Space market fundamentals can differ markedly across property types. Net absorption (demand) and net deliveries (supply) for the four traditional property types (retail, apartments, industrial, and office) highlight the ups and downs of the space markets and can illustrate excess net demand (net absorption less net deliveries) for each sector.

Recent data from CoStar showcase the supply and demand differences across property types. In the fourth quarter of 2024, retail was the only sector where quarterly demand exceeded supply. For the other property types, net absorption continued to fall short of net deliveries. Despite these shortfalls, each sector has been making progress toward reaching its equilibrium.

The chart above displays quarterly retail net absorption and net deliveries in millions of square feet, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2024. While both net absorption and net deliveries are typically positive numbers, in the chart, net absorption and net deliveries are indicated as positive and negative values, respectively.

Since 2023, retail supply and demand metrics have generally maintained balance. Quarterly net deliveries modestly outpaced net absorption for the first three quarters of 2024, but this trend has reversed. Excess net demand breached into positive territory in the fourth quarter of 2024 with the further curtailment of net deliveries. The sector’s ability to exercise discipline over its supply pipeline has benefitted its space market fundamentals. In the fourth quarter of 2024, retail occupancy and rental growth rates were 95.9% and 2.0%, respectively.

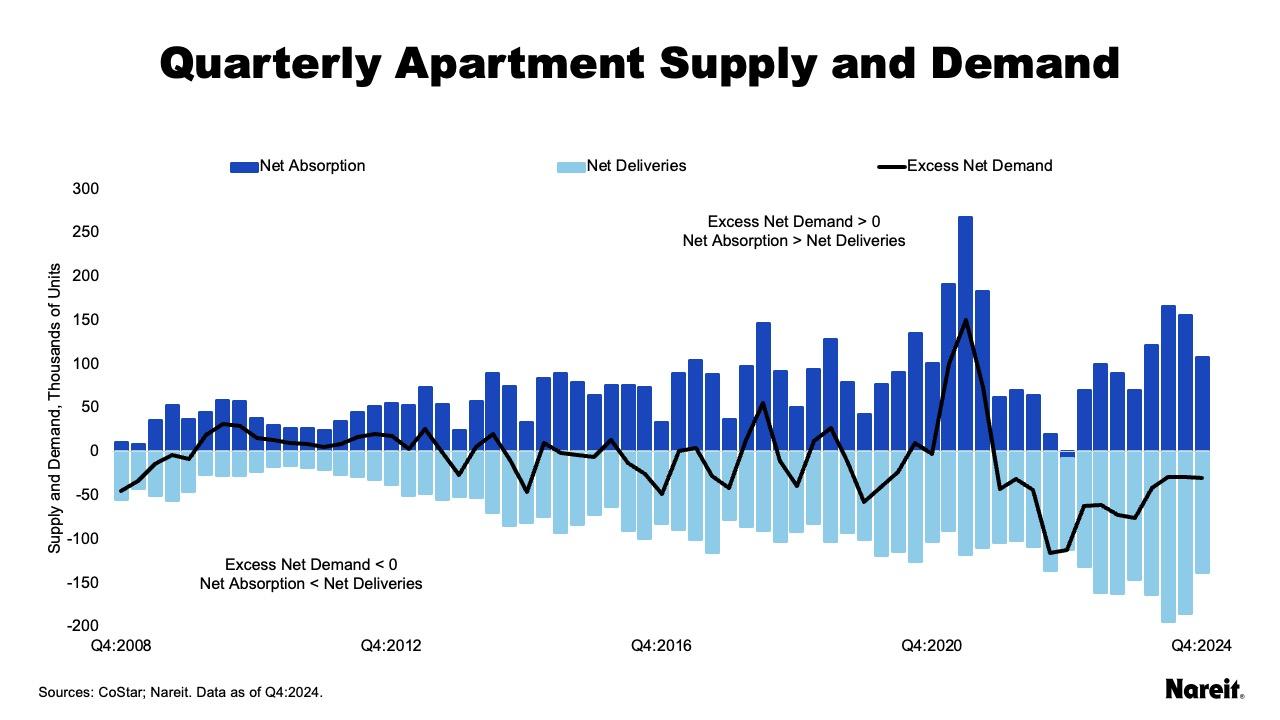

The chart above presents quarterly apartment net absorption and net deliveries in thousands of units, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2024. Apartment supply has now exceeded demand for 13 consecutive quarters. This has taken a toll on the sector’s occupancy and rental growth rates.

