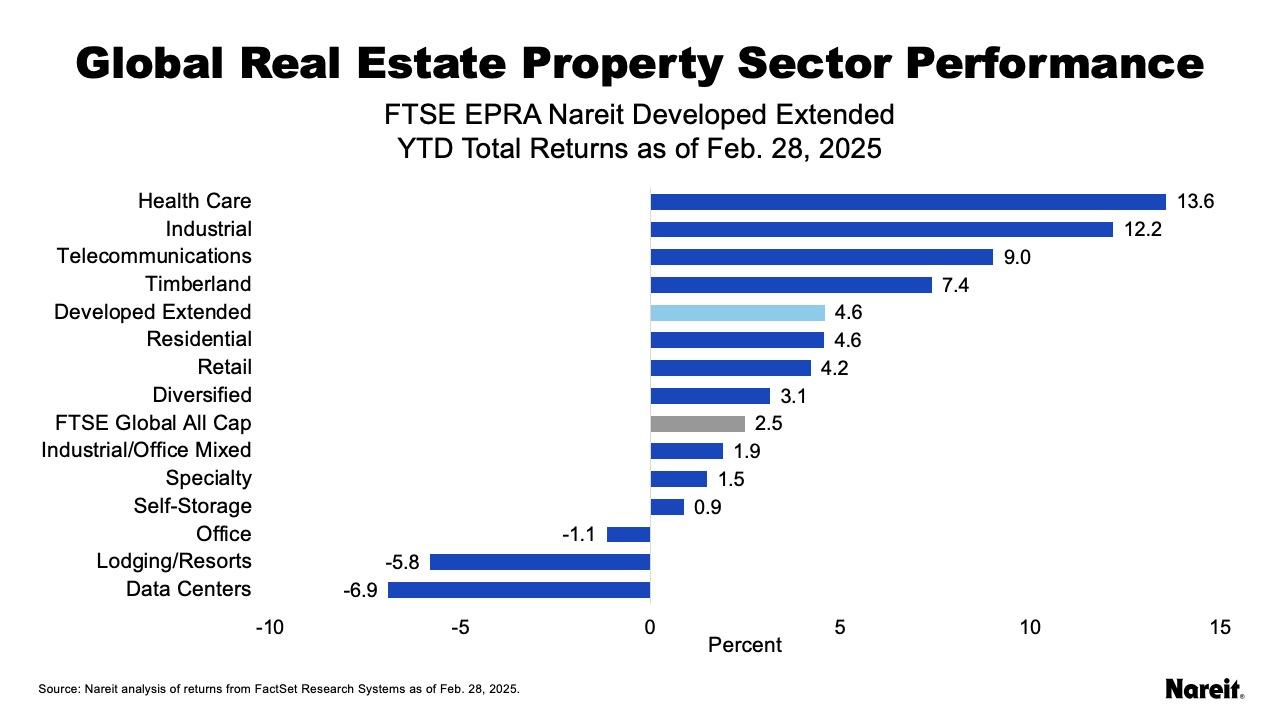

The FTSE EPRA Nareit Developed Extended Index rose 2.8% in February and was up 4.6% on a year-to-date basis at month-end. Equities underperformed real estate over these same periods, as the FTSE Global All Cap was down 0.8% for the month while gaining 2.5% for the year. The Dow Jones U.S. Total Stock Market fell 1.9% in February and is up 1.1% on the year.

U.S. stocks have sold off dramatically in March, with the Dow Jones U.S. Total Stock Market falling 6.0% through March 10, while the FTSE Global All Cap has fallen 3.3%. In March, concerns over the potential for slowing growth in the United States have heightened.

Property Sector Highlights

As shown in the chart above, health care leads on a year-to-date basis with a total return of 13.6%, followed by industrial at 12.2%, and telecommunications at 9.0%. Data centers continue to lag, down 6.9%, with questions about future capacity needs connected to AI investment; lodging/resorts fell 5.8% and office was down 1.1%.

