We often note that commercial real estate houses the economy with almost every place that we live, work, and play represented under the commercial real estate universe. But just as important is the role commercial real estate–including REITs–play in directly and indirectly supporting more than 12.5 million jobs in 2018. REITs activities alone supported 2.35 million full-time equivalent (FTE) jobs in 2018.

Over the past few months, government at all levels took dramatic and much-needed steps to ensure the health and safety of the public, shutting down a variety of economic activity while prioritizing essential services and frontline health care delivery. These steps, while necessary, resulted in economic distress across many sectors of the economy, putting pressure on the stream of commerce, including the collection of rent.

With the reopening of the economy now beginning in phases across the country, the focus for so many businesses, including for REITs and real estate companies, is increasingly on how to responsibly reopen places of business and over time resume a full range of economic activity in a safe and healthy manner. Only then can the stream of commerce on which the collection of rent is dependent flow without impediment.

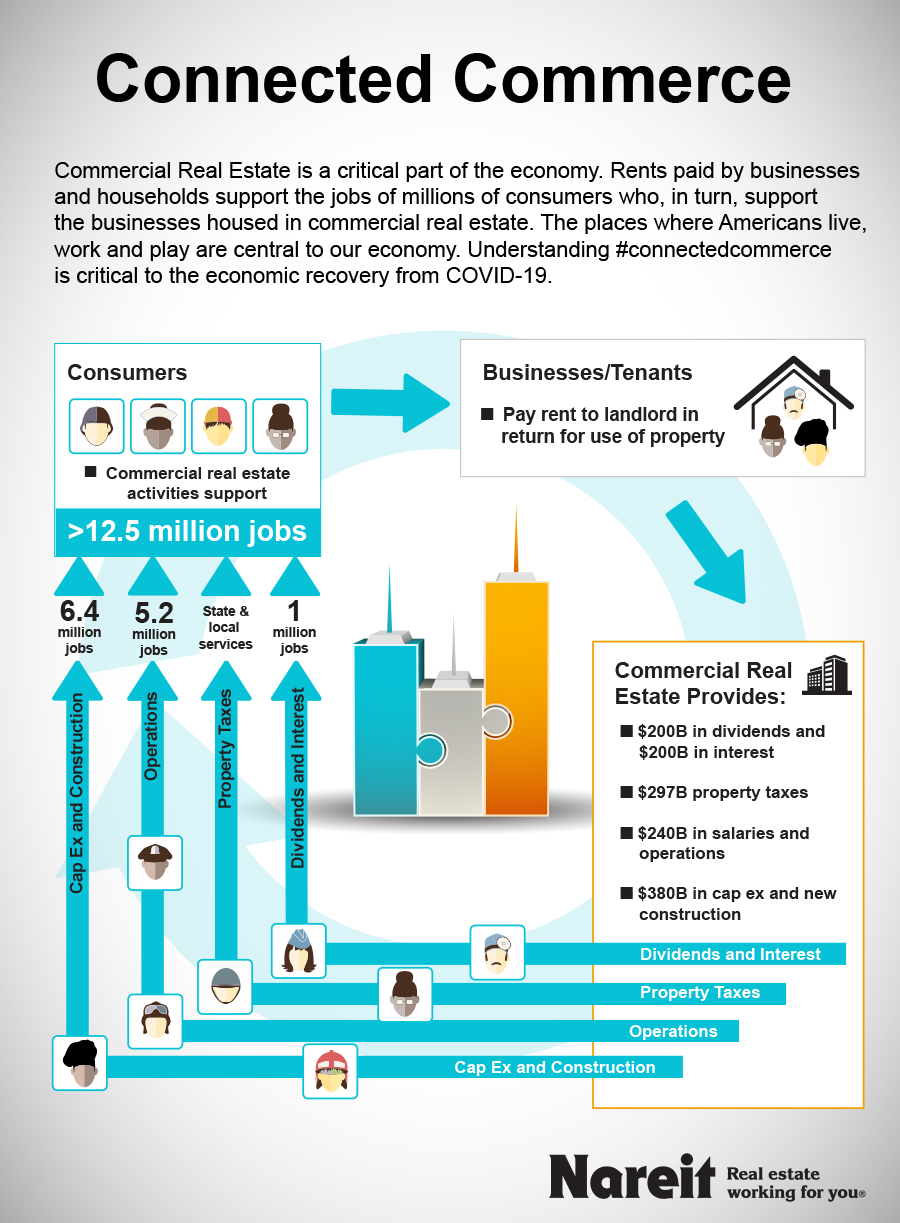

Each year renters and tenants of all sorts pay more than $1.5 trillion, the equivalent of more than 7% of GDP, in rent in exchange for the use of a broad range of real estate ranging from apartments, offices, and retail facilities to cell phone towers, data centers, and logistics facilities. Rent is an essential piece of the economic puzzle, supporting direct employment of people who maintain the buildings, utilities and other building services, construction and capital expenditures, property taxes to states and localities, and interest and dividends to banks, other lenders and investors.

As the infographic below illustrates, Nareit estimates that taken together, these commercial real estate activities support more than 12.5 million jobs.

Methodology

Each year, Nareit sponsors a research study by EY to estimate REITs’ economic contribution to the U.S. The most recent study finds that REITs supported 2.35 million full-time equivalent (FTE) jobs in 2018. Of course, REITs represent just 10% to 20% of commercial real restate in the U.S.

To estimate the impact of the entire commercial real estate sector, Nareit surveyed similar studies including:

- The Economic Impacts of Commercial Real Estate, 2020 U.S. Edition, sponsored by NAIOP, the Commercial Real Estate Development Association;

- The Contribution of Multifamily Housing to the U.S. Economy, sponsored by the National Multifamily Housing Council and the National Apartment Association; and

- The Contribution of Office Building Operating Outlays on the U.S. and States’ Economies in 2018, sponsored by the Building Owners and Managers Association International (BOMA).

Using these four studies as well as data from the IRS, Statistics of Income, CoStar, and previous Nareit analyses of the REIT share of commercial real estate, Nareit compiled estimates of the economic contributions from the office, retail, industrial, and multifamily sectors covering REIT and non-REIT properties. For other property sectors, we added the economic contribution estimates associated with just REIT-owned properties. This assumption, which ensures we are not double counting economic impacts, is quite conservative and implies that our estimates may be on the low side.

For each property sector, we estimated the economic contributions associated with property and building operations, new construction and development, capital expenditures for existing buildings, and interest and dividends. In cases where the source study did not estimate capital expenditures for existing buildings, we followed the methodology outline in the EY study to estimate capital expenditures.

Each of the source studies uses a slightly different methodology to estimate the overall economic contribution, but they all follow the same basic approach outlined in the EY study. The overall economic contribution of commercial real estate is measured as the sum of direct, indirect, and induced economic contributions. The estimated direct economic contribution consists of direct employment and the labor income earned by employees. Indirect economic contributions come from the purchase of goods and services from other U.S. businesses, supporting employment and income at these supplier businesses. Finally, induced economic contribution reflects the additional economic activity that results from consumer re-spending of income earned from commercial real estate and related supplier businesses.

The overall economic contribution of commercial real estate can be estimated using an input-output model of the economy as in the case of the EY study or using multipliers supplied by the Bureau of Economic Analysis (BEA) as done in the other three studies of broader commercial real estate economic impacts. The multipliers used in the three studies of broader commercial real estate economic impacts are drawn from the same sources and are consistent. The EY input-output model of the economy is calibrated to the same BEA data. Thus, we feel confident that combining the results of these studies provides a meaningful basis for estimating the economic impacts of commercial real estate.