Publicly traded REITs are providing transparency around key topics that are important to sustainability-focused investors, including documenting their approaches to risk management and performance reporting. Nareit’s REIT Industry Sustainability Report 2024 shows how a growing number of REITs have increased and expanded their reporting on sustainability efforts.

In 2023, 100% of the top 100 equity REITs by market capitalization (cap) publicly reported on sustainability, reflecting the sector’s commitment to providing transparency to investors and telling their stories to customers, employees, and community members. REITs also have further enhanced their data collection and analysis to expand their reporting on environmental risks and opportunities, particularly those surrounding climate mitigation and adaptation.

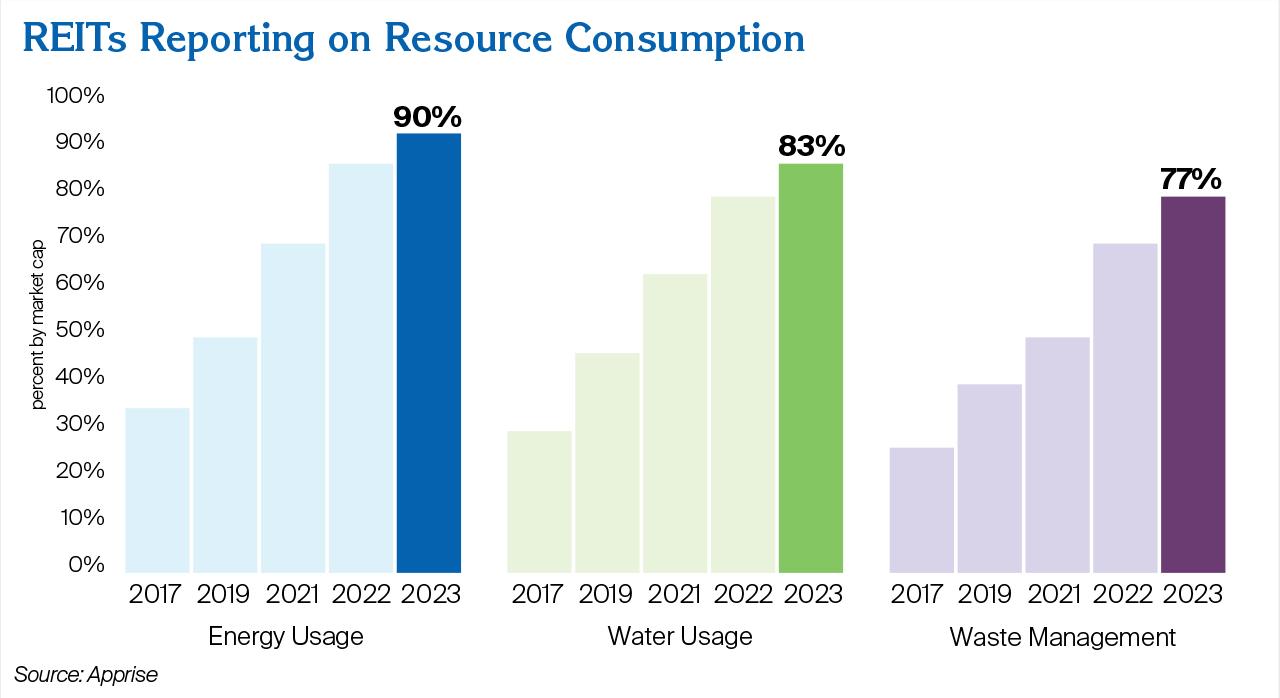

Resource Consumption: Reporting on Energy Usage Increased the Most

Through increased reporting, REITs are demonstrating their transparency about and progress in managing the environmental impact of their resource consumption.

The chart above demonstrates the growth in REITs’ reporting of energy usage, water usage, and waste management from 2017 to 2023. The findings show that:

- Energy usage reporting increased by 57 percentage points since 2017.

- Water usage reporting increased by 53 percentage points.

