Nareit analysis of data from Preqin, a financial research firm that tracks investments in alternative assets, indicates that the use of REITs by pension plans has been increasing, particularly among the largest, most sophisticated plans. As of January 2024, more than 1,800 defined benefit (DB) pension plans with more than $10 trillion of combined assets under management (AUM) reported having an allocation to real estate. Of those plans, 733 DB pensions with more than $7 trillion of combined AUM had REIT allocations.

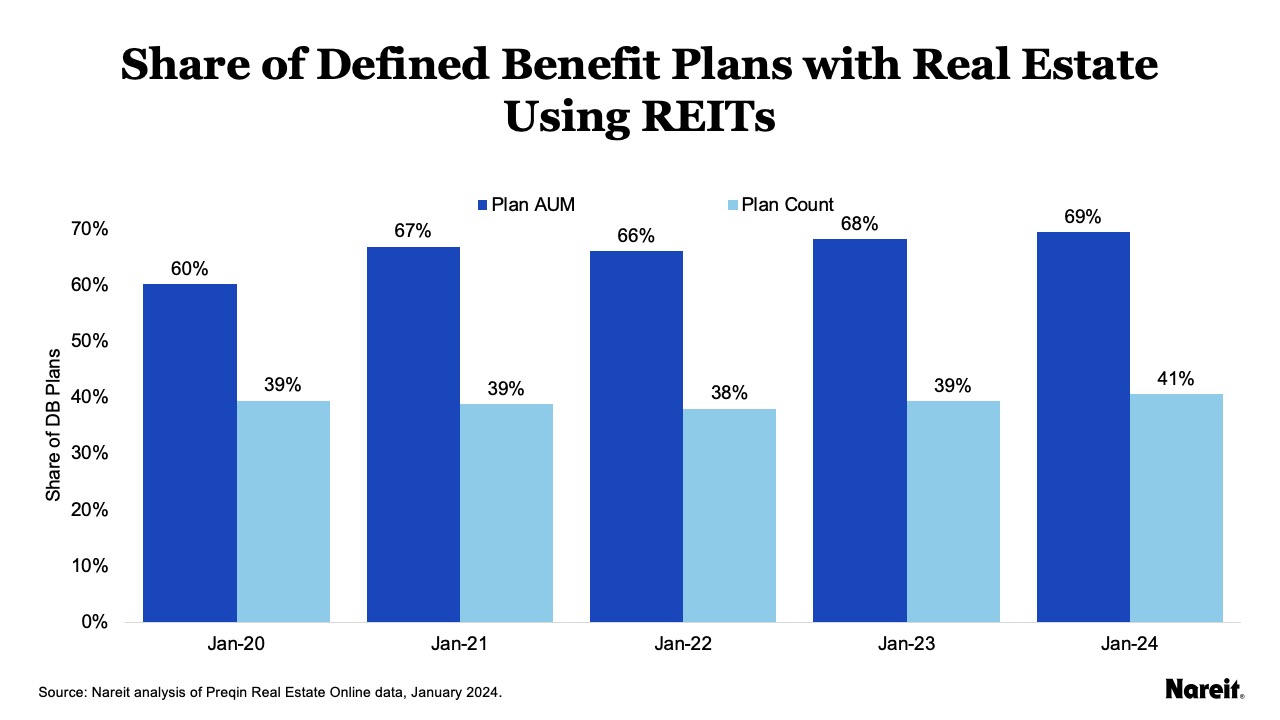

The chart above illustrates the growth of REIT asset-based market share among DB pensions from January 2020 to January 2024. While DB total assets have increased approximately 19% in the last five years, DB pension total assets with REIT exposure have increased by 37%. This has resulted in the asset-weighted share of DB pensions using REITs in their real estate strategy to increase from 60% in January 2020 to 69% in January 2024. The share of DB pensions by count using REITs in their real estate strategy in January 2024 has been relatively flat, increasing from 39% to 41% over the same time period.

