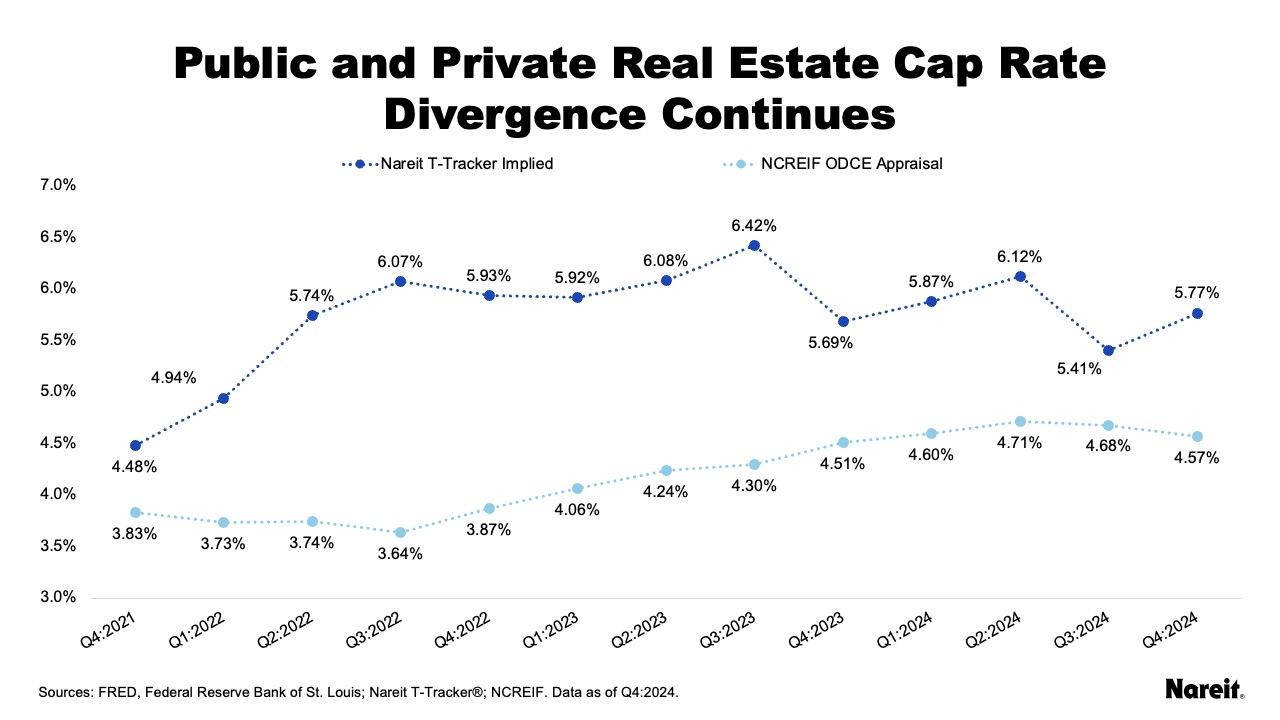

Having reached its crest more than two years ago, the spread between REIT implied and private appraisal cap rates has been stubbornly slow to close. In the third quarter of 2024, material progress was made in closing this gap. It appeared that commercial real estate (CRE) may have finally been able to say goodbye to its valuation divergence, but markets changed course in the last quarter of the year.

REIT implied cap rates pushed higher in the fourth quarter as REIT valuations declined with the significant rise in the U.S. 10-year Treasury yield and REIT net operating incomes strengthened. Interestingly, despite the surge in interest rates, private appraisal cap rates dropped. As of the fourth quarter of 2024 (the latest data available), the public-private cap rate spread remained wide; it stood at 120 basis points.

While CRE’s lingering valuation problem does not bode well for the revival of property transactions, it does present an opportunity for real estate investors, with REITs anticipated to maintain investment performance and acquisition advantages over their private market competitors.

The chart above displays public and private real estate cap rates from the fourth quarter of 2021 to the fourth quarter of 2024. REIT implied cap rates are from Nareit’s quarterly REIT Industry Tracker. Private appraisal cap rates focus on properties from open end diversified core equity (ODCE) funds from the National Council of Real Estate Investment Fiduciaries (NCREIF).

The spread between public and private real estate cap rates crested at 243 basis points in the third quarter of 2022. Since that time, markets have been trying to close the gap, but it has been a slow and arduous process. In the third quarter of 2024, CRE appeared to have entered the beginning phase of closure to its public-private valuation problem. At that time, the spread narrowed to 73 basis points; a level almost half its second quarter 2024 value and one approaching the average spread across time periods since 2000 that did not experience a valuation divergence.

Just as values were becoming more aligned, markets reversed course in the fourth quarter of 2024. The REIT implied cap rate pushed higher, the private appraisal cap rate declined, and the resultant gap widened to 120 basis points.

