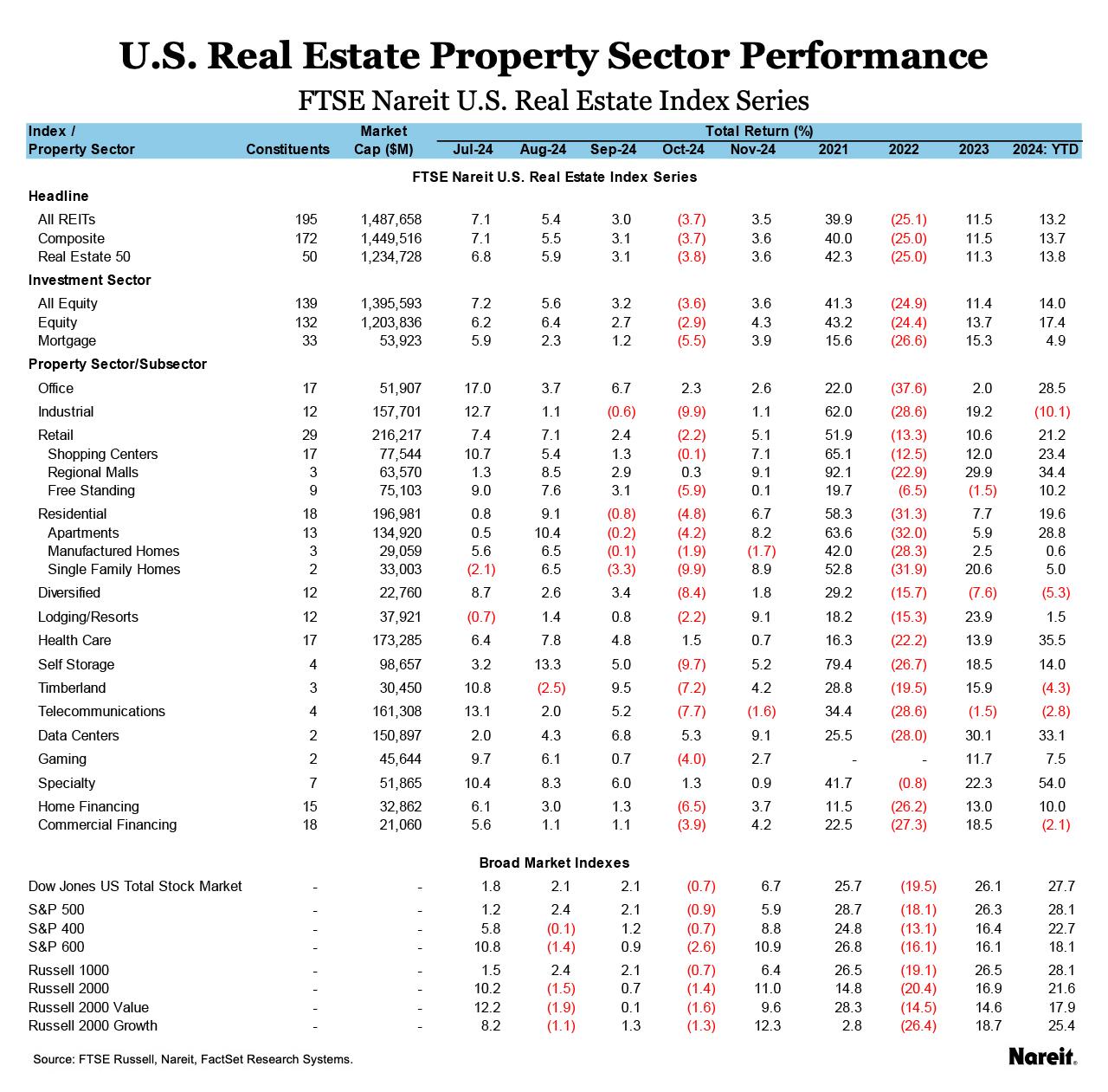

In November, the FTSE Nareit All Equity REITs Index gained back most of the ground lost in the previous month, posting a total return of 3.5%. The broader stock market posted strong returns as well, with the Dow Jones U.S. Total Stock Market rising 6.7% and the Russell 1000 rising 6.4%. The beginning of December has presented some headwinds for REITs as the All Equity REITs index has declined 3.6% through Dec. 10. On a year-to-date basis, the All Equity REITs Index is up 10.0%. The rate of disinflation has slowed in recent months, leaving investors with some uncertainty as to the magnitude and timing of future rate cuts, though most investors continue to expect a 25 basis point cut in December.

The yield on the 10-Year Treasury declined narrowly to end November at 4.19%. As of November 30, the dividend yield on the FTSE Nareit All Equity REITs index was 3.59% and the FTSE Nareit Mortgage REITs Index yielded 11.72%, compared to 1.18% for the S&P 500.

As shown in the table above, the yield on the 10-Year Treasury rose nearly 60 basis points since the middle of September to end November at 4.19%. During this time, REITs have traded sideways, with a total return of -1.0%. Since October 2023, when the 10-Year Treasury peaked at 4.98%, the All Equity REITs index has returned 39.2%.

As shown in the table above, at the sector level, lodging/resorts and data centers led with returns of 9.1% in November, followed by residential at 6.7%; while telecommunications, health care, and specialty lagged with returns of -1.6%, 0.7%, and 0.9%, respectively. On a year-to-date basis, specialty leads with a total return of 54.0%, followed by health care at 35.5%, and data centers at 3.1%. At the subsector level, regional malls, single family homes, and apartments all performed strongly in November, with respective returns of 9.1%, 8.9%, and 8.2%.

The FTSE Nareit Mortgage REITs Index rose 3.9% in November and is up 4.9% year-to-date. Commercial financing rose 4.2% for the month and home financing was up 3.7%. Year-to-date, home financing is up 10.0% and commercial financing is down 2.1%.