Real estate professionals worldwide have been given a large financial incentive to capitalize on the power of solar, battery storage, EV charging, and more. Specific to photovoltaics (PV) solar, Morgan Stanley estimated that investing in a solar energy system for commercial real estate asset energy needs would be cheaper than buying electricity from the grid for 90% of the top 50 REITs. Firms can also monetize their capital expenditure investment by selling or transferring IRA tax credits from these installations.

Of course, this lucrative opportunity comes with its own challenges. Solar and other renewable energy investments are not “set it and forget it” solutions. However, industry-leading real estate professionals have recognized that approaching solar projects with a robust post-installation strategy allows them to realize maximum ROI on these assets, seeing long-term success with their clean energy investments. Here’s how:

Forecasting for Operating Expenses

Large, established REITs and CRE entities often understand the capital expenses needed to develop and install a solar project, but may not have the most accurate data to forecast appropriately for ongoing system-related operating expenses. Understanding what it will take to keep that sustainability investment operating for 25-plus years, especially when it comes to recurring operations and maintenance (O&M), is how the most prolific developers protect their investments

Accurately forecasting for performance testing, QA/QC, and proactive maintenance not only ensures optimized asset performance and system lifespan, but also helps hit revenue targets faster, while avoiding the unexpected cash crunch of major corrective maintenance. When a robust solar performance and O&M program is folded into project planning, REITs can budget accordingly for both preventive and corrective long-term maintenance needs.

A properly forecasted post-installation service plan will also aid solar assets in providing reliable energy generation through preventive maintenance and proactive monitoring without going over budget. Consistency in solar power production means investors will see increased kWhs of production, and therefore a higher return on investment.

Having a valued performance assurance partner can help REITs understand the overall lifetime cost of energy and will help them qualify – or disqualify – projects on a long-term economic basis (including asset recapturing events). Once an investment is made and performing optimally, real estate professionals will be able to realize the full benefit of their decision.

