There is a high barrier to entry to invest directly in commercial property and most U.S. families do not invest in commercial property unless they have significant financial resources, according to data from the Federal Reserve’s Survey of Consumer Finances (SCF).

By contrast, REITs are an accessible way to realize the benefits of commercial property investing and far more households gain exposure to commercial real estate through REITs than through direct commercial real estate ownership. This research note summarizes REIT and direct commercial real estate ownership data from the SCF by net worth, income, and race.

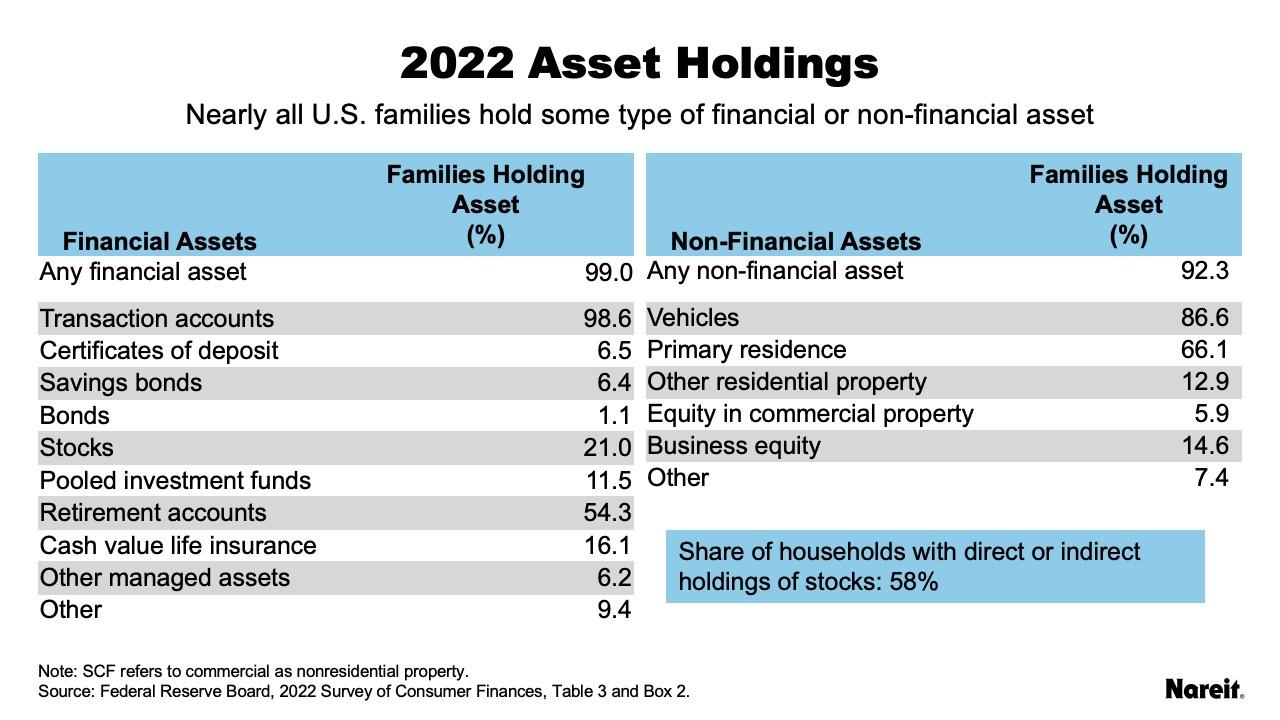

The SCF reports every three years on the financial health of U.S. families. Nearly all (99.7%) U.S. families hold some type of asset, either financial assets like stocks and retirement accounts and/or non-financial assets like vehicles and equity in non-residential (i.e. commercial) property.

The table above shows investment holdings by U.S. families, including stocks and equity in commercial property from the SCF. The SCF uses other residential property to refer to vacation homes and timeshares, not properties held for rent. Instead, the SCF uses “nonresidential real estate” equity to refer to holdings of commercial properties and land, here referred to as commercial property for ease of understanding. A total of 58% of families have direct or indirect holdings of stock typically through retirement accounts. An estimated 50% of U.S. families are invested in REITs according to Nareit. Only 6% of families hold equity in commercial property. REITs, as companies with publicly traded stock, allow for easier access to commercial real estate.