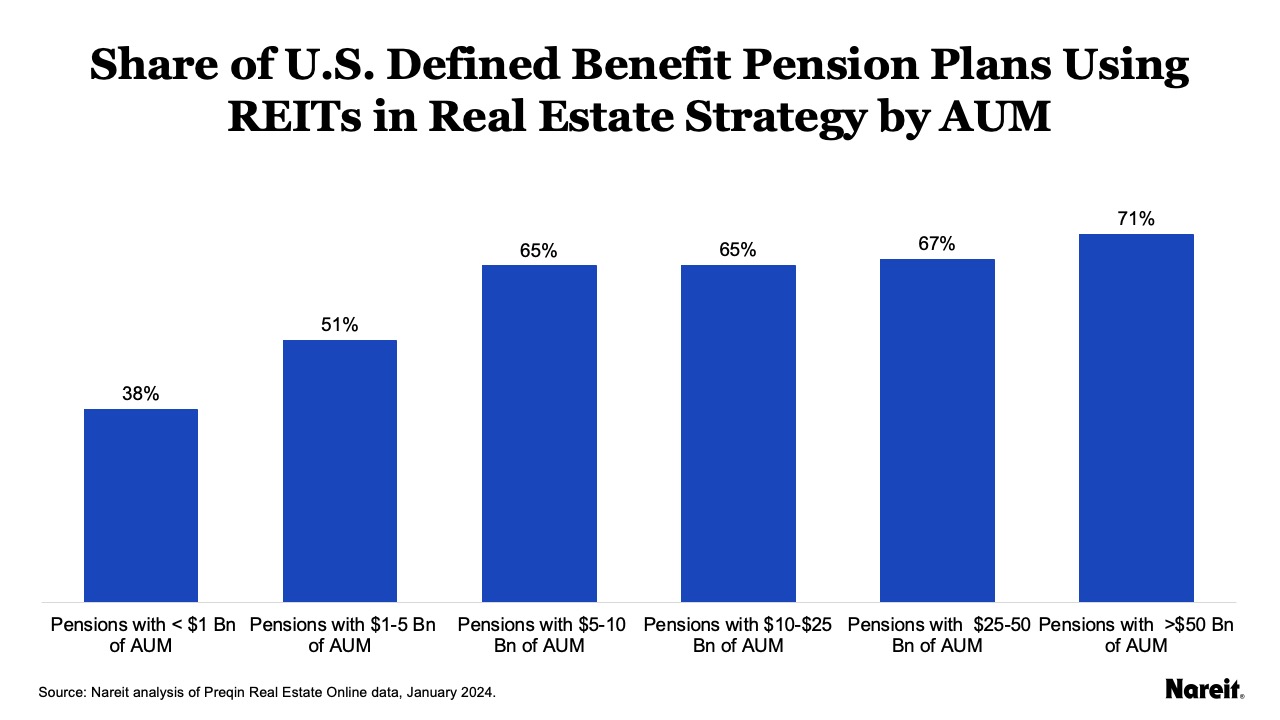

As shown in the chart above, REIT usage is more prevalent among larger, more sophisticated pension plans. While the share of all U.S. DB pension plans with REIT allocation is 41%, the share of U.S. DB pension plans with more than $50 billion of AUM using REITs in their real estate strategy rises to 71%.

These results are consistent with the 2023 Real Estate Allocations Monitor, a collaboration between Hodes Weill, an institutional real estate advisory firm, and Cornell University’s Baker Program in Real Estate. According to the study, the share of U.S. institutional investors using REITs was 43%. For U.S. institutions with more than $50 billion of AUM, the share increased to 65%.