Proactively Monitoring Performance

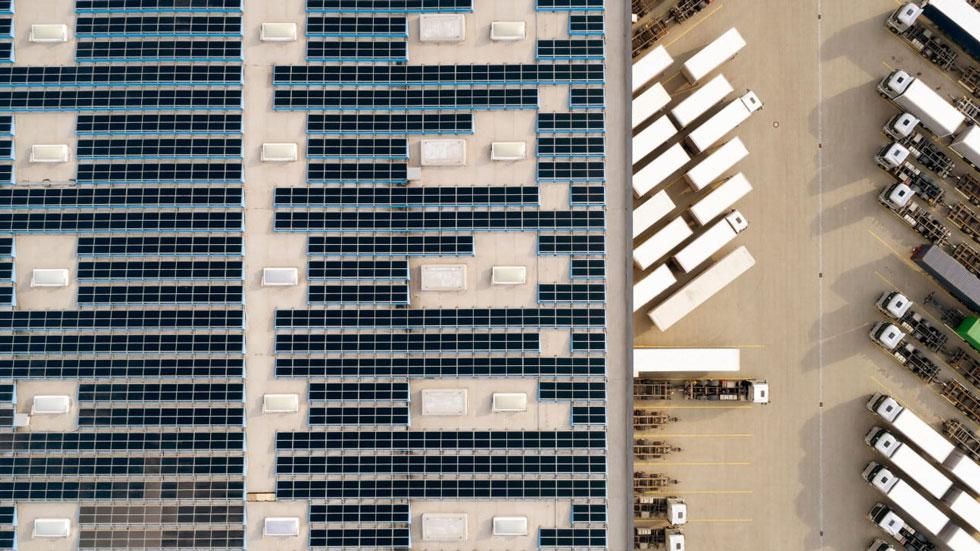

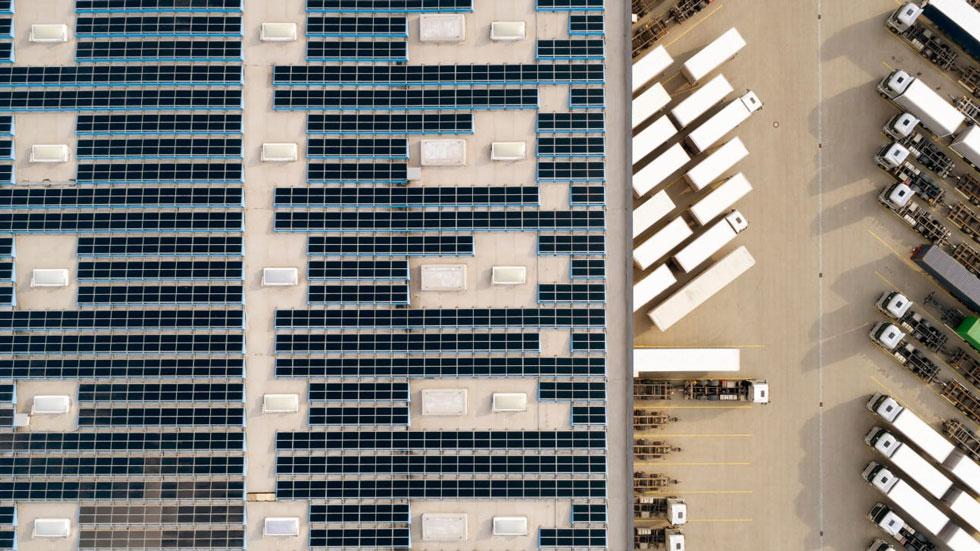

As noted above, REITs investing in solar energy expect peak performance and consistent production in order to harness these assets’ long-term benefits and ROI. As such, ensuring system uptime is crucial to the success of solar installations in any real estate setting, from residential rental buildings to industrial warehouses.

Monitoring solar installation performance from day one will help real estate investors understand their assets’ historical patterns of production and aid them in identifying which issues could prevent proper output and reduce revenue. An intelligent monitoring solution will not only identify these issues but will verify if underproduction alerts are valid and if the root cause requires boots-on-the-ground remediation.

Forward-thinking real estate investors remove much of their risk to internal rate of return by assuring performance through system monitoring. This continual monitoring – as well as correcting for asset downtime only when necessary – helps avoid costly maintenance expenses, and ultimately drives predictable ROI across solar investments.

REITs can proactively monitor asset performance through partnerships with companies that specialize in solar performance assurance and management. By focusing on optimal uptime, REITs can be assured that once a PV investment is made, it will continue to perform efficiently and generate revenue throughout its lifespan.

Investing in Quality Maintenance

Real estate owners/operators with solar investments face a key maintenance challenge: consistent, quality servicing and reporting. In order to see the full financial benefits of solar assets, investors need reliable maintenance work that meets the highest standards possible, as well as thorough reporting and service insights that are presented in a consistent, digestible manner.

Highly-rated and thoroughly vetted maintenance providers can ensure solar assets are serviced immediately if an issue requires attention, and will offer professional insights and guidance on any next-step remediation needs. They will also provide consistent work quality and reporting throughout service visits, ensuring REITs have a holistic view of their solar assets’ performance.

However, it’s not prudent for real estate investors, who can have demanding schedules, to source and vet these types of providers themselves. It’s also not optimal for investors to deal with multiple maintenance providers (often across different geographies) whose quality of work can differ greatly, or whose disparate reports make it difficult to piece together vital information on solar investments.

Fortunately, REITs investing in PV can work with a reputable third-party partner who manages a nationwide network of vetted and trusted service providers. This solution not only creates the opportunity to quickly scale real estate portfolios with solar across different geographies and properties, but also provides the peace of mind that these renewable energy investments are in capable hands for the entirety of their lifespans.

As the adoption of solar becomes more financially viable and attractive across the real estate industry, savvy investors adopting this clean energy solution will see stronger ROI when they forecast for operating expenses, monitor performance proactively, and invest in quality maintenance partnerships. These strategies will help investors turn potential challenges with solar investments into an opportunity for long-term financial growth.

About Omnidian

Omnidian is an asset performance management and nationwide service provider for commercial and residential solar and storage assets whose mission is to protect and accelerate investments in clean energy technology. Launched in 2016 by solar veterans and backed by investors such as Microsoft, HSBC Asset Management, and Liberty Mutual, Omnidian is responsible for assuring the performance of over 2GW of renewable energy assets.