In gambling, “advantage players” use legal techniques and expert knowledge to gain a winning edge over casinos. In commercial real estate, REITs have long maintained competitive advantages over typical property investors. Examples of REITs having held the upper hand include their best-in-class operator expertise and efficient access to cost-advantaged capital. With their well-structured balance sheets, REITs can be considered advantage players in the commercial real estate marketplace.

Many property investors are envious of current REIT balance sheets. Data from the Nareit Total REIT Industry Tracker Series (T-Tracker®) show that REITs have continued to maintain low leverage ratios, focusing their financing activities on fixed interest rates, longer-term maturities, and unsecured debt.

Second quarter of 2024 Nareit T-Tracker data show that, on average:

- Leverage ratios were low with debt-to-market assets at 34.1%.

- Weighted average term to maturity of REIT debt was 6.4 years.

- Weighted average interest rate on total debt was 4.1%.

- Fixed rate debt accounted for 90.8% of listed REITs’ total debt.

- Unsecured debt was 79.2% of REITs’ total debt.

These debt structure characteristics have afforded REITs greater operational flexibility and allowed them to face less stress than their competitors with high debt loads and costs. Disciplined balance sheets have also placed REITs in the catbird seat for potential acquisition and development opportunities in the current marketplace.

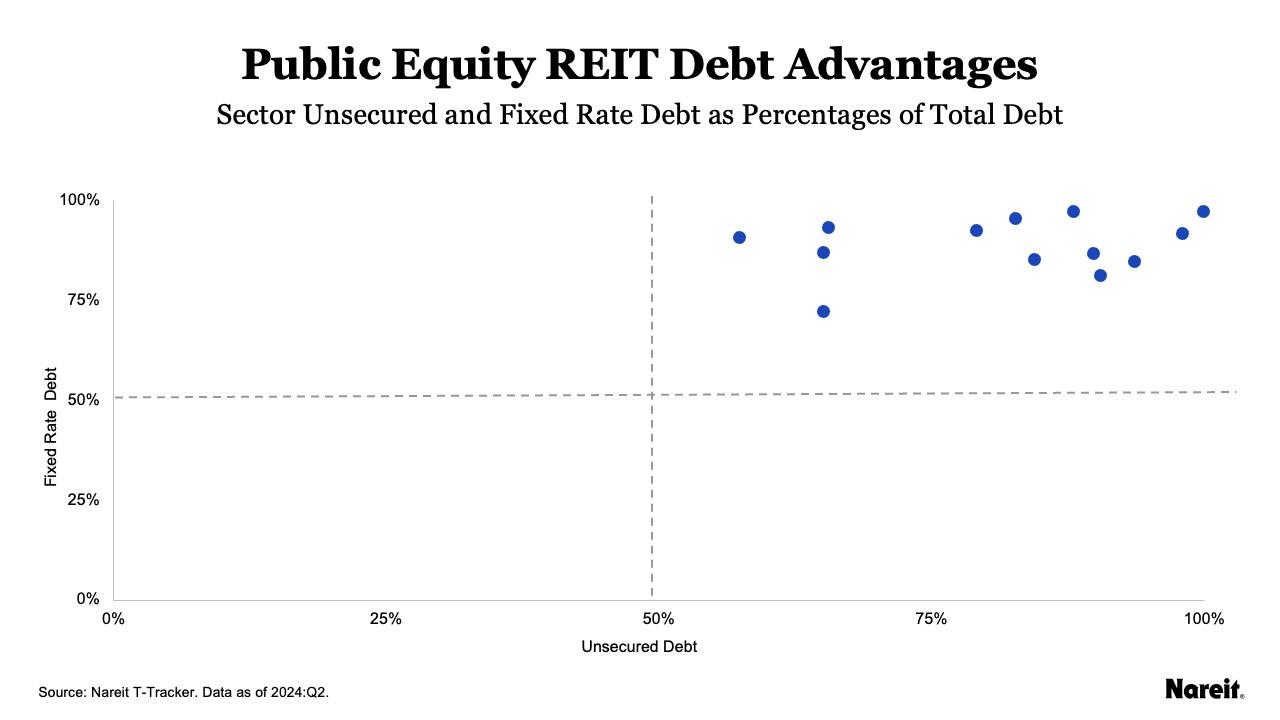

The chart above displays a scatter plot of unsecured and fixed rate debt usage as percentages of total debt for 13 REIT sectors defined by FTSE Nareit as of the second quarter of 2024. It also includes dashed vertical and horizontal lines that divide the chart into quadrants. The upper right-hand quadrant represents the region of the chart with both significant secured and fixed rate debt usages. Highlighting REITs’ robust use of unsecured and fixed rate debt, all plotted points are found in this quadrant.