As of the fourth quarter of 2024, apartment occupancy averaged 91.9%; its lowest level over the last 25 years. Year-over-year rent growth struggled to remain positive at 1.0%. Demand and supply have tempered in recent quarters, but both remain at historically high levels. It appears that the sector is moving toward a balanced supply and demand relationship as the supply boom induced by historically high demand and rent growth is working through the system.

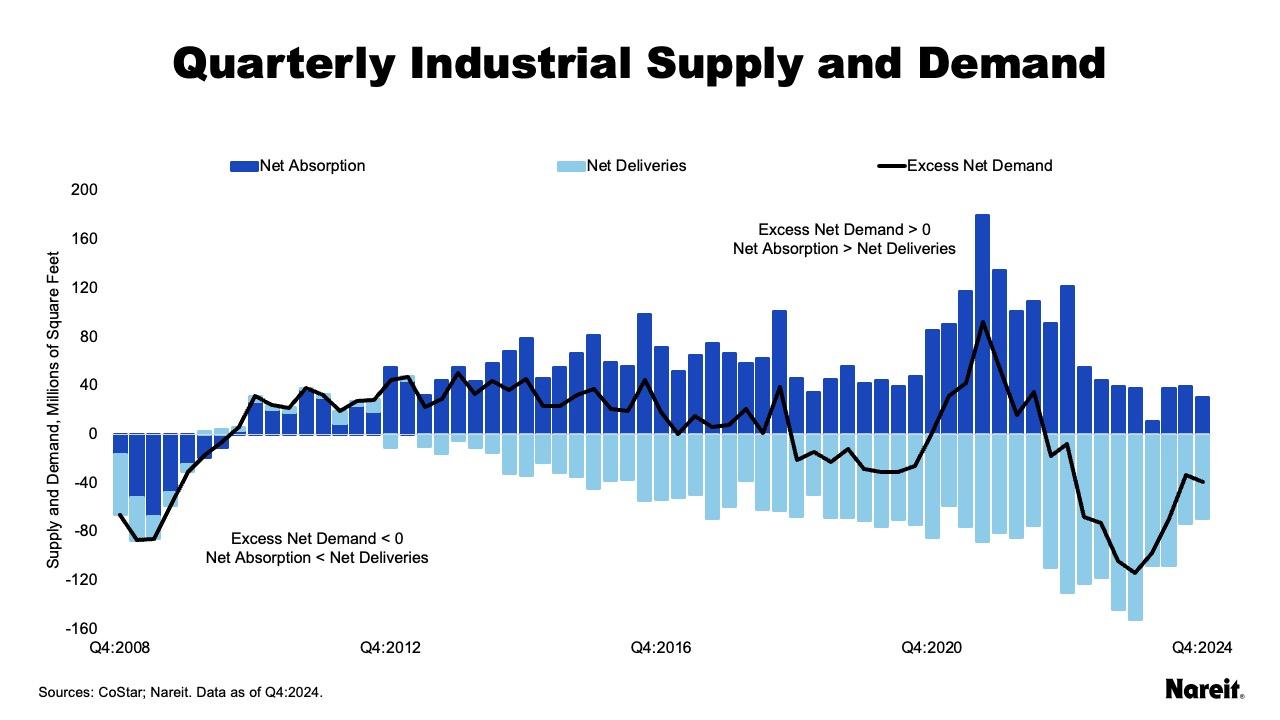

The chart above shows quarterly industrial net absorption and net deliveries in millions of square feet, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2024. For more than a decade, industrial enjoyed strong demand with analogous supply responses. At the end of 2021, net absorption started its decline. Net deliveries, however, generally continued to grow through the end of 2023. As of the fourth quarter of 2024, industrial supply had bested demand for 10 quarters in a row, resulting in an occupancy rate of 93.2% and rent growth rate of 2.6%. Although recent reductions in new supply have made progress in restoring balance, further declines will likely be necessary to meet existing demand levels.

