The April 12 announcement that the headline Consumer Price Index (CPI) increased 8.5% from a year earlier is the highest rate of inflation since late 1981. Supply chain issues, food, and energy prices continue to drive elevated inflation rates. Core CPI (excluding food and energy) rose 6.5%, roughly in line with February. Despite continuing high inflation, REIT returns continue to outpace returns for the S&P 500 on an annualized basis and REIT operating performance growth has exceeded price growth in 2021. For the 12 months ended in the first quarter of 2022, with inflation still running well above recent trends, REITs outperformed the S&P 500 by 7.9 percentage points on an annualized basis.

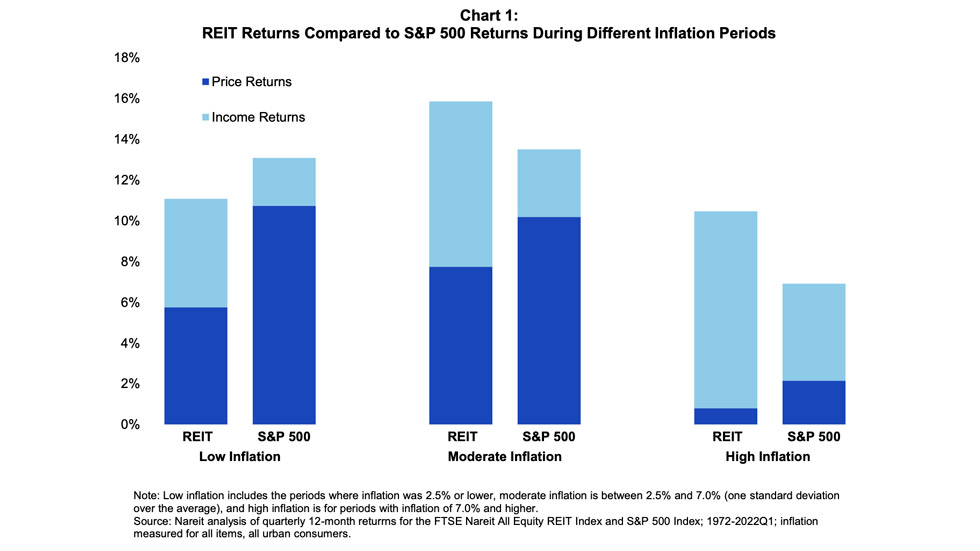

Inflation reached levels not seen since the 1980s. Chart 1 compares 12-month returns of equity REITs and the S&P 500 measured quarterly during periods of high, moderate, and low inflation. High inflation is defined as greater than one standard deviation from the time period’s annual average of 3.9%, greater than 7.0%. Moderate inflation is between 7.0% and 2.5% (based on the Federal Reserve target), and low inflation is below 2.5%. In the first quarter of 2022, REITs outperformed the S&P 500 by 7.9 percentage points with a 12-month return of 23.6% compared to 15.6% for the S&P 500.

REITs historically tend to outperform the S&P 500 in high inflation quarters, with strong income returns offsetting low REIT price returns. On average, REITs outperformed the S&P 500 by 3.5 percentage points during these periods. In periods of moderate inflation, REIT dividends more than compensated for the higher price returns on the S&P, leading total returns on REITs to exceed the S&P 500 by 2.4 percentage points. In periods of low inflation, REIT returns fall just below the S&P 500 as the income return does not fully compensate for the S&P 500’s superior price returns.

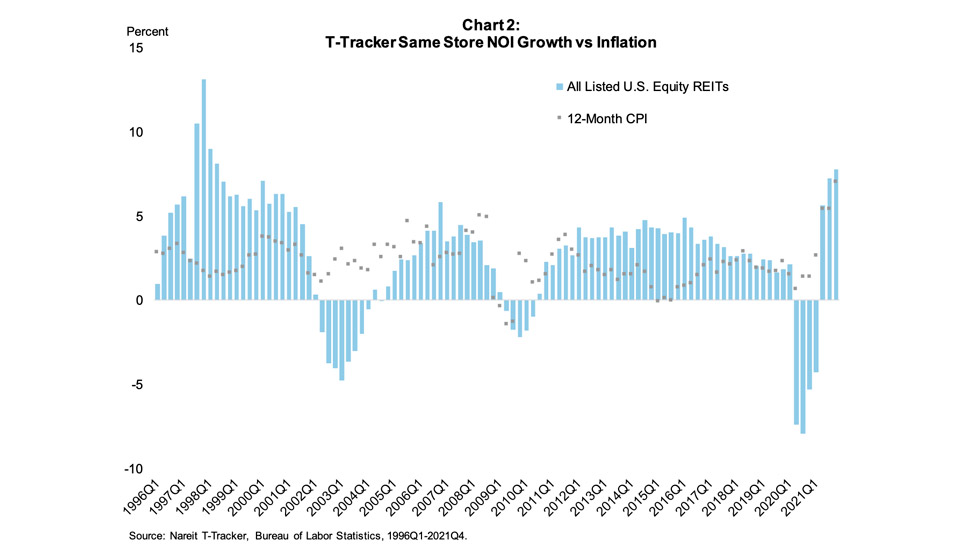

REITs’ operating performance has generally more than kept pace with inflation over the past few decades. Same store net operating income (SSNOI) from Nareit’s T-Tracker gives a conservative estimate of REIT growth during different periods of inflation. SSNOI doesn’t include growth from acquisitions and the data are not available for some of the highest growth property sectors of the last decade—including lodging/resorts, timberlands, infrastructure, data centers, and specialty. Even with 7.0% inflation at the end of 2021, SSNOI outpaced inflation by 72 basis points.

More Nareit coverage on inflation: