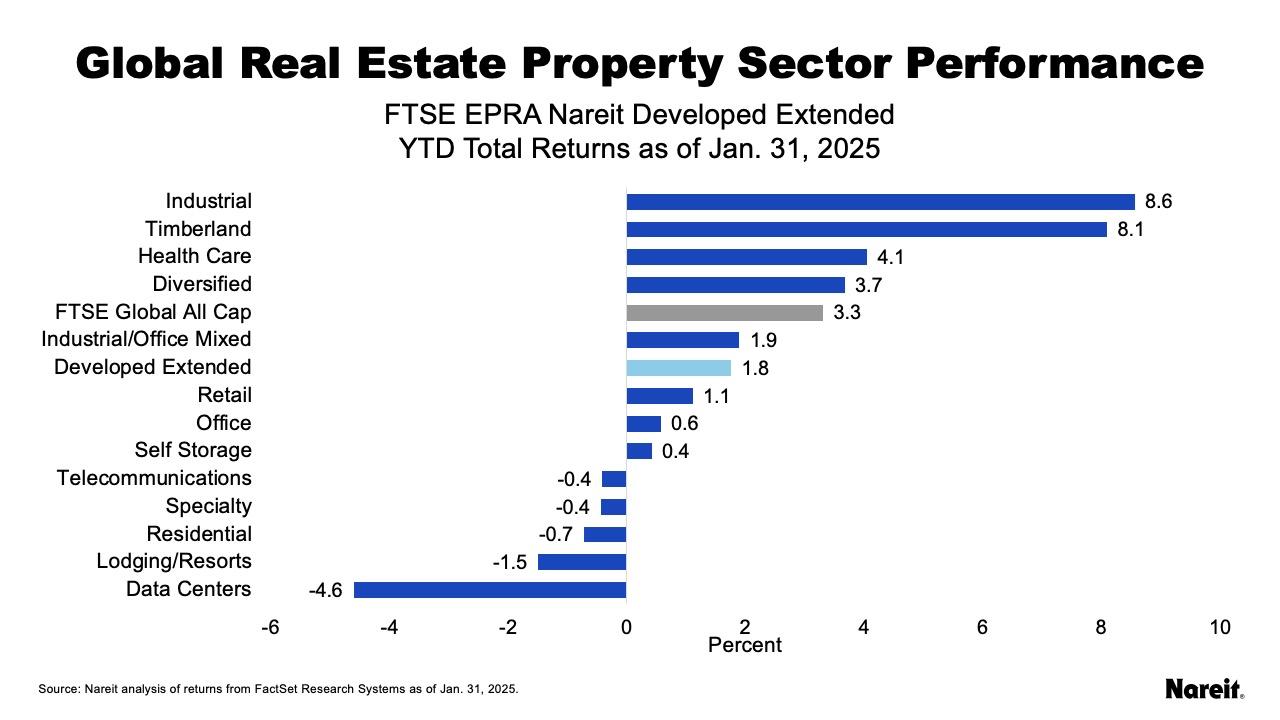

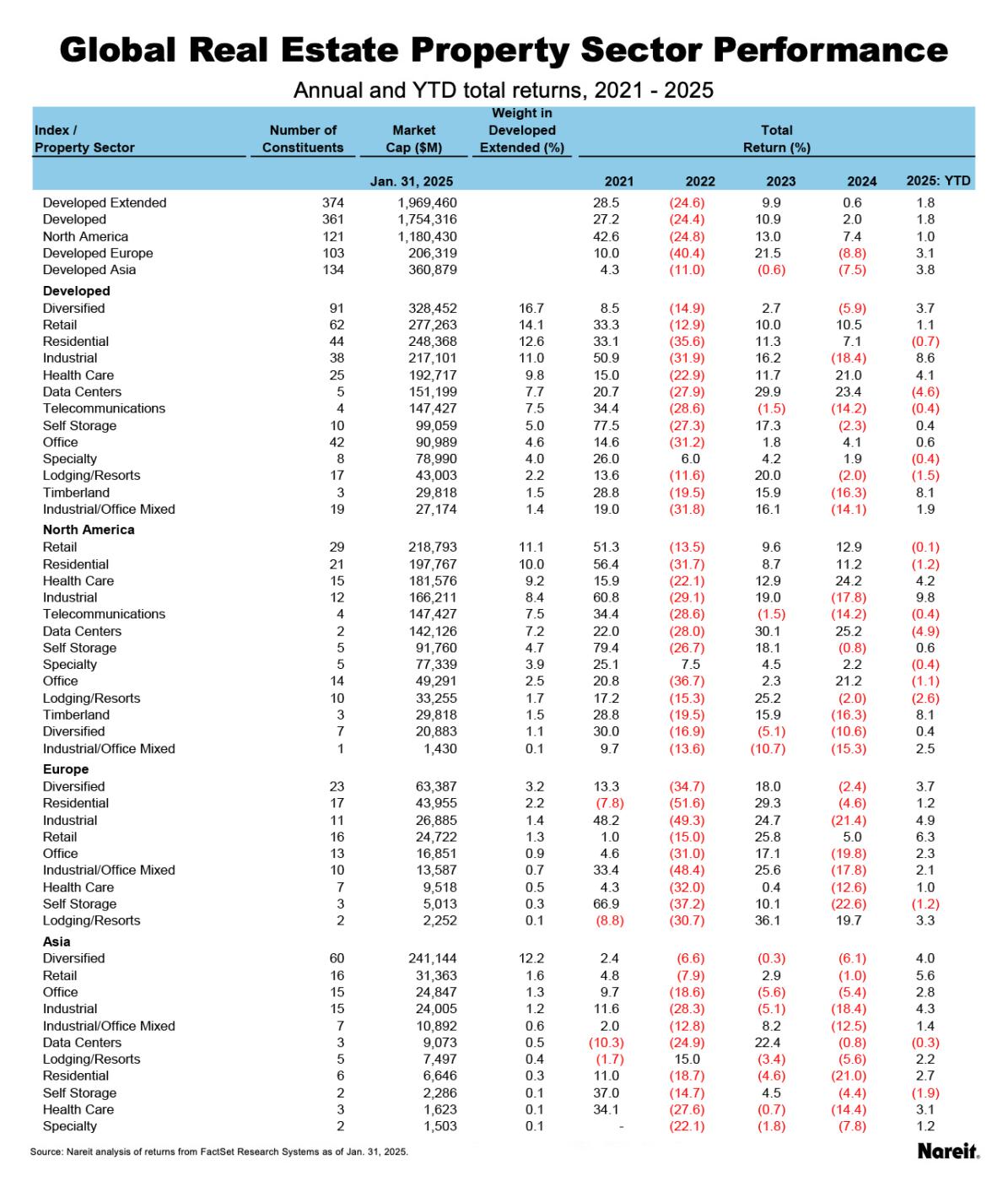

The FTSE EPRA Nareit Developed Extended and Developed Indexes (PDF) each rose 1.8% in the first month of 2025, led by industrial, timberland, and health care. Broader markets outperformed real estate, as the FTSE Global All Cap rose 3.3% and the Dow Jones U.S. Total Stock Market returned 3.1% in January. Global investors generally expect central banks to ease interest rates over the course of the year, though the number of cuts and the pace remain uncertain.

Property Sector Highlights

As shown in the chart above, industrial led with a total return of 8.6% in January, followed by timberland at 8.1% and health care at 4.1%. Data centers lagged at -4.6%, as they got caught up in the uncertainty introduced by the release of a new AI model by Chinese AI service DeepSeek; lodging/resorts followed at -1.5%, with residential at -0.7%.