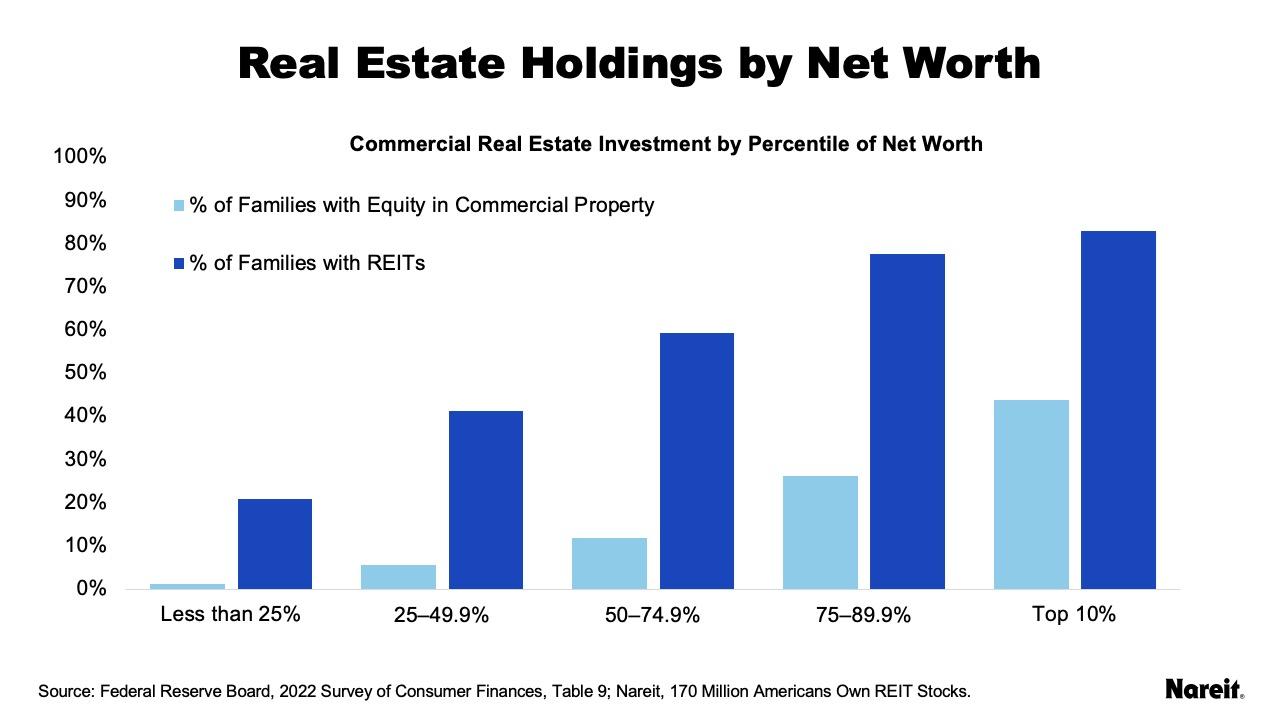

The share of families holding commercial property or equities varies greatly by net worth. The table above shows net worth by percentile, translated into dollar figures, with their holdings of any stock (directly or indirectly), REITs (separately estimated by Nareit), and commercial property. Those with the lowest net worth are much less likely to hold stock, REITs, or commercial real estate.

The chart above compares holdings of equity in commercial properties and holdings of REITs. An estimated 21% of families at the lowest net worth level are invested in REITs, while only 1% of those families hold any commercial property. The rate of commercial property ownership by net worth percentile increases for both types, but REITs far outpace individual commercial property ownership at every percentile of net worth.

