Norges Bank Investment Management’s real estate investment strategy combines 50% REITs and 50% private real estate investments to enhance diversification, access new and emerging property sectors, and optimize cost management. The European Public Real Estate Association (EPRA) recently released a video interview with Mie Caroline Holstad, chief investment officer of real assets at Norges, discussing the firm’s real estate investing philosophy and practice.

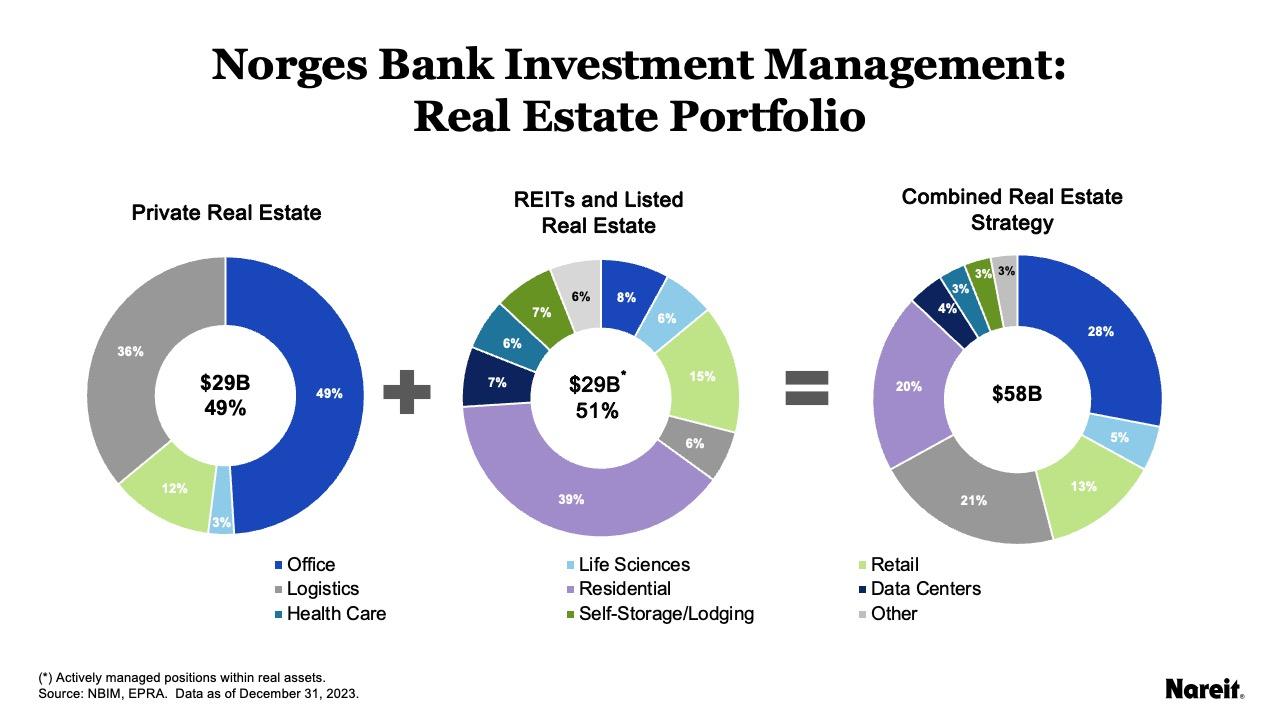

NBIM manages the Government Pension Fund Global (Norway's oil fund) on behalf of the Norwegian people, aiming to achieve the highest possible return while maintaining safety, efficiency, responsibility, and transparency. It currently oversees $1.7 trillion in assets under management, including roughly $58 billion (3.4%) in real estate.

The chart above shows how Norges manages public and private real estate as one portfolio. The REIT strategy gives Norges access to sectors like residential, data centers, health care, self-storage, and lodging, which private funds may not be able to efficiently access. Office properties make up nearly half of Norges’ private portfolio, but this exposure drops to 28% of the total portfolio when REITs are included. REITs thus play a crucial role in improving sector diversification and the overall risk-return profile of the fund.

For more on NBIM, see Norges Bank Investment Management: Public and Private Real Estate All the Same in the Long Run on REIT.com from September 2023.