Regional Performance

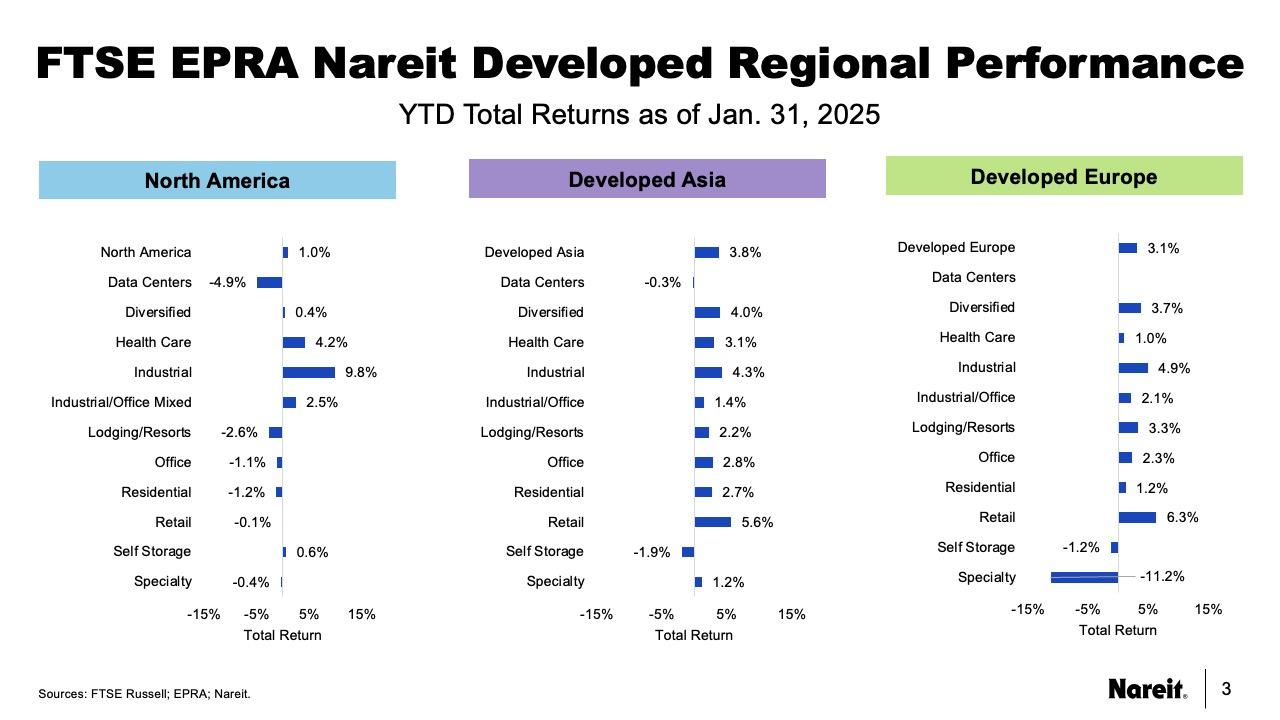

Regionally within the FTSE EPRA Nareit Global Real Estate Index Series, Developed Asia outperformed in January, with a total return of 3.8%, followed by Developed Europe at 3.1%, and North America at 1.0%, as reflected in the above table. Asia was led by retail, industrial, and diversified, with respective returns of 5.6%, 4.3%, and 4.0%. In Europe, these same sectors led with returns of 6.3%, 4.9%, and 3.7%. In North America, industrial outperformed with a total return of 9.8%, followed by timberland at 8.1%, and health care at 4.2%.

As reflected in the above exhibit, year-to-date performance by region within the EPRA Nareit Developed series has been broader based in Asia and Europe, while North America has seen an early reversal of 2024 performance when data centers led and industrial and timberland lagged.