New research by Nareit estimates that 168 million Americans, or roughly 50% of American households, were invested in REIT stocks in 2023. The analysis estimates the number of American households and Americans living in them that own REIT stocks directly or indirectly through mutual funds, ETFs, or target date funds. This is a 12% increase from 2022’s estimated 150 million Americans, fueled largely by an increase nationwide in equity investing, particularly in employer sponsored retirement savings plans.

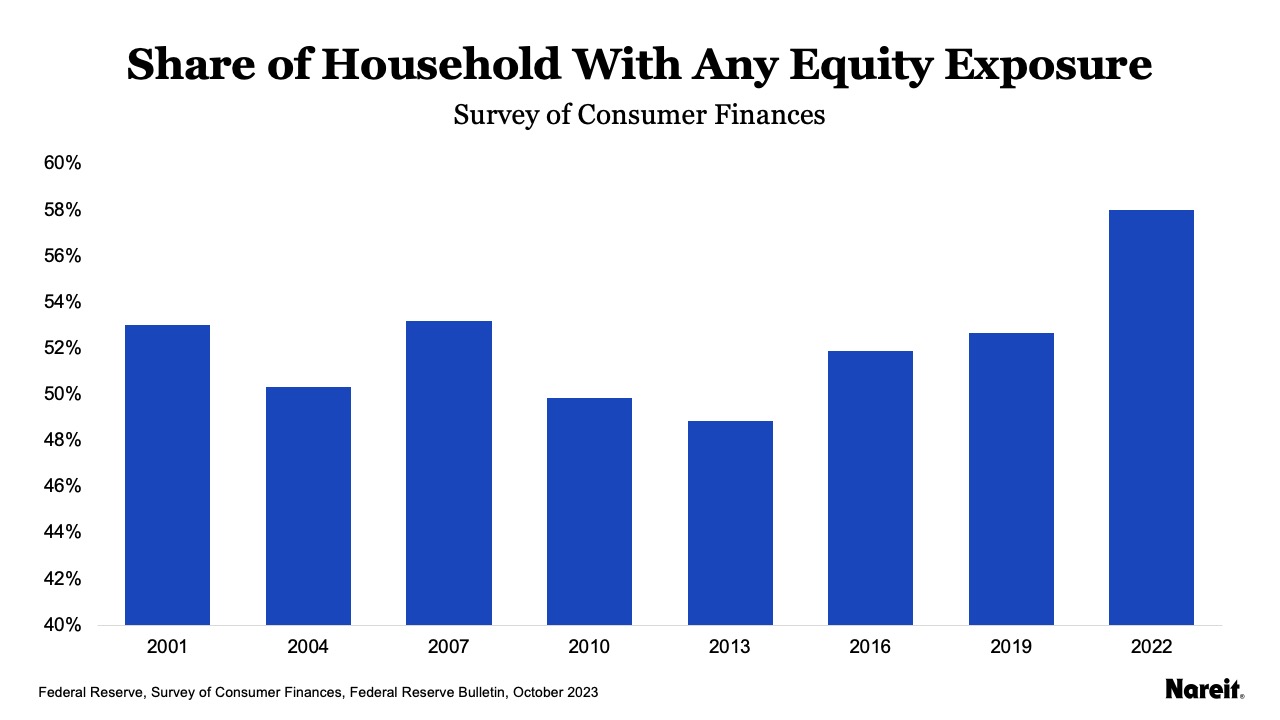

The base of the estimate is the triennial Survey of Consumer Finances (SCF) produced by the Federal Reserve. The SCF is a comprehensive overview of finances for American households, including income, net worth, and debt. The most recent estimate of Americans with REITs is derived from the percentage of Americans with any equity investments as reported in the 2022 SCF. The most recent SCF reflects large changes in American household finances from the pandemic since the prior report in 2019.

The chart above shows the share of households with any equity from 2001 to 2022. The share fluctuates from survey to survey, but hovers around the 51% average pre-2022. Post Great Financial Crisis surveys in 2010 and 2013 show the share dipped below 50%. Pandemic stimulus and reduced spending in 2020 and 2021 caused savings to surge in the U.S. This allowed for more households to invest new savings into equity markets, and the share with equity exposure surged to 58%. Direct holdings of stocks increased from 15.2% of households in 2019 to 21.0% in 2022. Most households’ equity investments are through tax-deferred retirement accounts that increased from 50.5% of households in 2019 to 54.3% of households in 2022. We may see a regression toward the mean in the 2025 survey with some of the gains reversed.

