Nareit has updated its Global REIT Approach to Real Estate Investing study, documenting the global growth of REITs and the benefits, especially to developing nations, of enacting a REIT regime. This study summarizes the dramatic growth of REITs around the world since their inception more than 60 years ago and the benefits of the REIT model for communities, economies, and investors. There are currently 42 countries and regions, accounting for 84% of global GDP with a combined population of five billion people, that have enacted REIT legislation.

The map above shows the global growth of REITs over the past six decades. REITs had an early foothold in the U.S. in 1960, with the Netherlands, New Zealand, Taiwan, and Australia all adopting REITs before 1970. REITs continued to spread throughout the world; Brazil became the first country to adopt REITs in South America in 1993 and Israel and the Emirate of Dubai in UAE were the first two countries to adopt REITs in the Middle East in 2006, followed by South Africa in 2013 as the first country in Africa. Mauritius is the most recent country to adopt REITs in 2023.

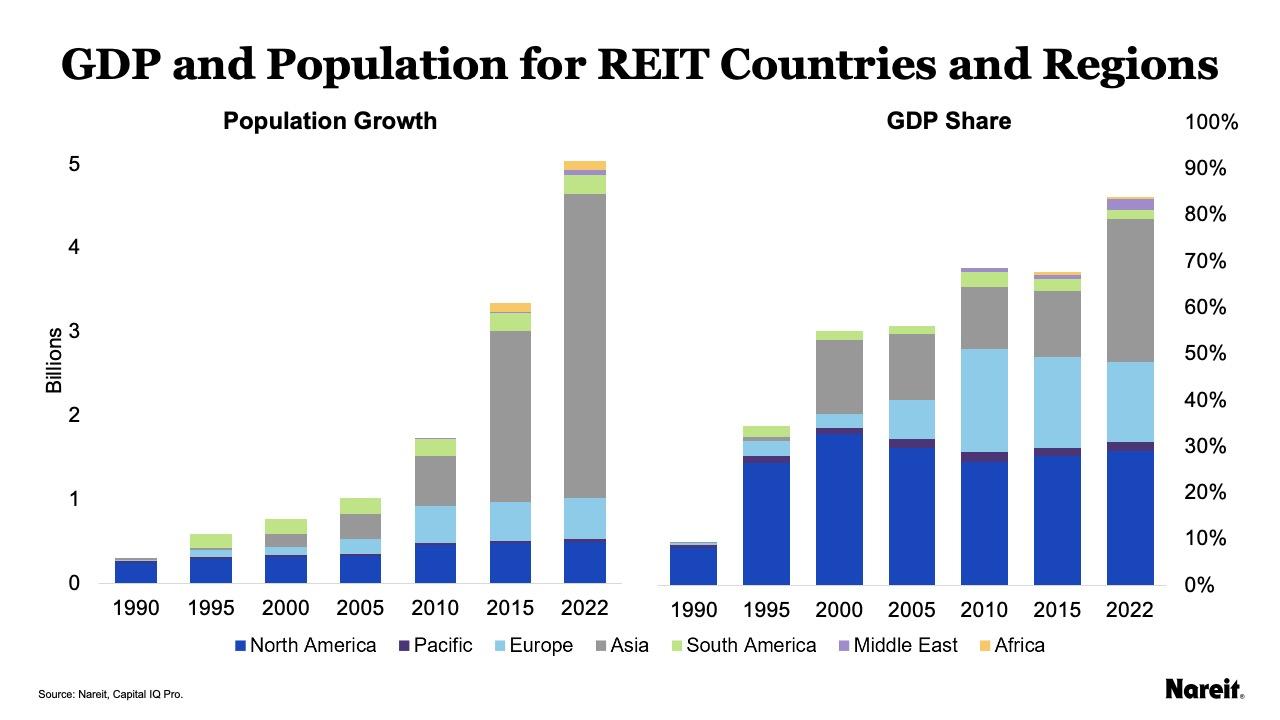

As shown in the charts above, in 1990, REIT countries and regions had just a 6% share of global population and have grown to account for 63% of the world’s 2022 population. Asia has driven the growth in population for REIT countries and regions, most notably with the adoption of REITs in India in 2014 and China in 2021. These countries and regions also represent 84% of 2022 global GDP, increasing from 28% of global GDP in 1990. The GDP of REIT countries and regions has increased from $6.5 billion to more than $84 trillion in this timeframe for the current REIT countries and regions.

