2.0 billion of investments in 2024, substantially all of which are focused on senior housing.

- Welltower Inc. (NYSE: WELL) saw $6.0 billion in investment activity in 2024, the highest level in the company’s history.

Such deals stand out in a real estate market that was relatively quiet on the transaction front. The persistent bid-ask gap kept many property sellers on the sidelines, while M&A activity also was subdued with just two deals announced or completed in 2024 totaling $12.9 billion.

From a high-level view, there is an expectation that the broader real estate market will see increased transaction activity in the coming year and REITs have the potential to lead the charge.

“We think capital is pretty abundant for the public REIT market, and REITs are well positioned to be very competitive with respect to acquisition opportunities,” says Todd Kellenberger, client portfolio manager for public REIT and infrastructure strategies at Principal Asset Management. “We think they'll continue to fund, where appropriate, development and redevelopment pipelines as well.”

There is a consensus that the real estate market is close to the end of valuation writedowns. As market participants feel that the floor has been reached in terms of value, it provides a base from which to start to underwrite and think about transacting.

“Hopefully, we will see more buyers and sellers come off the sidelines, and bid-ask spreads, which are quite wide, start to narrow. And when that all occurs, we think transaction activity picks up,” Kellenberger says.

Following nearly three years of muted CRE transaction activity, J.P. Morgan also expects to see a recovery unfolding that should provide external growth opportunities for REITs. “Part of the outlook for transaction volume is a function of this capitulation on everyone's part that we are higher for longer in terms of rates, and that it's time to get going and make it happen,” says Mark Streeter, a managing director at J.P. Morgan. “I think patience is wearing thin for a lot of REITs to put capital to work.”

Although the 10-year Treasury may be higher than people want, the credit spread has exceeded all expectations to the tight side, which is a benefit to REITs that are accessing unsecured debt in the bond market. “I think that's given some confidence that we could see some more transaction volumes in terms of acquisitions,” Streeter adds.

Plenty of dry powder

Analysts agree that REITs are well positioned from a liquidity and access to capital standpoint. Public companies continue to have a lot of options at their disposal, including their ability to tap equity markets through forward equity offerings or at the market offerings (ATMs), which allow them to opportunistically and quickly raise equity cheaply so that they can arbitrage pricing in the private market.

The debt markets also have been open for REITs through much of 2024 in both the secured and unsecured markets.

REITs’ access to the bond market is giving them an edge over private real estate firms thanks to spreads that are near all-time tights. Unsecured REIT debt could be 50 to 100 basis points cheaper than CMBS or a secured loan or mortgage, which is meaningfully less expensive. REITs also have access to equity and hybrid forms of capital, such as preferreds and convertible bonds that give them further flexibility, as well as through joint ventures with large, sophisticated institutional investors.

“In my opinion, REITs are one of the best-positioned class of real estate investors from a liquidity perspective,” says Matthew Sgrizzi, chief investment officer of LaSalle Global Solutions. Their size and transparency make them good counterparties for lenders and equity investors, and their access to diverse forms of capital and generally low leverage also affords them a lot of flexibility, he adds.