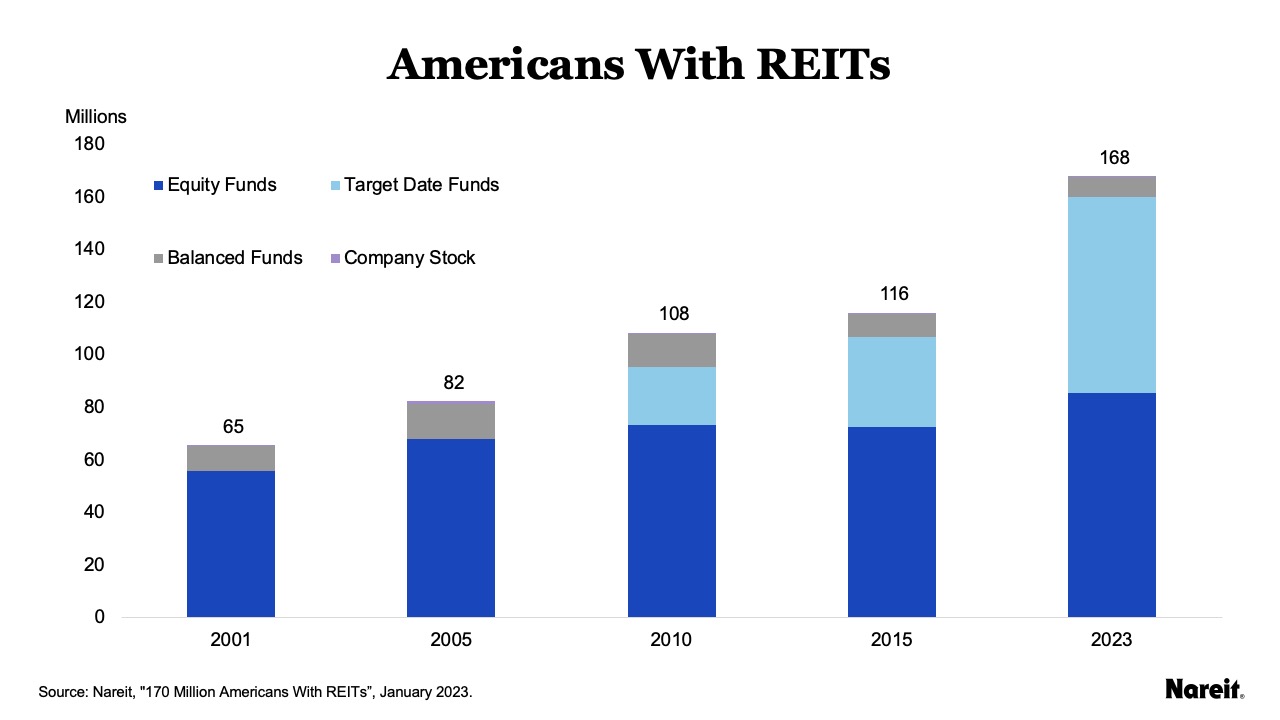

The estimate for the number of households and Americans investing in REITs reflects this increased number of households investing in the equity market through retirement accounts. The Employment Benefit Research Institute (EBRI) divides retirement saving into four mutually exclusive categories: equity funds, balanced funds, target date funds, and company stock.

The chart above shows the estimated number of Americans invested in REITs by each fund category, with the share of total Americans with REITs for that year labeled above the bars. The share of retirement assets held in equity funds and balance funds has decreased with the establishment and popularity of target date funds starting in 2007. Starting in 2001, approximately 86% of these REIT holdings were through equity funds tied to retirement accounts, with another 14% in balanced funds tied to retirement accounts. By 2010, 79% of Americans invested in REITs through equity and balanced funds, and 21% invested in REITs through target date funds. The share invested through target date funds has continued to grow, to 44% in 2023, leading to growth in the number of Americans with REITs. The most recent increase in Americans with REITs is predominantly fueled by the increase in equity investment since the pandemic, along with an increased share in target date funds.