- Waste management reporting increased by 50 percentage points.

This reporting provides valuable insight into REITs’ efforts to reduce operating costs, improve efficiency, and reduce their environmental footprint.

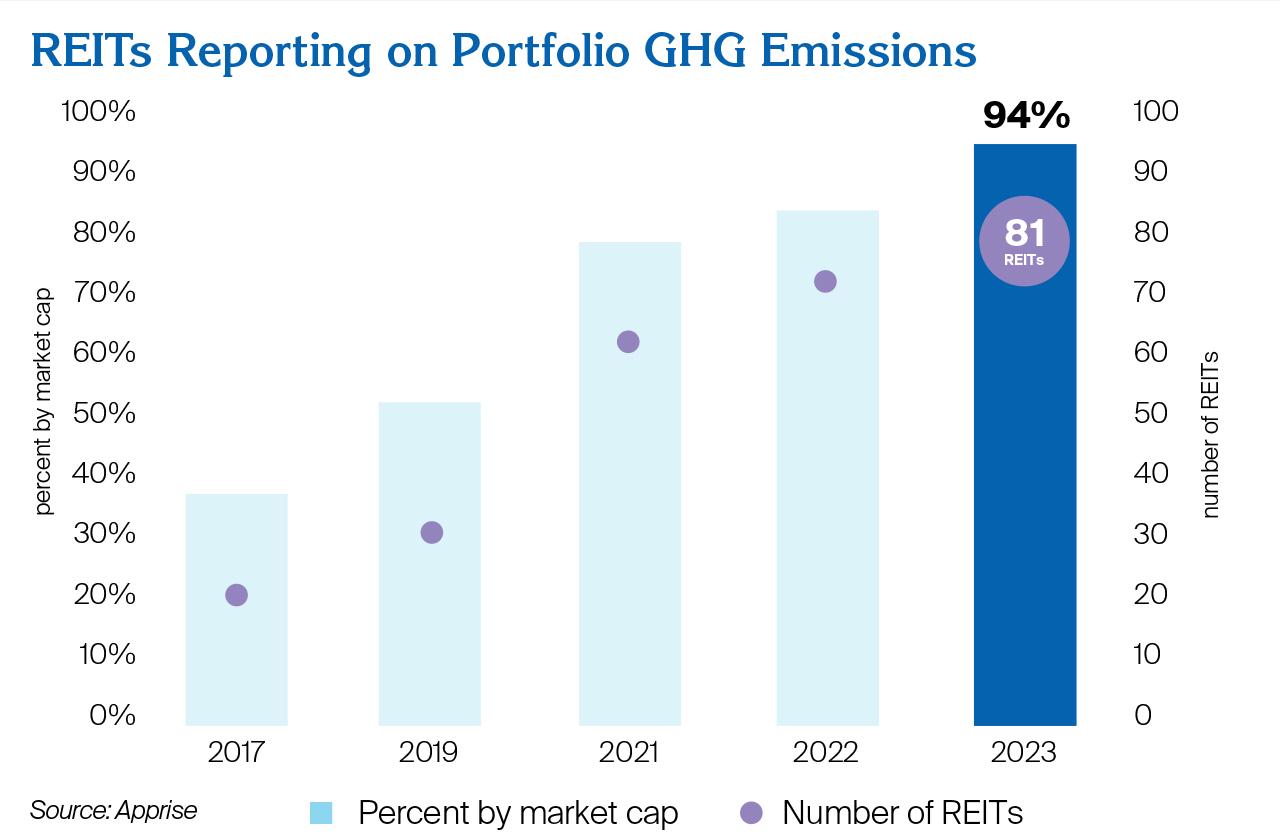

GHG Emission Reporting More Than Doubled

The percentage of REITs reporting their greenhouse gas (GHG) emissions has more than doubled in the last seven years.

