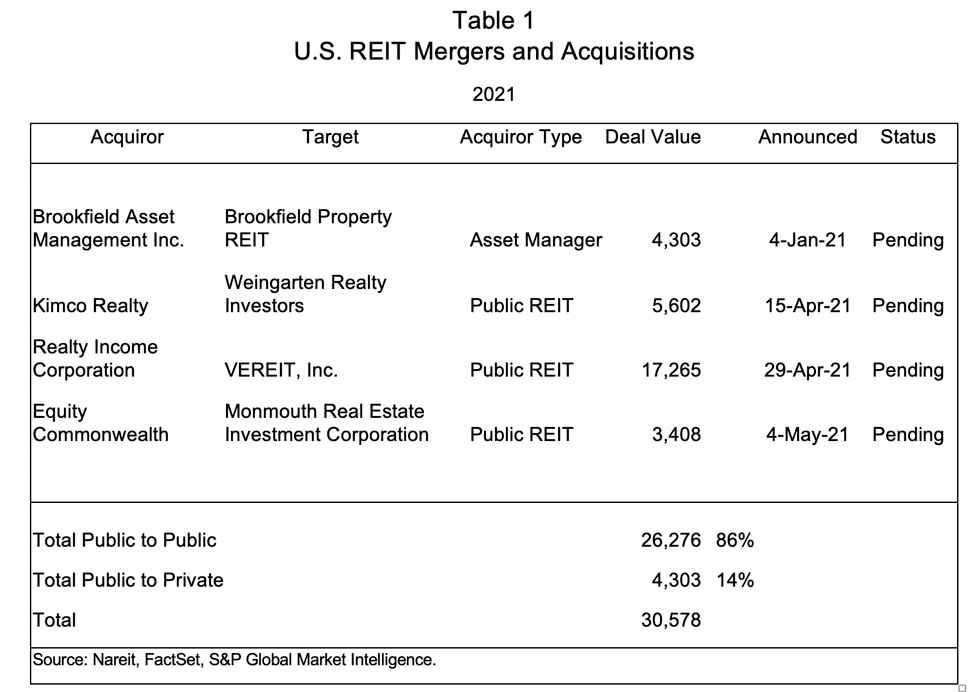

April (and early May) capital markets activity was highlighted by the announcement of three large REIT mergers. It is notable that each of these M&A transactions are the result of long-time REITs looking to combine portfolios strategically to prepare for future growth. Far from the distress transactions that were being discussed in the middle of last year, the transactions reflect confidence in the business model and the sector outlooks.

Capital Raising

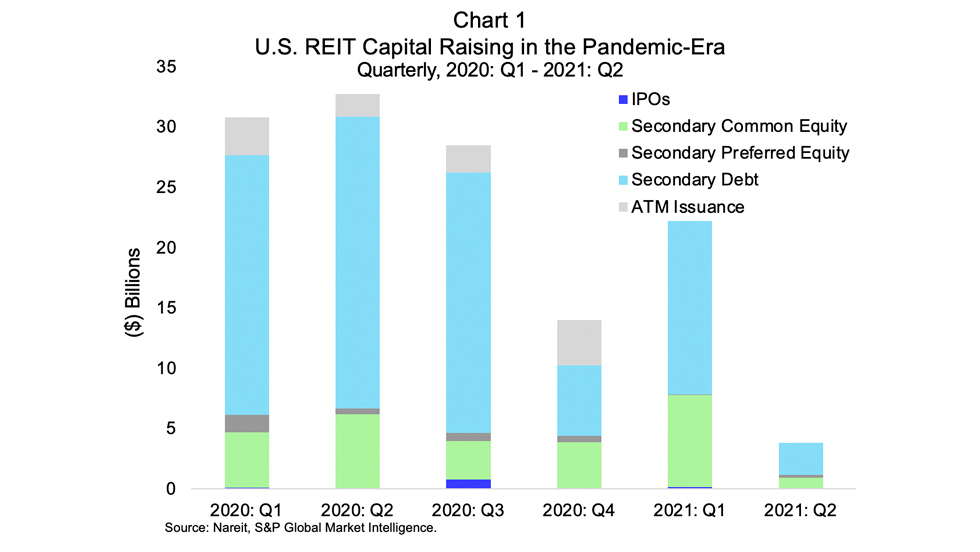

As of April 30th U.S. REITs have raised over $26 billion in IPOs and secondary debt and equity offerings year to date in 2021.

- Equity issuance totaled $9 billion, including $137 million raised in one IPO (AFC Gamma, Inc.), $8.6 billion raised through 23 common equity offerings, and $285 million raised through three preferred equity offerings. Total equity raised in 2019 was $50 billion, with $33 billion in 2020.

- Debt issuance totaled $17 billion raised through 22 secondary debt offerings. In 2021 REITs have issued $2.2 billion in green bonds, $1.3 billion from Equinix and $900 million from Alexandria Real Estate Equities. Over the same time period in 2020 $2 billion in green bonds were raised. Total debt raised in 2019 was $63 billion, with $73 billion in 2020.

To this point in 2020, REITs had raised over $33 billion ($5.6 billion from secondary common equity, $1.5 billion from secondary preferred equity, $23.1 billion in secondary debt, and $102 million in IPOs and $3.1 billion in ATM offerings). Due to lag in reporting, ATM issuance data for 2021 are not yet available.

Mergers & Acquisitions

In 2021 four deals to acquire public U.S. REITs have been announced; three of the four deals, or 86% of the transaction value of the announced deals, represent acquisitions by other publicly traded U.S. REITs (see Table 1). The proposed acquisition price of each deal represents either a premium or is comparable to the pre-pandemic share price. On average, these deals reflect a price per share 2.4x their low during the pandemic.