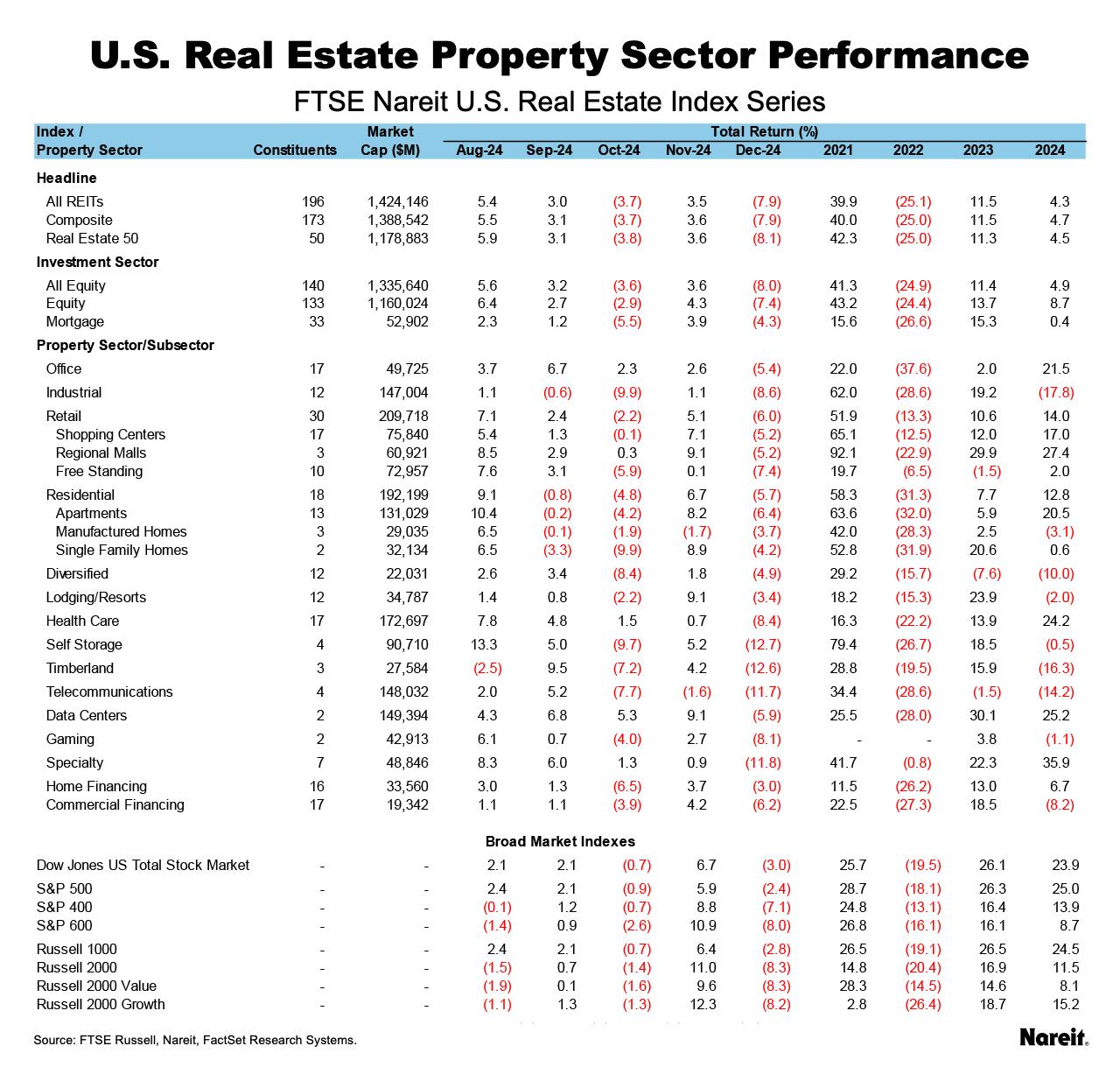

REITs rose 4.9% in 2024 while facing considerable headwinds in December, as the FTSE Nareit All Equity REITs Index posted its worst monthly performance of the year, declining 8.0% on a total return basis.

The broader stock market was also challenged, with the Russell 1000 dropping 2.8% and the Dow Jones U.S. Total Stock Market falling 3.0% during the month. More-hawkish commentary from the Federal Reserve in December has led many investors to reduce the number of expected rate cuts in 2025.

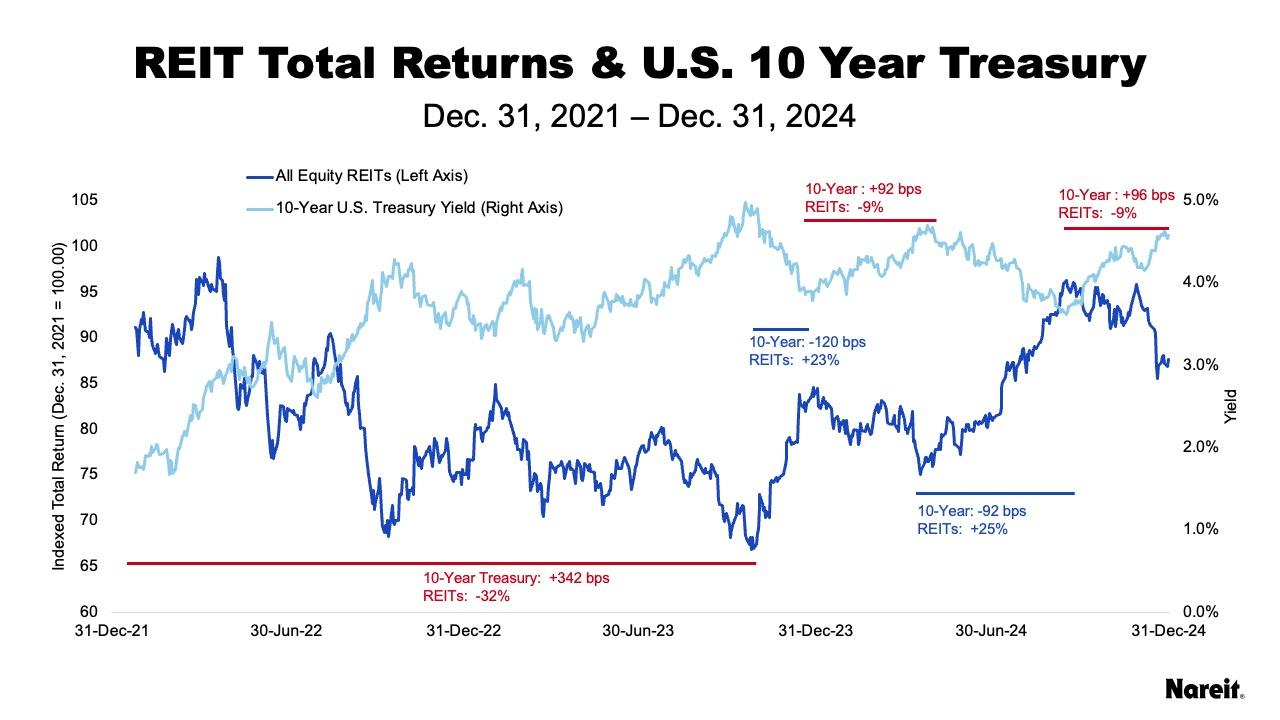

The yield on the 10-year Treasury rose 39 basis points in December to end the year at 4.58%. As of Dec. 31, 2024, the dividend yield on the FTSE Nareit All Equity REITs index was 3.96% and the FTSE Nareit Mortgage REITs Index yielded 12.65%, compared to 1.22% for the S&P 500.

As shown in the table above, the yield on the 10-year Treasury rose nearly 100 basis points since the middle of September. During this time, REITs fell 8.9% while the Russell 1000 rose 5.1%. Since October 2023, when the 10-year Treasury peaked at 4.98%, the All Equity REITs index has returned 28.1% while the Russell 1000 is up 40.0%.

December was a tough month for REITs across all property sectors. Lodging/resorts, diversified, and office led with respective returns of -3.0%, -4.9%, and -5.4%. Self-storage, timberland, and specialty lagged with returns of -12.7%, -12.6%, and -11.8%, respectively. For the year, specialty led with a total return of 35.9%, followed by data centers at 25.2%, and health care at 24.2%. Industrial lagged the most in 2024, with a total return of -17.8%, followed by timberland at -16.3%, and telecommunications at -14.2%.

The FTSE Nareit Mortgage REITs Index fell 4.3% in December and was flat for the year with a total return of 0.4%. Home financing fell 3.0% for the month and commercial financing was down 4.3%. For the year, home financing rose 6.7% and commercial financing was down 8.2%.