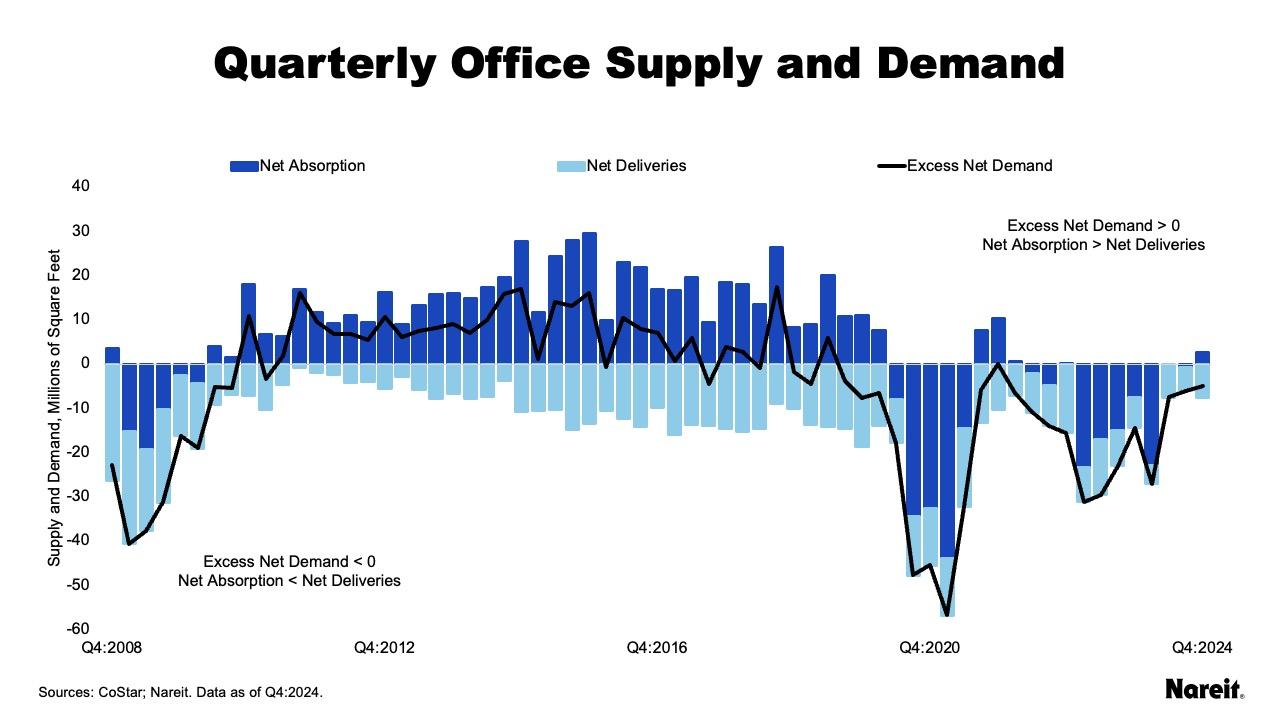

The chart above depicts quarterly office net absorption and net deliveries in millions of square feet, as well as excess net demand from the fourth quarter of 2008 to the fourth quarter of 2024. Office has continued to face battles on two fronts. While office demand challenges are well known, the property type has also suffered from supply issues. Years of negative net absorption have not restrained office net deliveries. Negative excess net demand has generally persisted since 2019.

In the fourth quarter of 2024, office maintained its lowest level of occupancy in the last 25 years (86.2%); year-over-year rent growth was 1.1%. Given the quality divide within the office sector, new(er), amenity rich, well-located properties are enjoying better space market fundamentals than their older counterparts.

Recent data from CoStar tell the nuanced stories of the supply and demand differences across the four traditional property types. While retail has generally maintained balance in its space market fundamentals, the other three property types have fallen short with quarterly net deliveries outpacing net absorption. Each sector’s ability to maintain or make continued progress in moving toward its equilibrium will likely determine the strength of its property operational gains in 2025.