The chart above shows this growth in GHG reporting. REITs reporting the GHG emissions of their portfolios increased by 56 percentage points since 2017, with 94% of REITs reporting in 2023. By publicly reporting on the carbon footprint of their operations, REITs provide stakeholders insights into the potential financial risks associated with the transition to a low-carbon economy and demonstrate the results of efforts to reduce emissions.

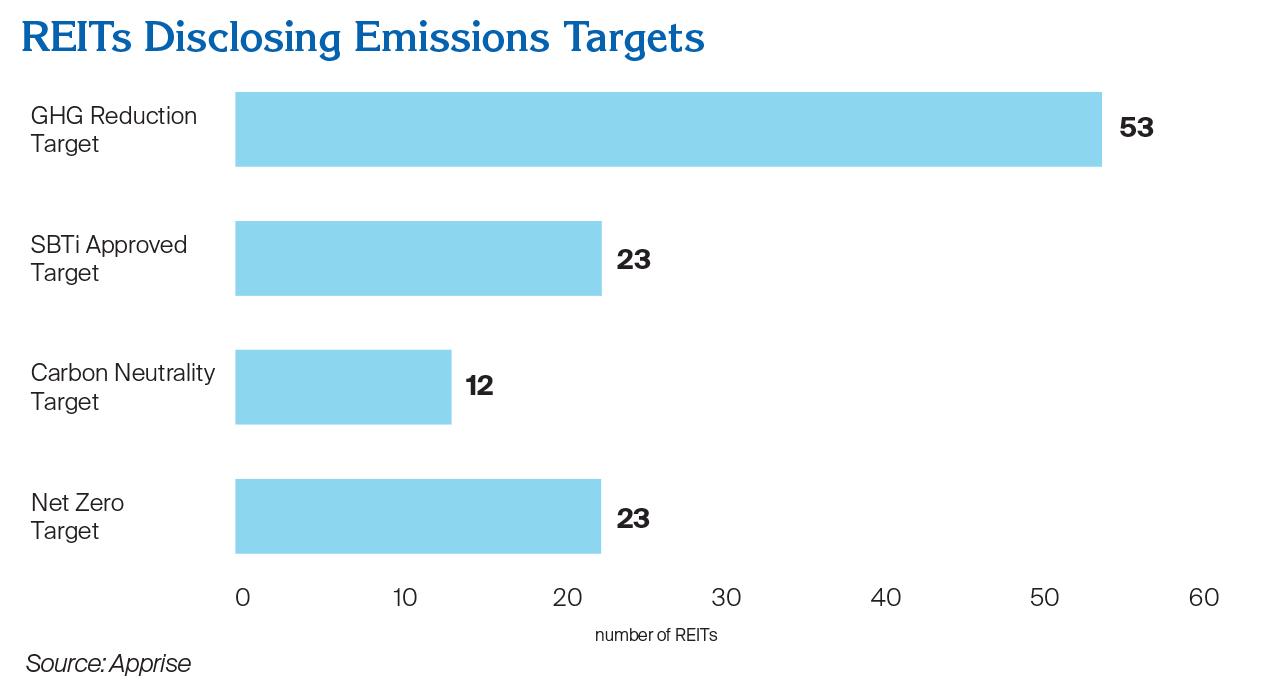

Increasing: Public Reporting of Emissions Reduction Targets

REITs are actively focused on building decarbonization efforts and have aimed to align climate targets with voluntary industry frameworks where possible. In 2023, 73% of REITs publicly reported on emissions reduction targets in some form.

Fifty-three REITs of the top 100 by market cap have set emission reduction targets, and the chart above shows the breakdown of those various emissions targets. Last year:

- 23 REITs had targets approved by the Science Based Targets Initiative (SBTi).

- 23 REITs set net zero targets.

- 12 REITs set targets for carbon neutrality.

By aligning with industry standards and providing specific details about how they plan to decarbonize, REITs are helping stakeholders better understand the potential risks related to compliance costs with increased environmental regulations.