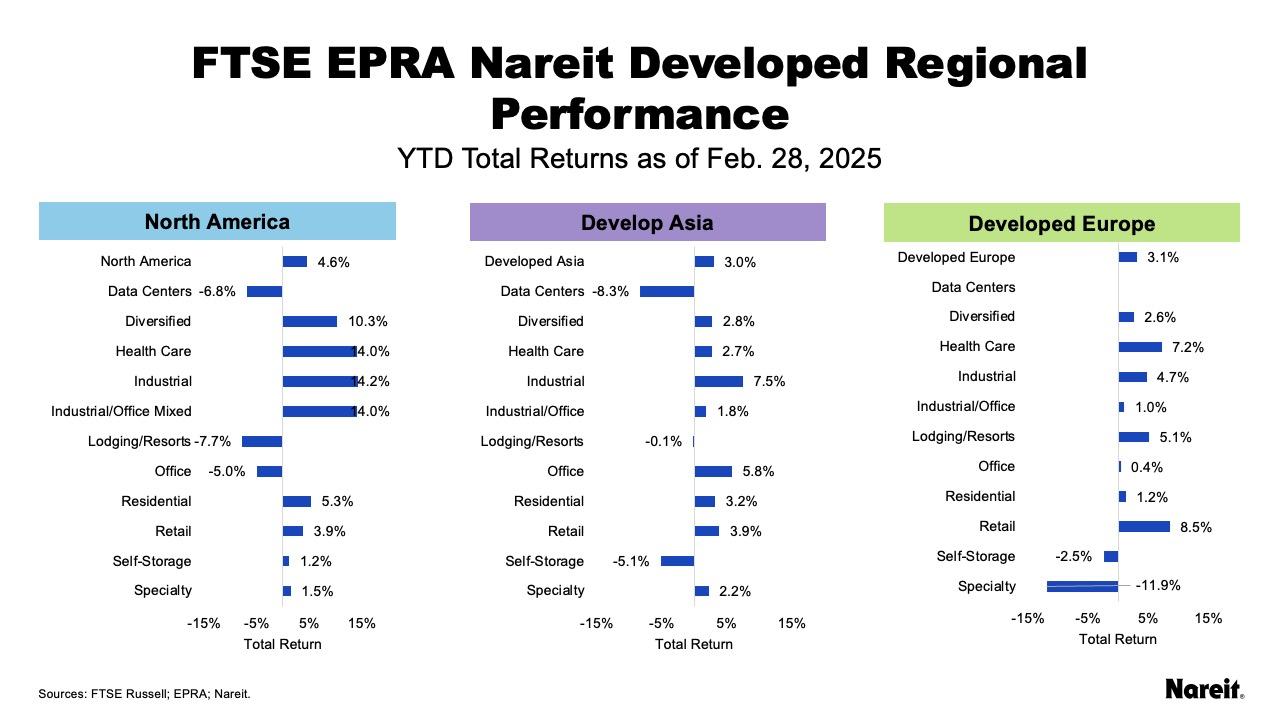

Regional Performance

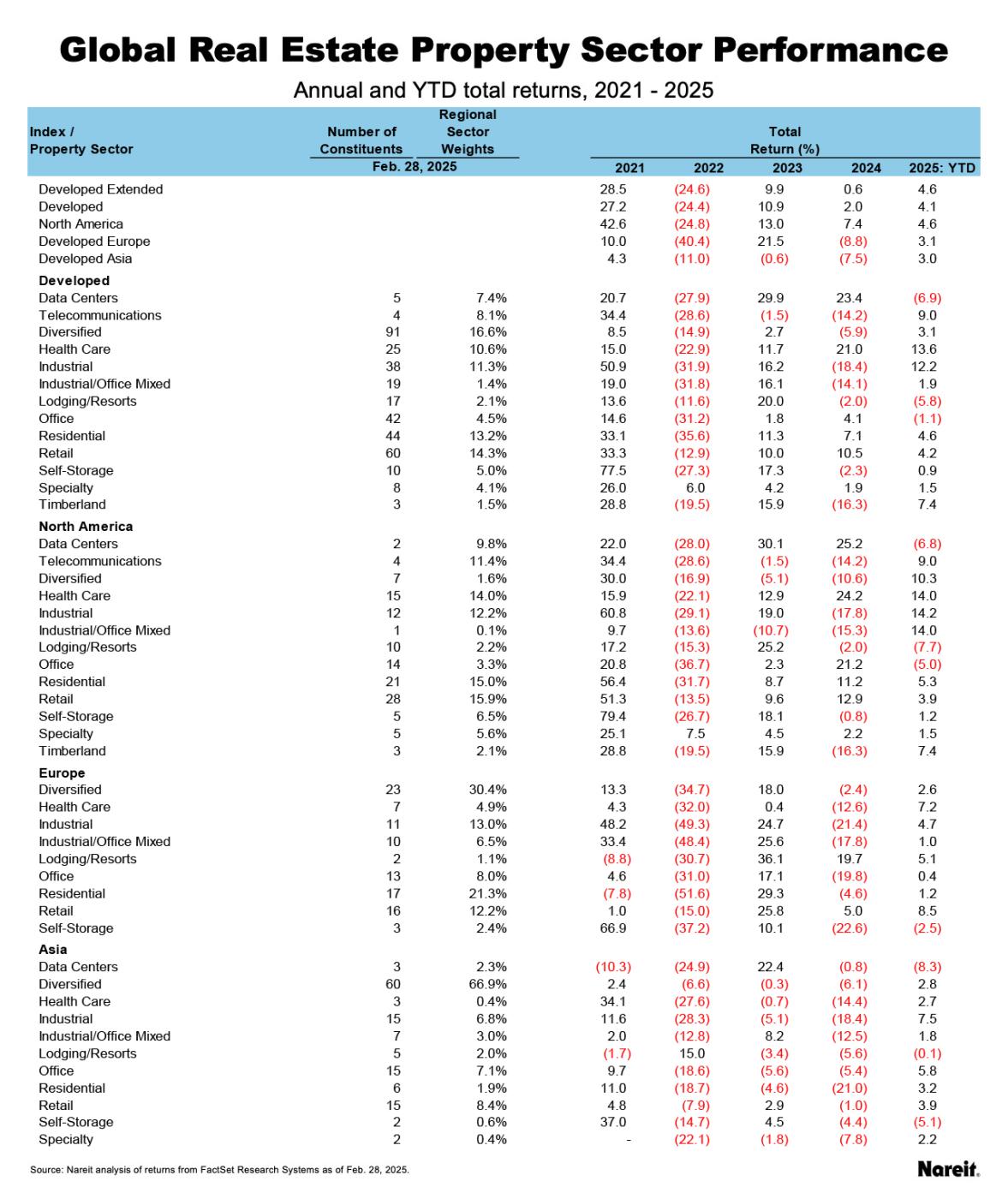

North America leads with a total return of 4.6%, followed by Developed Europe at 3.1%, and Developed Asia at 3.0%, as reflected in the preceding table. North America was led by industrial, health care, and industrial/office, while Europe was led by retail, health care, and lodging/resorts. Industrial, office, and retail led in Asia.

As reflected above, health care, industrial and retail have seen broad support across regions, while data centers have been challenged in both North America and Asia. Lodging/resorts has performed well in Asia, while facing headwinds in North America.