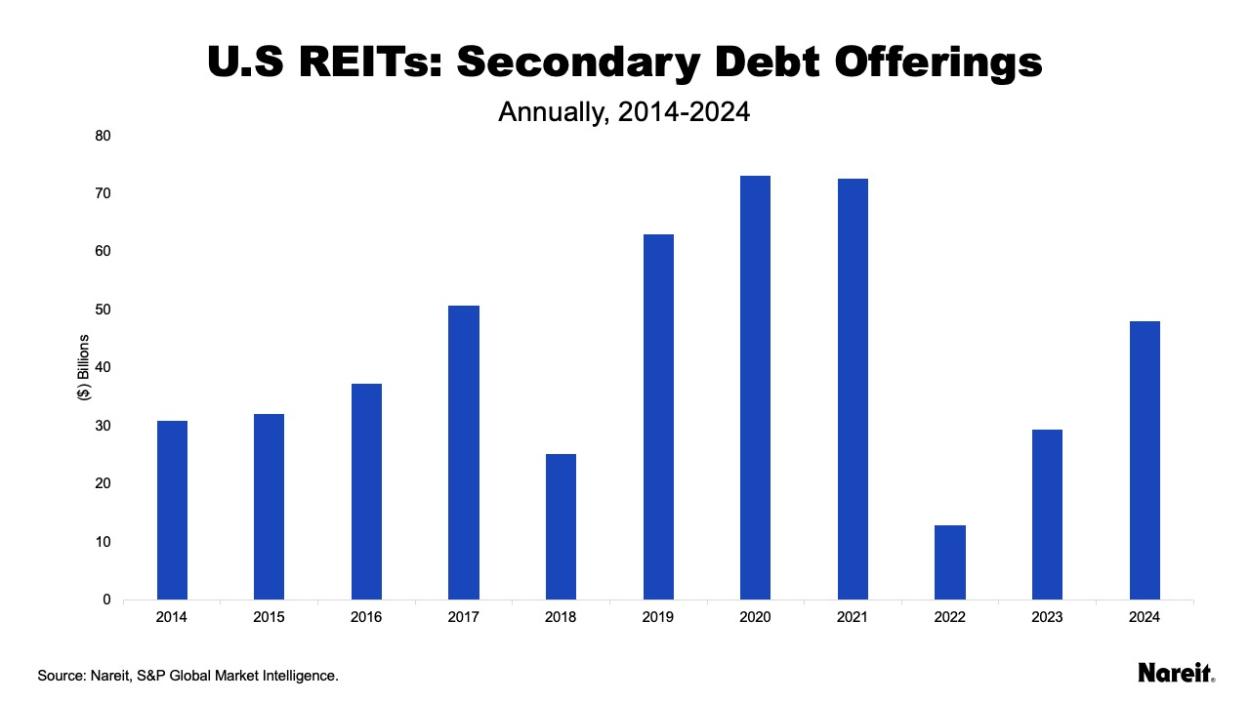

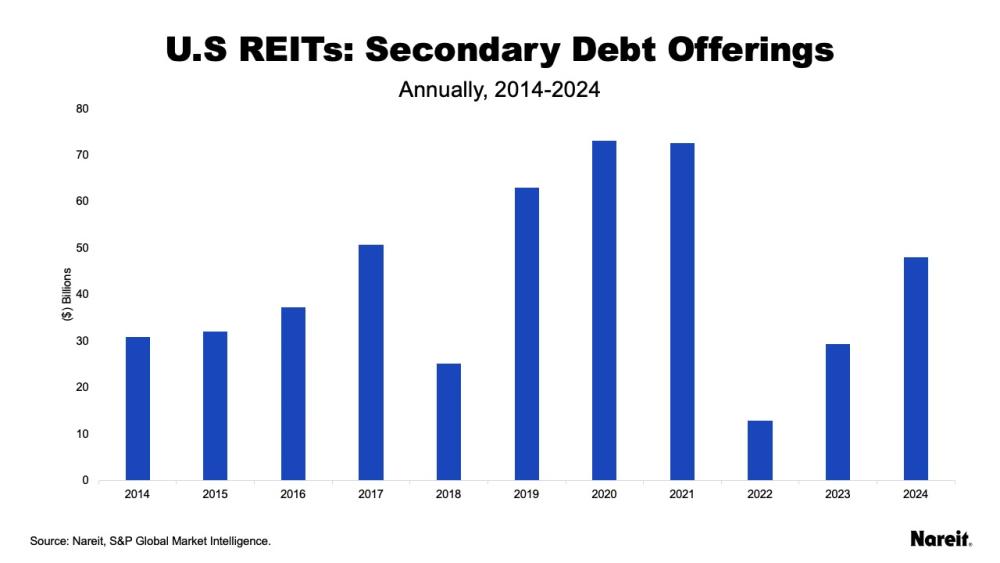

Last year, REITs raised $84.7 billion in secondary debt and equity offerings and IPOs, according to Nareit. During 2024, REITs generated:

- $48.1 billion through secondary debt offerings (compared to $29.4 billion in 2023)

- $15.8 billion in secondary equity issuances (compared to $12.7 billion in 2023)

- $14.6 billion in ATM issuance (compared to $19.6 billion in 2023)

- $6.1 billion through three IPOs (compared to $0 in 2023)

“Once rates come down, you're going to see more favorable pricing in the market, which could in turn make equity offerings more attractive for REITs,” says Chris Hudgins, research analyst, real estate, at S&P Global Market Intelligence. “But for right now, most of 2024 was debt offerings.”

According to S&P Global, what they categorize as the specialty real estate sector, including advertising, data centers, energy infrastructure, and timber, led capital raising activity in 2024, totaling $17.4 billion. It was followed by the industrial sector, which raised $12.4 billion. Logistics REIT Prologis, Inc. (NYSE: PLD) raised the most amount of capital of any REIT in 2024 at $5.2 billion. The Lineage Inc. IPO and Digital Realty (NYSE: DLR) followed in second and third place, raising a respective $5.1 billion and $4.9 billion last year.

Record debt issuance ahead in 2025

Specific to the REITs J.P. Morgan tracks, the firm is predicting a record year of debt issuance ahead for 2025 at an estimated $42.5 billion compared to the previous high of $41 billion in 2021.