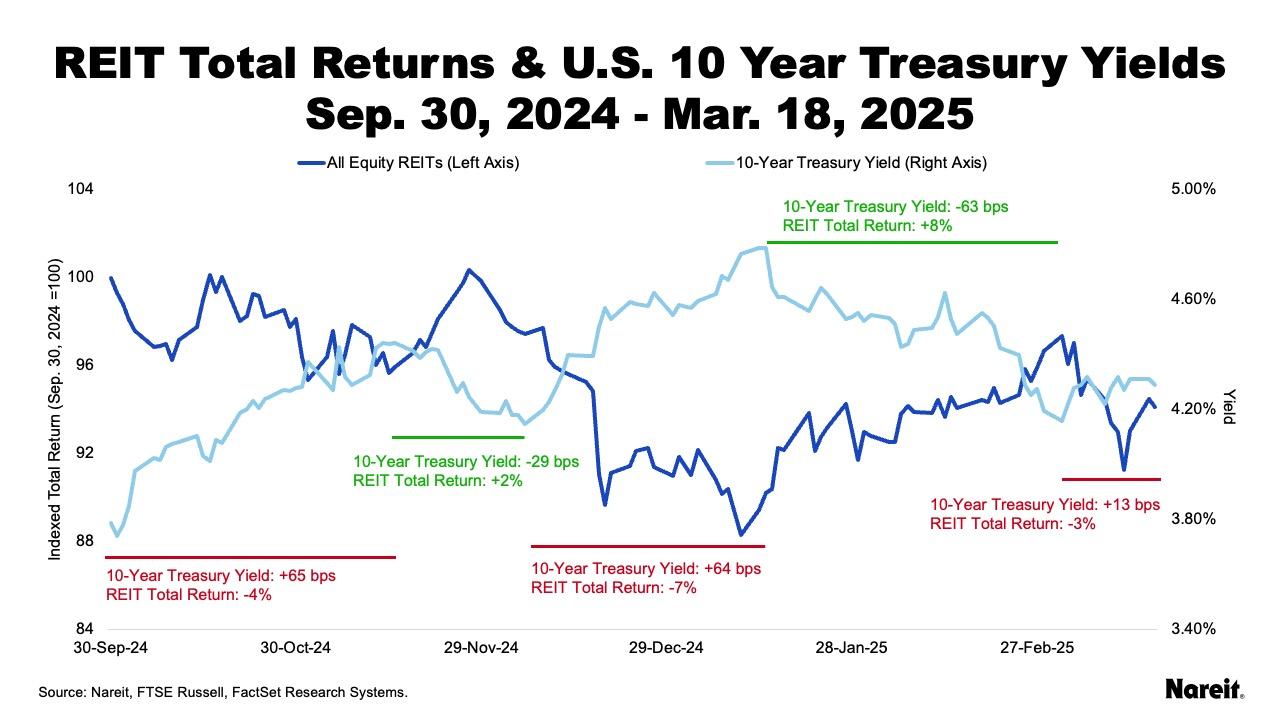

The chart above displays U.S. 10-year Treasury yields and the FTSE Nareit All Equity REITs Total Return Index on a daily basis from Sep. 30, 2024 to March 18, 2025. It shows that REIT performance has generally followed an inverse relationship with Treasury yield movements. As the Treasury yield has risen, REIT total returns have typically fallen, and vice versa.

In the fourth quarter of 2024, the 10-year Treasury yield surged 79 basis points. Consistent with the observed inverse relationship between REIT performance and Treasury yields, REITs posted a total return of -8.15%. The Nareit REIT Industry Tracker also indicated that aggregate REIT net operating income (NOI) grew by 1.34% in the last quarter of the year. The fall in value and rise in NOI both contributed to the increase in the REIT implied cap rate to 5.77%. Given the significant interest rate uptick, it is unclear why the appraisal cap rate fell by 11 basis points to 4.57% in the fourth quarter of 2024.

Since the end of the year, the 10-year Treasury yield has experienced considerable volatility. It moved materially higher through Jan. 14, reaching 4.79%, and then generally followed a downward trend. As of March 18, the Treasury yield stood at 4.29%; 29 basis points below its year-end value. With this decline, REITs posted a total return of 2.49% year-to-date through March 18. These movements have likely reduced the REIT implied cap rate and the corresponding public-private cap rate spread, but not to the levels experienced in the third quarter of 2024. Looking forward, interest rates are expected to play a critical role in the continuing valuation adjustment process.

Although the lingering CRE valuation divergence has been disruptive, it has created opportunities for investors and benefited REITs. As public and private property values become more in sync, REITs will likely continue to maintain investment performance and acquisition advantages over their private market counterparts. Declining implied cap rates are expected to fuel REIT outperformance. Well-structured balance sheets and efficient access to cost-advantaged capital are anticipated to place REITs in the catbird seat for acquisitions. While the public-private real estate valuation divergence continues, a long-awaited goodbye to this dislocation may be on the horizon in the coming quarters.