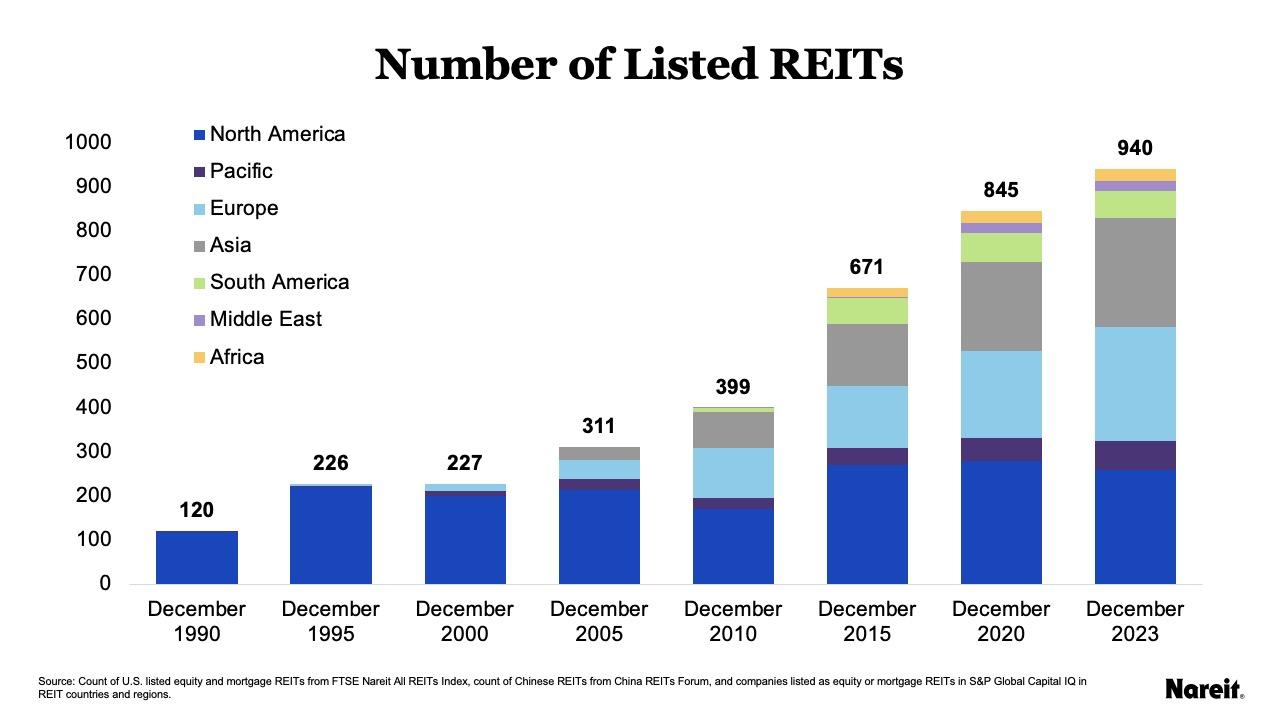

The growth in the number of REITs since 1990 by region is shown in the chart above. A total of 940 listed REITs with a combined equity market capitalization of approximately $2 trillion at the end of 2023 are in operation around the world. Europe and the Pacific have seen the largest growth in REITs since 2020, with Europe adding 62 REITs (31% growth) and the Pacific adding 13 REITs (25% growth). China is another driver of growth, only adopting REITs in 2021, yet with 33 listed REITs on the Beijing Stock Exchange at the end of 2023.