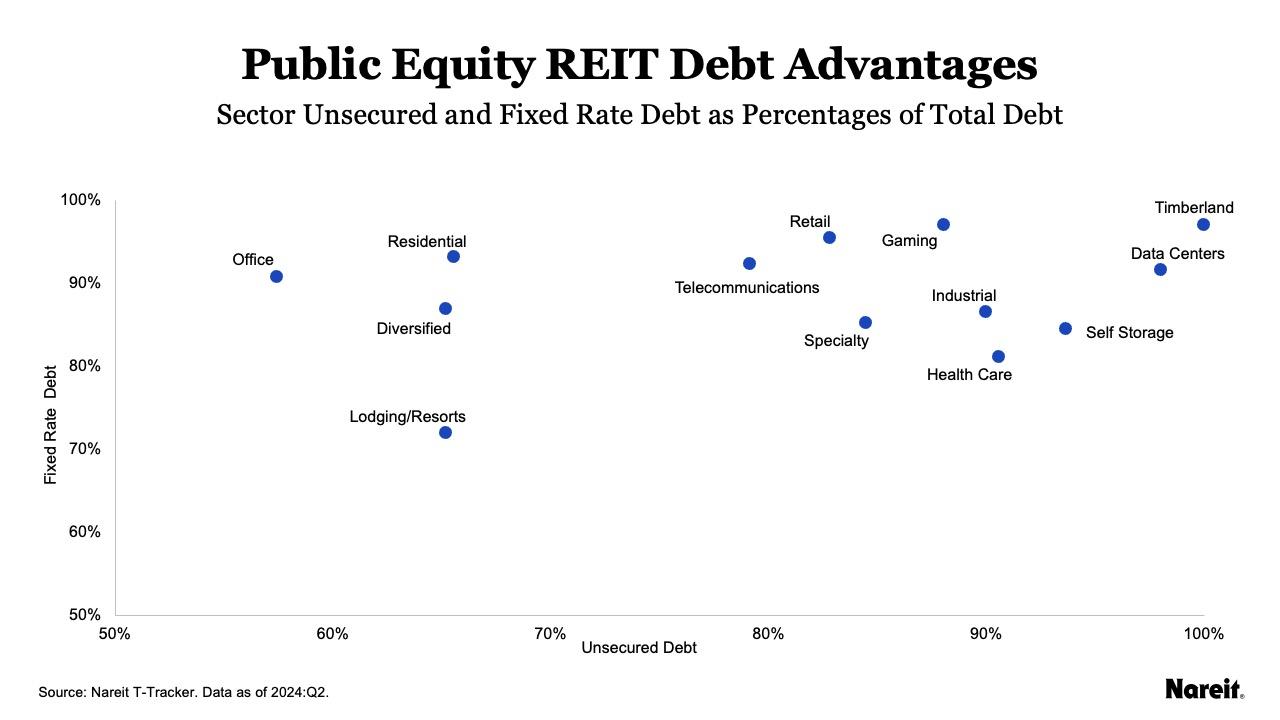

The next chart zooms in on the upper right-hand quadrant of the first chart. It presents the same information, but its two axes have been recalibrated to start at 50% and the 13 REIT sector coordinates have been labeled—data centers, diversified, gaming, health care, industrial, lodging/resorts, office, residential, retail, self-storage, specialty, telecommunications, and timberland. This chart again showcases REITs’ strong preferences for secured and fixed rate debt.

Highlighting REITs’ typical longer term investment focus, fixed rate debt across the 13 sectors, on average, accounted for more than 90% of total REIT debt. All sectors, with the exception of lodging/resorts, had fixed rate debt usage percentages greater than 80%. Fixed rate debt accounted for more than 90% of total debt for seven sectors: data centers, gaming, office, residential, retail, telecommunications, and timberland. This emphasis has kept REITs reasonably well-insulated from fluctuating interest rates.

Access to unsecured debt provides REITs with a competitive advantage over many of their private real estate market counterparts. Across all REIT sectors, unsecured debt comprised nearly 80% of total debt. Eight of 13 sectors—data centers, gaming, health care, industrial, retail, self-storage, specialty, and timberland—had unsecured debt usage rates greater than 80%. In the second quarter of 2024, REIT debt issuance totaled $12.5 billion and the average yield to maturity of REIT unsecured debt offerings was 4.5%. This average cost of debt is enviable; the U.S. 10-Year Treasury yield averaged 4.4% over the same quarter.

Throughout the ups and downs of real estate cycles, REITs have maintained competitive advantages over typical property investors. Best-in-class operator knowledge and efficient access to cost-advantaged capital gives REITs an edge over their competition. Disciplined balance sheets have also placed REITs in an enviable position when it comes to potential growth opportunities. Today, REITs remain advantage players in the commercial real estate marketplace.