One of the dominant themes among institutional real estate investors over the past few years has been the shift toward “alternative” property types.

Increasingly, we are observing institutional investors of all sizes using REITs and listed real estate to gain access to new and emerging property sectors. Recently, the National Pension System of Korea (NPS) announced that it will allocate $1 billion to a strategy benchmarked against a new completion-oriented index developed in collaboration with FTSE, Nareit, and the European Public Real Estate Association (EPRA). A case study of NPS shows how a large institutional investor successfully designed and executed a REIT index and allocation to help complete their real estate portfolio.

NPS, the world’s third-largest pension fund by total assets, is using the new index to expand its sector footprint in the expectation that the strategy will increase diversification and enhance the risk-adjusted return of the entire real estate portfolio in the long run.

REITs and listed real estate have been on the forefront of bringing new and emerging property sectors into the institutional real estate space. In fact, today the modern economy sectors outside of the traditional office, retail, industrial, and apartment property types account for more than 60% of the U.S. focused FTSE Nareit All Equity REIT index. Globally there has been a similar trend toward new and emerging sectors as REITs have been innovators in institutionalizing new categories of real estate.

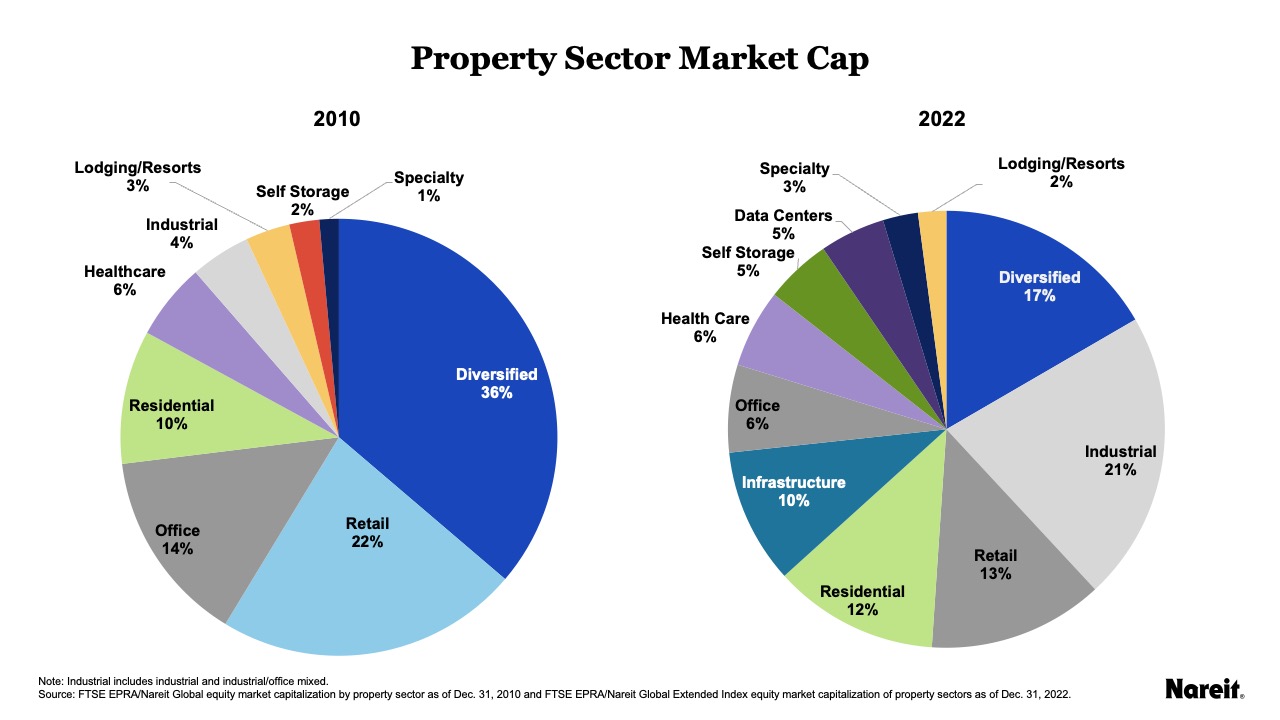

The chart above shows the change in market capitalization of the FTSE EPRA Nareit Developed Extended index between 2010 and year-end 2022. As the chart shows, there has been dramatic growth in new and emerging sectors including cell towers, data centers, health care, self-storage, and others as the traditional real estate share has fallen from 82% to 69%.

