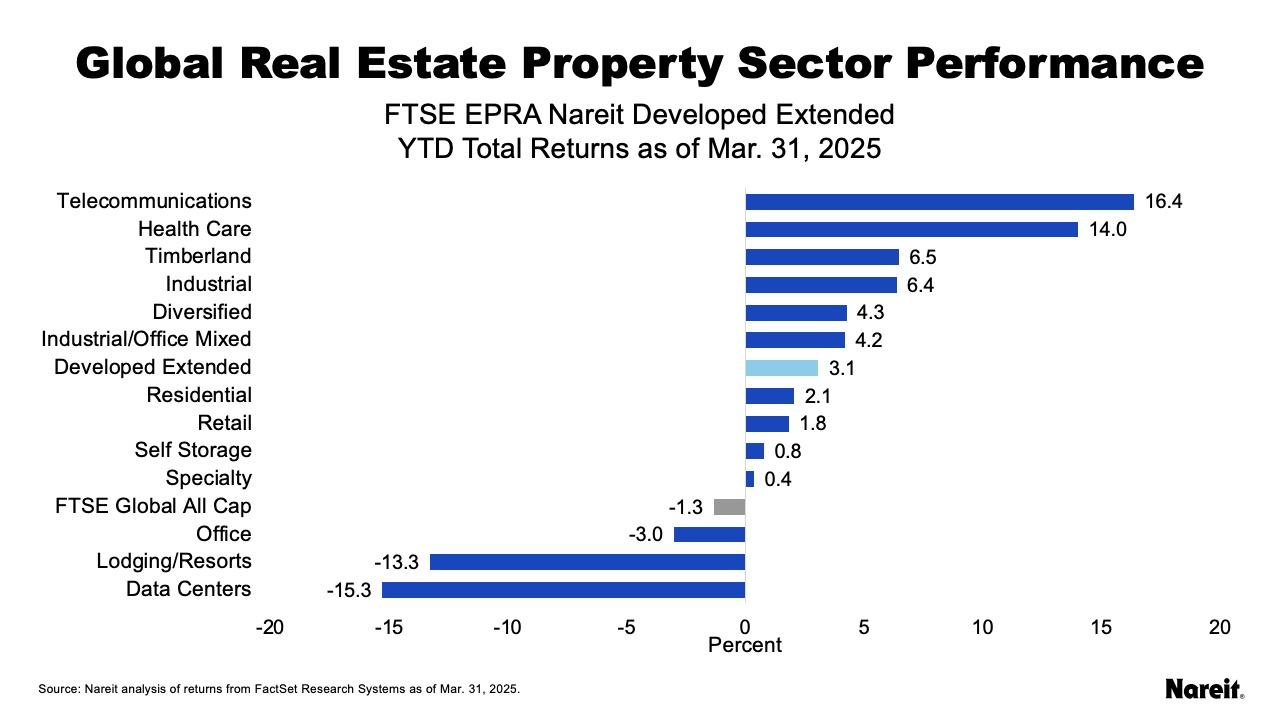

The FTSE EPRA Nareit Developed Extended Index declined 1.4% in March and has risen 3.1% on a year-to-date basis as of March 31. Real estate has outperformed equities over these same periods, as the FTSE Global All Cap was down 3.7% for the month while losing -1.3% for the year. The Dow Jones U.S. Total Stock Market declined more sharply, with a total return of -5.9% in March while losing 4.9% year-to-date.

Through April 9, global markets have been roiled by debates over international trade policy. The FTSE EPRA Nareit Developed Extended Index has underperformed stocks in April, posting a total return of -6.3% in volatile trading. The FTSE Global All Cap is down 5.2% over the same period.

Property Sector Highlights

As shown in the chart above, telecommunications leads on a year-to-date basis, followed by health care, and timberland, with respective total returns of 16.4%, 14.0%, and 6.5% Data centers are the worst performing sector at -15.3%. Lodging/resorts fell 12.3% and office was down 3.0%.