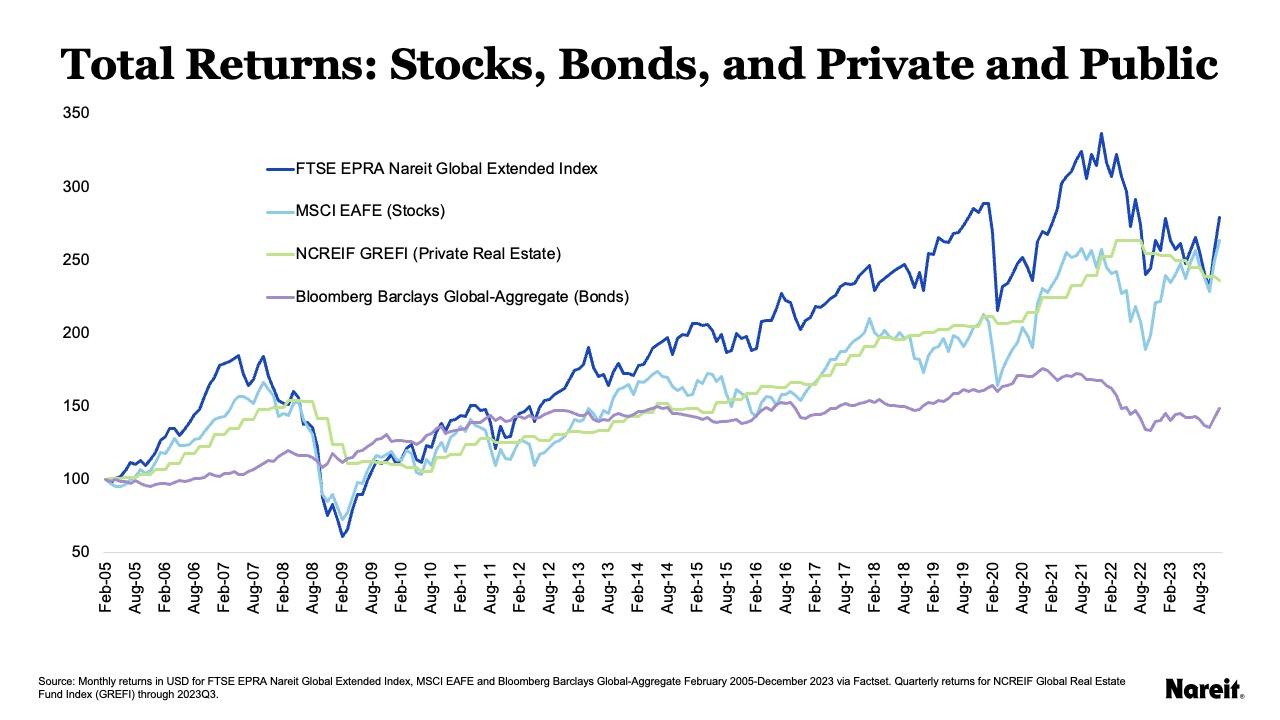

The study also shows that over the long term, global listed real estate, including REITs, has generally outperformed both global stocks and global bonds. The compound annual growth rate in returns from February 2005 to December 2023 is 7.5% for the FTSE EPRA Nareit Global Extended Index, compared with 5.8% for the broader global stock market (represented by MSCI EAFE), 5.7% for private real estate, and 3.1% for global bonds (Bloomberg Barclays Global-Aggregate bond index). The chart above shows the growth in returns. REITs have also had low correlation with other stocks and bonds, with FTSE EPRA Nareit Global REITs having a 0.82 correlation with MSCI EAFE.

For more information on the global growth and benefit of REITs, see the full study here.