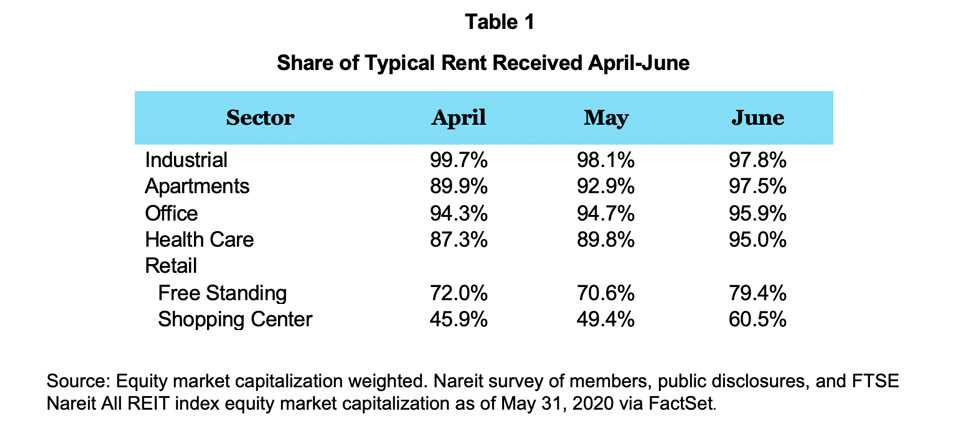

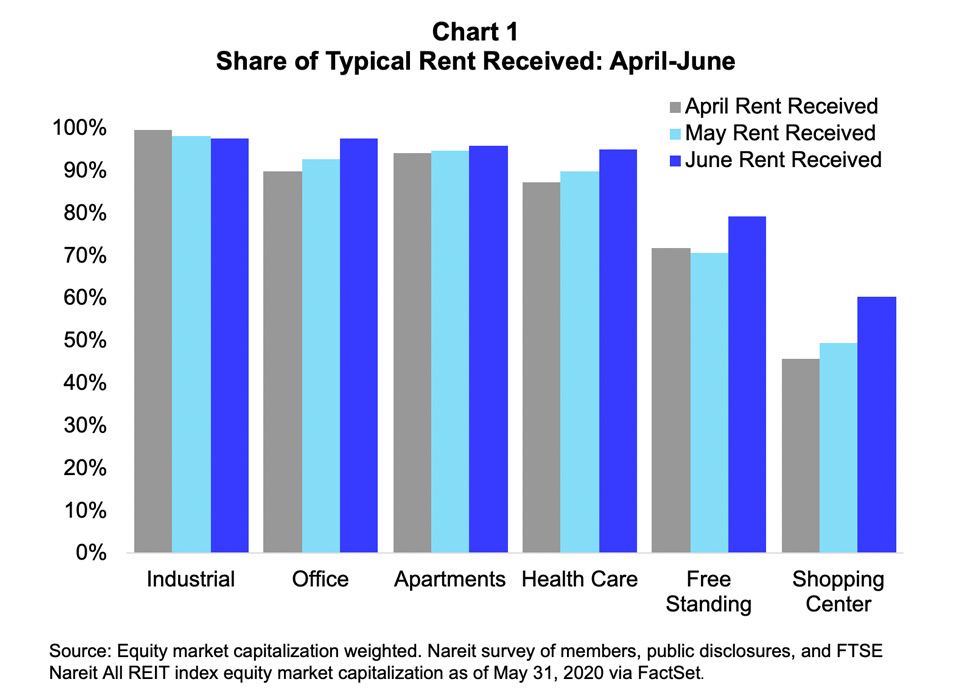

Nareit is surveying its membership about monthly rent collections in the wake of the COVID-19 pandemic and related closures. The June results show an improvement for most sectors compared with last month with large improvements in the retail subsectors for free standing and shopping center-focused REITs. This improvement suggests that re-openings of the retail sector in many parts of the country in May have had a positive economic impact for retail REITs. Read the Research Note for a full description of the surveys and results.

There are 35 equity REITs in the sample across six property sectors (industrial, apartments, office, health care, free standing retail, and shopping centers). The data come primarily from three surveys conducted by Nareit, supplemented by public disclosures of rent collections. The sample represents 61% of the FTSE All REITs total equity market capitalization for those property sectors. Sectors are only reported where survey participation is sufficient to maintain participant confidentiality. Table 1 and Chart 1 show the estimated REIT rent collections in April, May, and June as a share of typical rent collections. The results are displayed by property sector and are weighted by respondent REIT equity market capitalization.