Regional Performance

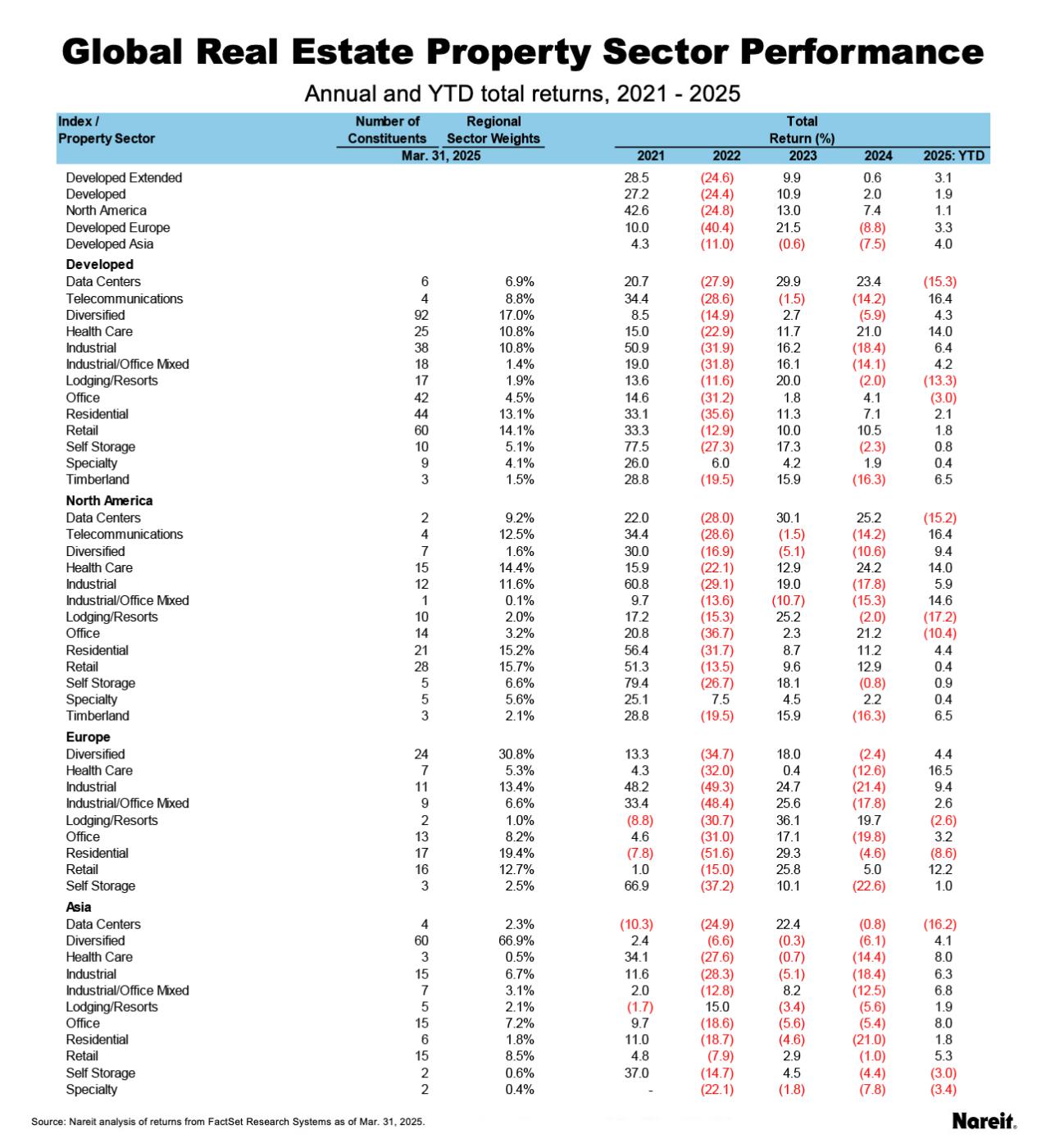

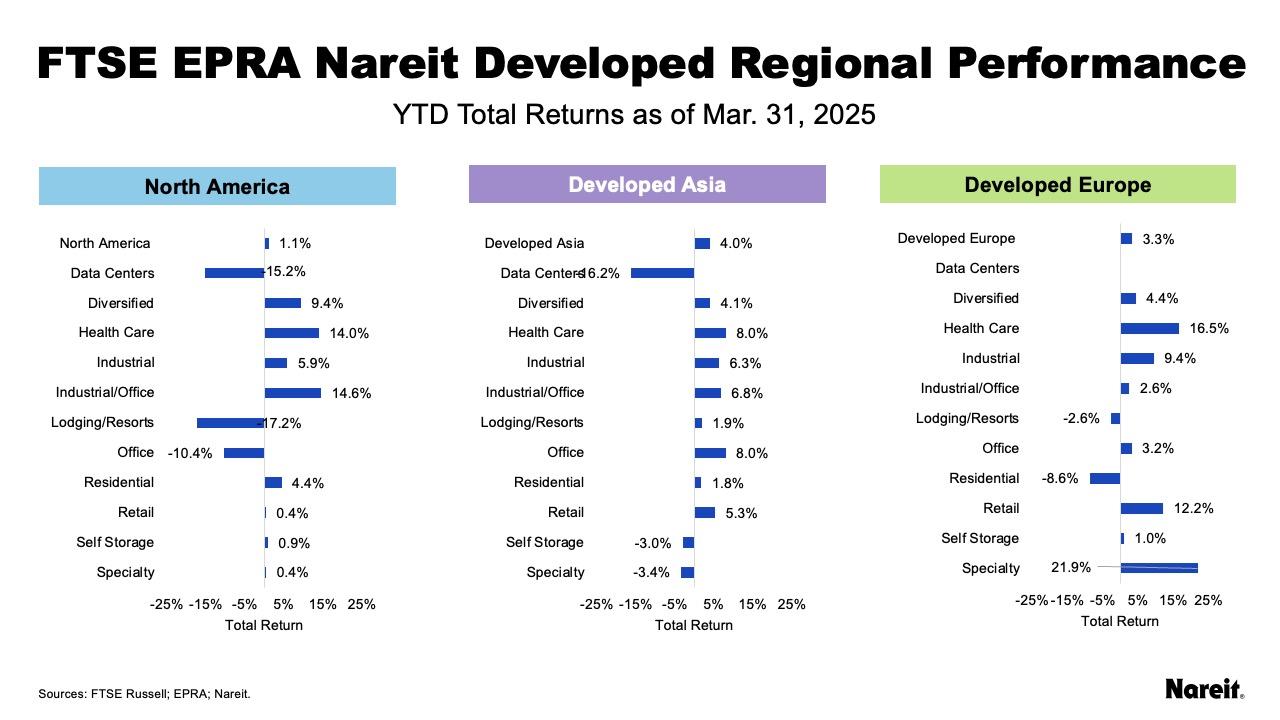

Developed Asia leads year-to-date with a total return of 4.0%, followed by Developed Europe at 3.3%, and North America at 1.1%, as reflected in the preceding table. Developed Asia was led by health care, office, and industrial/office mixed, while Europe was led by health care, retail, and industrial. In North America, telecommunications leads, followed by industrial/office mixed, and health care.

As reflected above, data centers have struggled in both North America and Asia following concerns of overbuilding in the sector. Health care and industrial have posted strong performance across regions.