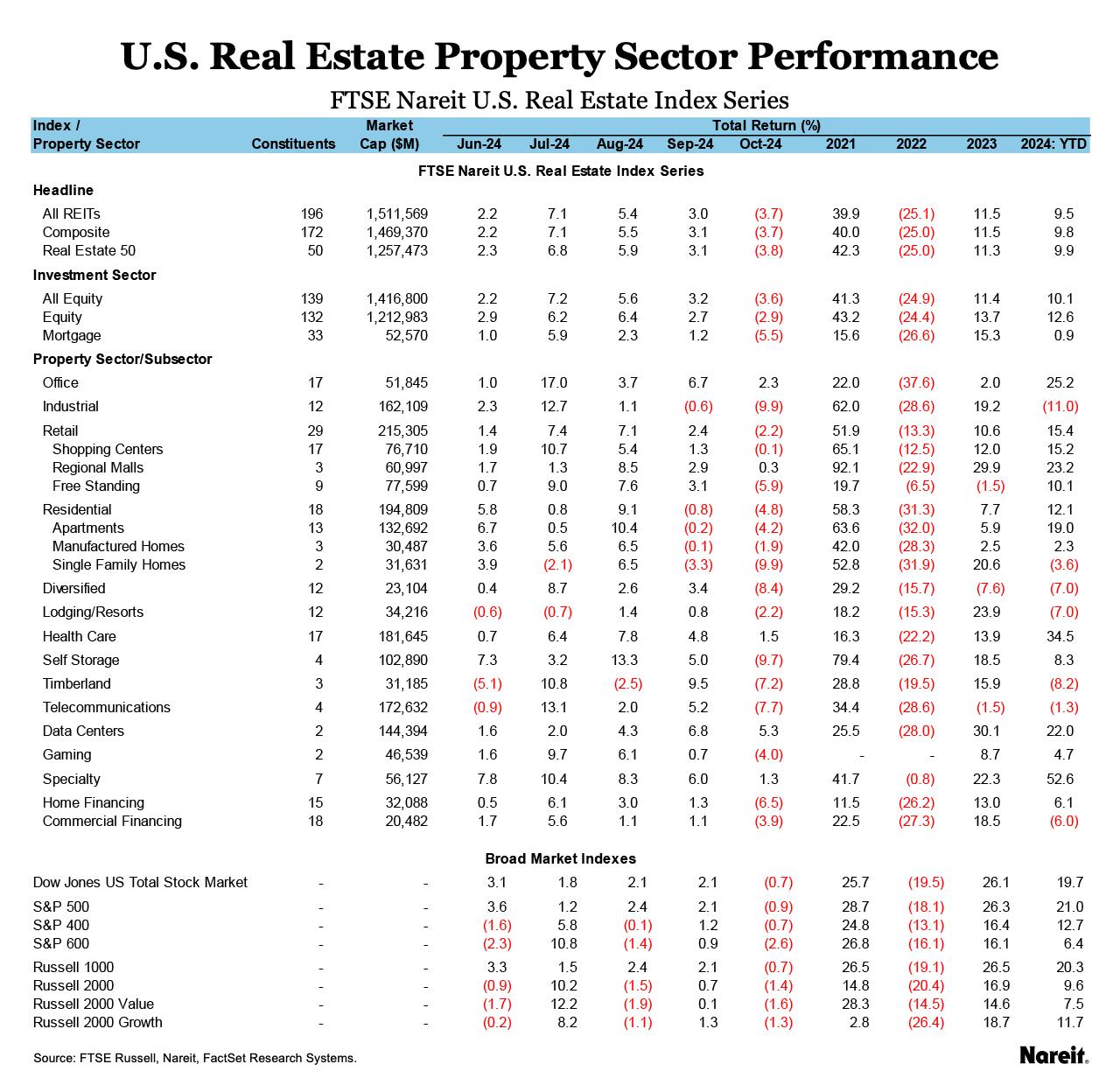

The FTSE Nareit All Equity REITs Index fell 3.6% in October, underperforming the broader stock market as the Dow Jones U.S. Total Stock Market and Russell 1000 declined 0.7%. On a year-to-date basis, the All Equity REITs Index is up 10.1%.

The yield on the 10-Year Treasury rose 50 basis points (bps) to end the month at 4.28%. As of Oct. 31, the dividend yield on the FTSE Nareit All Equity REITs Index was 3.71% and the FTSE Nareit Mortgage REITs Index yielded 12.10%, compared to 1.24% for the S&P 500.

As shown in the table above, the All Equity REITs Index is up 20% since April while the 10-Year Treasury yield has declined 42 bps. Since October 2023, when the 10-Year Treasury peaked at 4.98%, the All Equity REITs Index has returned 34.4%.

As shown in the table above, Data Centers led with a return of 5.3% in October, followed by Office at 2.3%, and Health Care at 1.5%. Industrial and Self-Storage lagged with a return of -9.9%, followed by diversified at -8.4%. On a year-to-date basis, Specialty leads with a total return of 52.6%, followed by Health Care at 34.5%, and Office at 25.2%.

The FTSE Nareit Mortgage REITs Index fell 5.5% in October and is up 0.9%, year to date. Home financing fell 6.5% for the month and commercial financing declined 3.9%. Year to date, home financing is up 6.1% and commercial financing is down 6.0%.