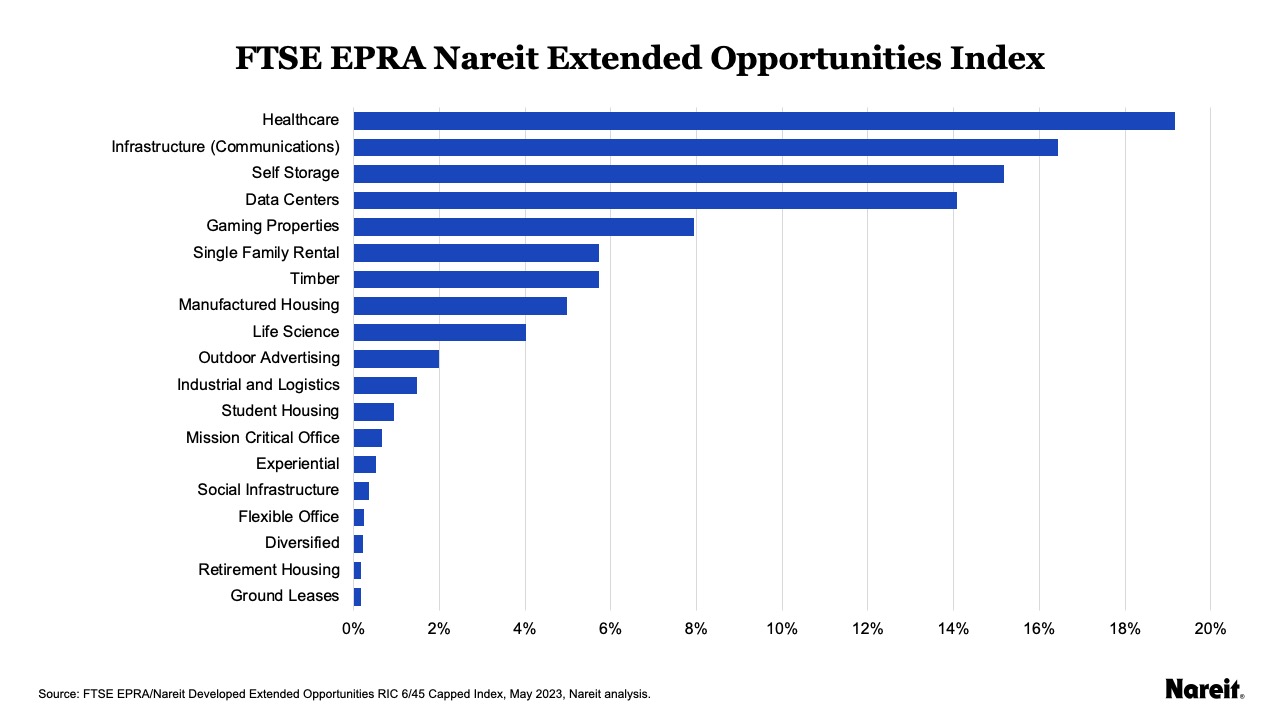

The FTSE EPRA Nareit Developed Extended Opportunities RIC 6/45 Capped Index being used by NPS to benchmark their completion strategy focuses both on new and emerging sectors and unique strategies within traditional sectors.

As the chart above shows, the new index provides access to a broad range of innovative property types. The largest property sector is health care, which encompasses REITs and listed real estate companies that own and lease properties housing medical offices, skilled nursing and long-term care facilities, and senior housing. The second largest sector is infrastructure, which comprises cell towers and communications real estate, followed by self-storage, with data centers as the fourth largest sector. There are a number of constituents that are in the new and emerging sub-sectors of the residential, office, and industrial sectors. In residential, this includes single family rental, manufactured, student, and social housing. In office, this includes flexible office space and mission critical (government, law enforcement, and military) offices. Industrial includes cold storage and other specialty industrial and logistics facilities.

Read additional portfolio completion case studies