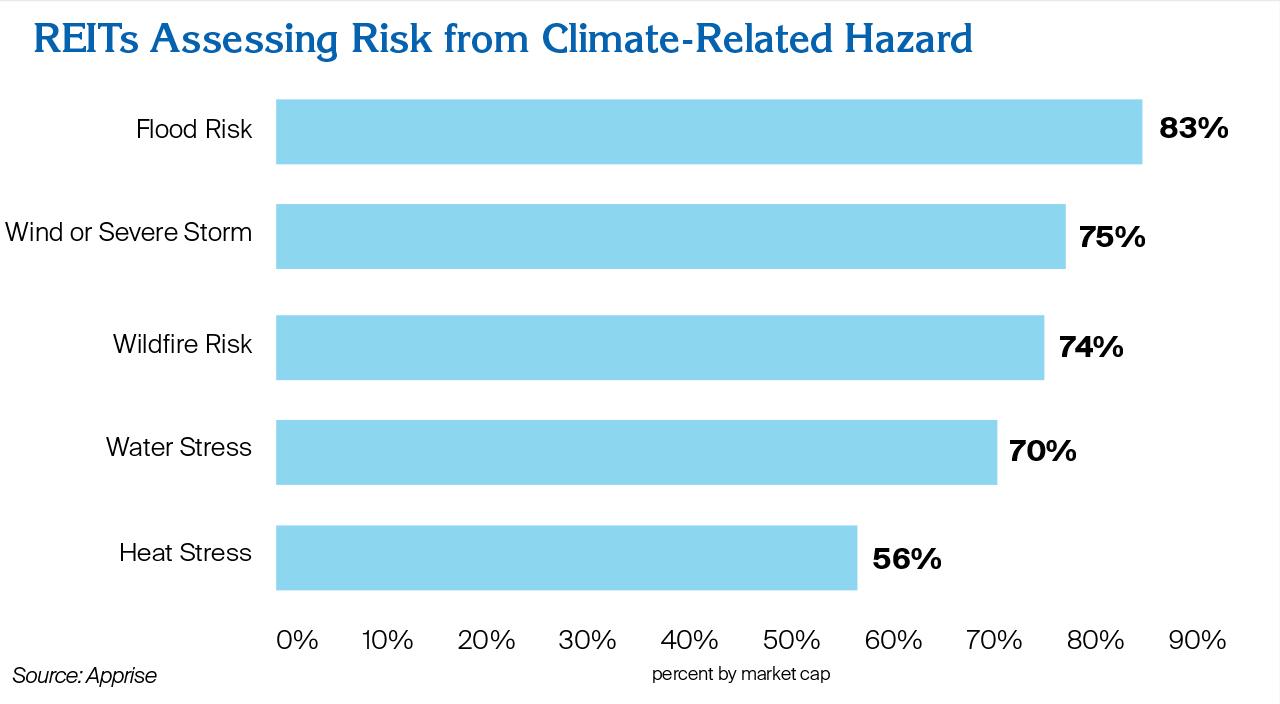

Majority of REITs Reporting Weather-Related Risks

Many REITs also assess exposure to severe weather events to support informed decision-making and communicate with investors about how these risks may impact investment performance.

The chart above depicts the percentage of REITs assessing risk from different climate-related hazards. In 2023, 83% of REITs reported assessing flood risk, 75% reported assessing wind or severe storm risk, and 74% reported assessing wildfire risk. A majority of REITs also reported that they have been assessing risks attributed to stressors, such as water and heat stress. Data on the likelihood, frequency, and intensity of hazards facing building portfolios is helping REITs prepare for the potential financial impacts of extreme weather events.

As REITs continue to track and further their understanding of climate-related risks, they are taking steps to improve the resilience of their portfolios. In 2023, 75% of REITs reported on resilience capital improvements. By upgrading buildings to avoid damages associated with extreme weather events, REITs are better prepared to mitigate potential losses, support tenants, and contribute within their communities.