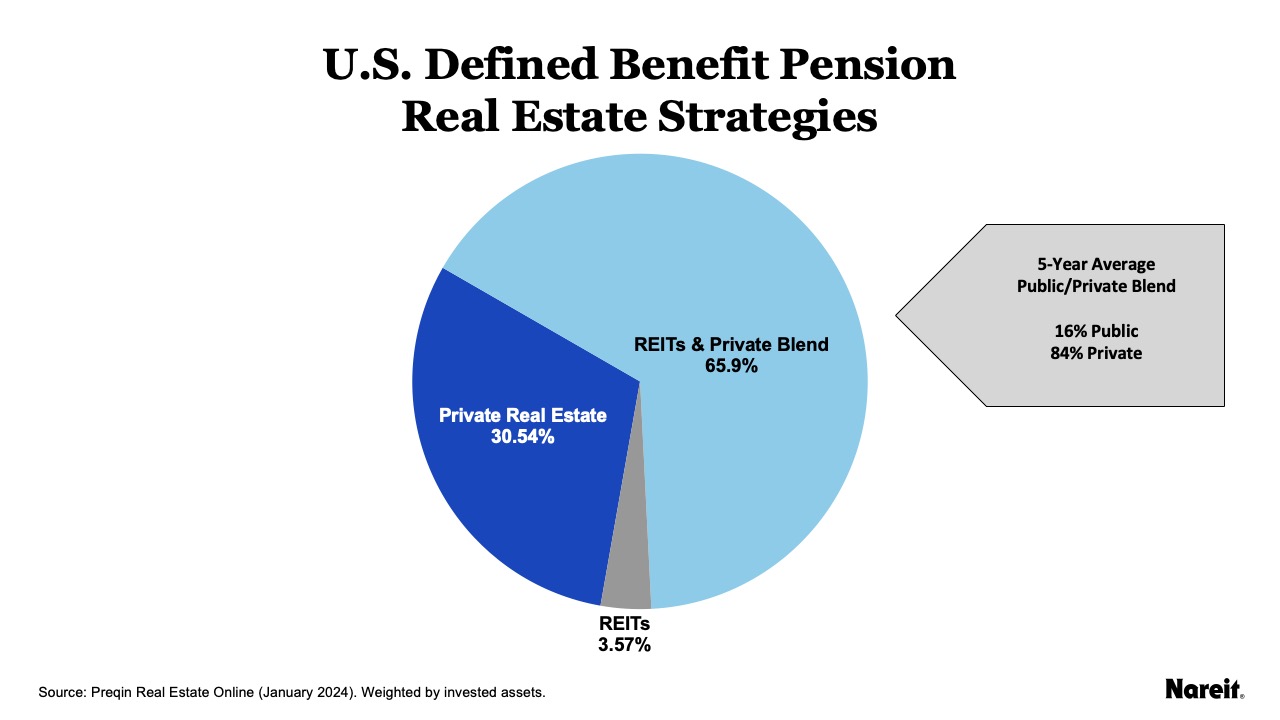

The chart above depicts the real estate investment strategies of DB pensions as of January 2024. According to Preqin, 69% of all DB pension real estate investors report gaining some or all of their exposure to real estate through REITs, with most investing in both REITs and private real estate. For those DB pensions investing in both public and private real estate, the allocations for the 5-year blended portfolio were 16% REITs and 84% private real estate.

The increase in REIT allocation among pension plans over the past 5 years may be driven in part by the long-term REIT outperformance shown in the 2023 CEM Benchmarking study (pdf). The Nareit-sponsored report showed that over a 24-year period (1998-2021), REITs outperformed private real estate by nearly 2.3%. The study looked at realized investment performance of the assets chosen by plan managers and trustees over 24 years using a dataset covering more than 200 public and private sector pensions close to $4.4 trillion in combined AUM. The CEM analysis found that REITs had an average annual net return over that period of 10.9%, the second highest out of 12 asset classes. Listed real estate outperformed private real estate, which produced an average annual net return of 8.6% over the period.

DB pension plans are increasingly using REITs in their real estate strategy to complement their private real estate investment.