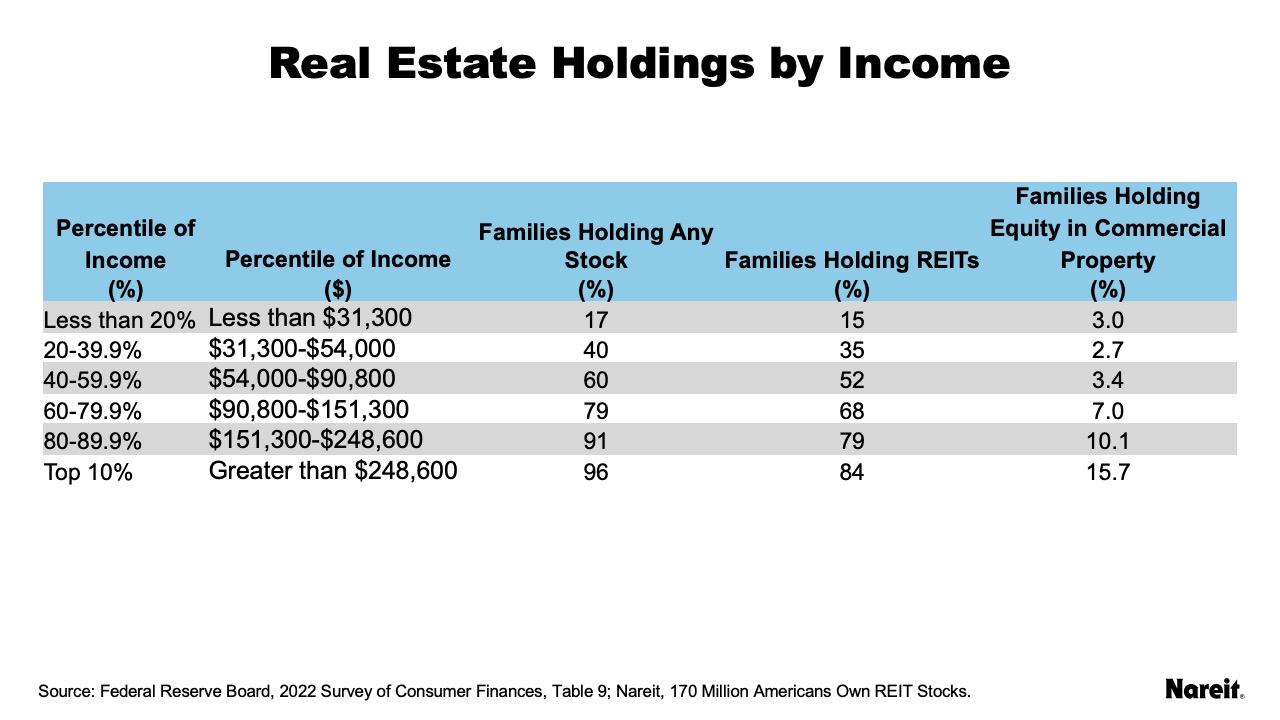

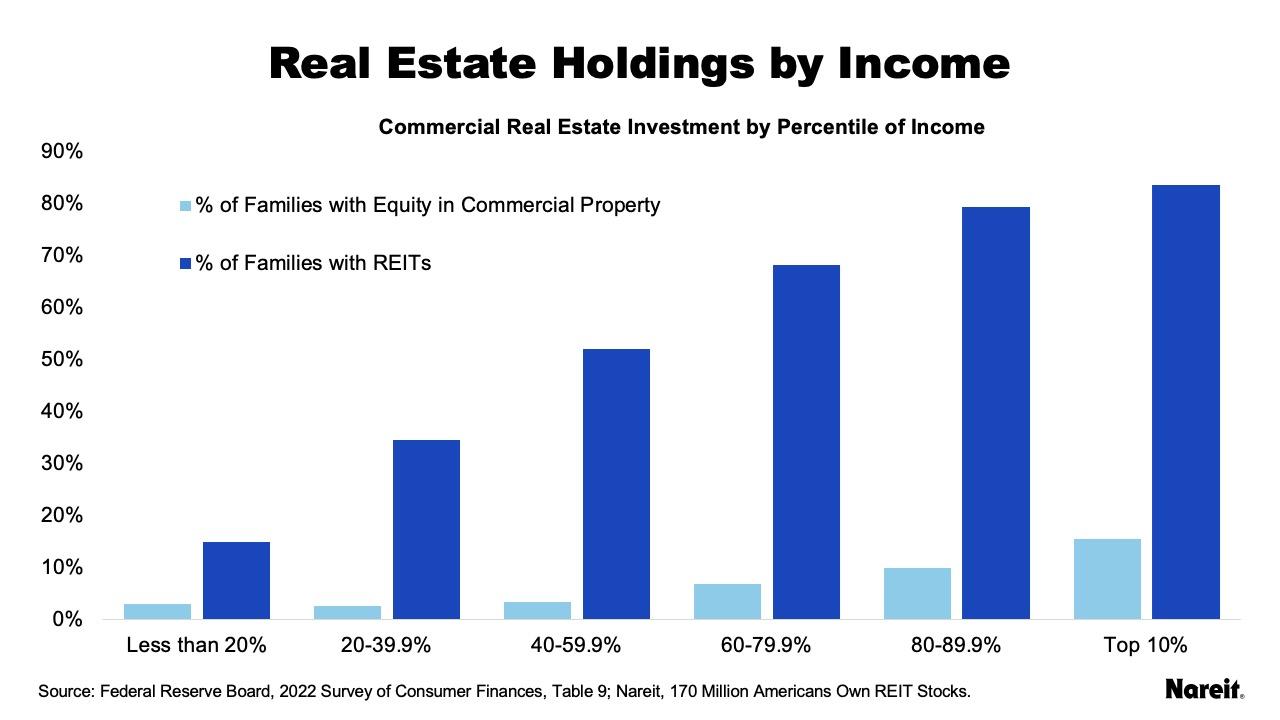

Net worth is a better indicator of direct commercial property investment than income. The table and chart above show commercial property holdings by percentile of income, translated into dollar amounts. At the highest income levels, only 16% of families have equity in commercial property, lower than the 44% of families in the top percentile of net worth.

As with net worth, across the income distribution, households are far more likely to access commercial real estate through REITs than through direct ownership. The chart above compares ownership of REITs and direct commercial real estate by income percentile. Those with higher incomes have higher investments both directly in commercial property and through REITs. While only 3% of those families making less than $31,300 have equity in commercial property, 15% have at least some investment in REITs. The share with equity in commercial property barely budges as income increases to $90,800, but the share with REITs increases to over 50% for those making between $54,000 and $90,800. At the top of the income distribution, more than 79% of families have an investment in REITs but equity in commercial property tops out at 16%.

The table above shows commercial property holdings by race and ethnicity. Across race/ethnicity groups, more families get access to commercial real estate using REITs than direct commercial real estate ownership. There are only minor differences across groups in commercial property investment. White families have the highest share of commercial property investment at 7%, followed by 5% of Asian families. Asian families have the highest share of equity ownership at 80%, followed by white non-Hispanic families at 66%. This gives Asian families a higher share in REITs, however the SCF reports a lower share of Asian families holding equity in commercial property than white families, 5% compared to 7% respectively. Hispanic or Latino families are the least likely to hold equities at a 28% share, while 39% of Black families hold equities.

REITs provide a bridge to commercial property investing for families across the distribution of income and net worth. For example, only 3% of families in the bottom 20% of income have commercial property investment, but 15% of them hold REITs. Across racial and ethnic groups, very few families hold commercial property while the share with REIT investment is an order of magnitude higher. REITs were established by Congress in 1960 to give access to income-producing real estate for everyday Americans and have successfully provided access to commercial real estate for over half of American families.

Key Takeaways:

REITs far outpace individual commercial property ownership at every percentile of net worth.

Across the income distribution, households are far more likely to access commercial real estate through REITs than through direct ownership.

Across race/ethnicity groups, more families get access to commercial real estate using REITs than direct commercial real estate ownership.