However, the firm’s forecast is contingent on the 10-year Treasury cooperating. Despite Federal Reserve rate cuts in the third and fourth quarters, the 10-year benchmark rate began to move higher in December 2024. After hitting a high of nearly 4.8% in January, the 10-year Treasury dropped back to 4.5% as of Feb.14.

According to Streeter, if the 10-year Treasury holds at around 4.6% or higher it will be a gating factor on how much issuance occurs this year. J.P. Morgan’s forecast that the 10-year will settle at 4.55% is embedded in its forecast for REIT issuance.

So far, issuance this year is off to a slow start, in large part because of the spikes in the 10-year Treasury that has caused REITs to pull back and take a wait-and-see approach. At the same time, spreads are very tight, and J.P. Morgan anticipates that spreads could tighten another 5, 10, or even 15 points this year. “Treasury moves can have a dramatic influence on REIT CFO issuance routines and their ability to pull the trigger and actually issue,” Streeter says.

So, what do REITs have planned for capital raised in what could very well be record issuance? One is paying off debt maturities. Debt maturities that were low the last couple of years do step up again over the next two years. Investment grade bond and bank maturities for 2025 are at $25 billion, rising to $43 billion for 2026, and $79 billion for 2027, according to J.P. Morgan. The firm’s forecast for record debt issuance also accounts for acquisition volume, specifically from triple net lease REITs and health care REITs, which are the two sectors that have been the most acquisitive over the past year.

Sectors likely to pursue acquisitions

Where REITs are trading relative to NAV will play a big role in how acquisitive management teams are likely to be in the coming year. “The range is historically quite wide, and there are still a number of big REITs where the door is still pretty open for them to do acquisitions because they're trading at premiums. So, their cost of equity capital is competitive,” Sgrizzi says.

Notably, that includes REITs in the health care, triple net lease and data center sectors. “We’ve seen them be active, and I think that they can continue to be active,” Sgrizzi says. “But again, we are really on this knife edge of what will happen, and things can change quickly.” Market conditions have changed quickly over the past six months, which is frustrating for a lot of real estate investors and REIT management teams, he adds.

The list of top equity and debt issuers offers some insight into REITs that have been or are planning to be active acquirers. Health care is one sector that tops the list with REITs such as CareTrust REIT, Inc. (NYSE: CTRE), Welltower Inc. (NYSE: WELL), and American Healthcare, Inc. (NYSE: AHR) that have been busy with new issuance.

Other REITs, where “the door is closed,” are where they are trading at discounts to NAV, and they should not be growing the size of their companies. “That's the signal that they get, and I think the management teams have gotten really good at heeding that signal,” Sgrizzi says.

REITs are in a great position to use third-party capital because of their high-quality operating platforms. A term people are using in the REIT business is “capital light,” meaning they can leverage their operating expertise and use other people’s money or JV equity partners to finance their growth, Sgrizzi notes. “That can be a really nice way for REITs to efficiently increase the returns that they get on their invested capital,” he says.

Finding accretive opportunities

REIT NAV will be an important trigger to watch in terms of transaction velocity that may be accelerating or slowing down. REITs started off 2024 a little weak, followed by a rally that lifted them to NAV premiums and put them in a better position to issue equity. That reversed in the fourth quarter.

“The amount of time that REITs spent having that green light for doing acquisitions was a short window over the course of 2024,” Sgrizzi says. Management teams are reading those signals correctly and have not been very acquisitive.

Although quieter, private-to-public M&A activity also continued in 2024, notably with Blackstone targeting three different REITs. “We expect that if REITs sell-off and trade at persistent discounts to NAV then private equity will probably continue to come looking for deals within public REITs. Cash buyers, especially, are going to be motivated to put that cash to work as many people believe 2025 could be a good vintage to buy real estate for the next cycle,” Kellenberger says.

Interest rates will continue to play a big role in the level of transaction activity in the coming year. In addition, volatility in rates could create a drag on activity as both buyers and sellers need confidence to support underwriting for the future.

“We've been in this environment the last couple of years where 10-year bond yields are moving 25 to 50 basis points in one quarter, and they're moving the other direction the next quarter,” Kellenberger says. “That rate volatility brings disruption to the cost of financing, but importantly, property cap rates. It's difficult to transact when the window for buyers and sellers to agree on pricing is constantly opening and closing.”

What REITs are buying also matters. Is the deployment of that capital a good use of those proceeds? “When REITs come to the market and look to raise capital, we're going to be looking at that very closely and judging whether that was a good capital allocation decision or not,” he adds.