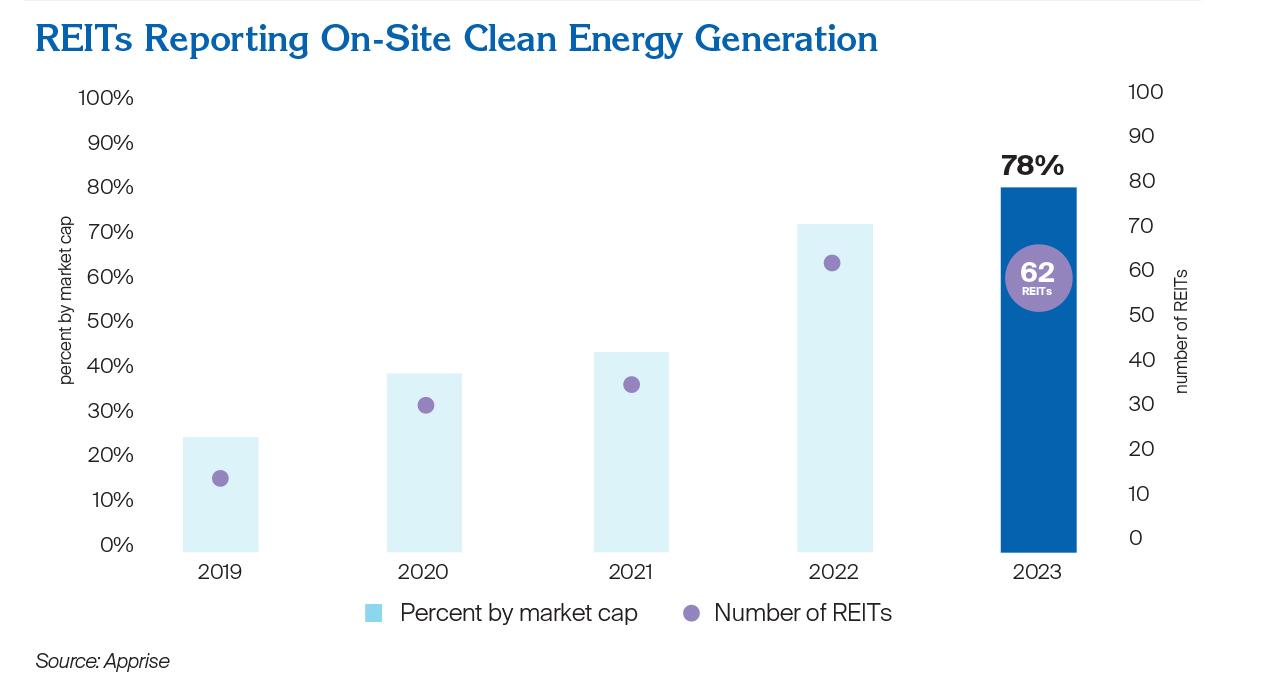

On-Site Clean Energy Generation: REIT Reporting Tripled

REITs are finding opportunities to generate and procure carbon-free energy to power, heat, and cool buildings.

The chart above shows the increase in REITs reporting on-site clean energy generation from 2019 to 2023, which has more than tripled in the last five years, from 23% in 2019 to 78% in 2023. Furthermore, 77% of REITs report procuring clean energy generated off-site. REITs are using various market-based solutions to shift to clean energy sources and are taking advantage of the opportunities presented in the clean energy economy.

These key findings from Nareit’s REIT Industry Sustainability Report 2024 show how REITs are increasingly disclosing information that is critical to evaluating environmental risks and opportunities. The report includes many more findings, which underscore that publicly traded REITs inherently have good governance and accountability embedded within their business model. Investors with sustainability-focused real estate strategies should note REITs’ commitment to transparency and the value that REITs’ sustainability work can bring to their portfolios.

Interested in more sustainability related news? Sign up for Nareit’s new quarterly sustainability newsletter.