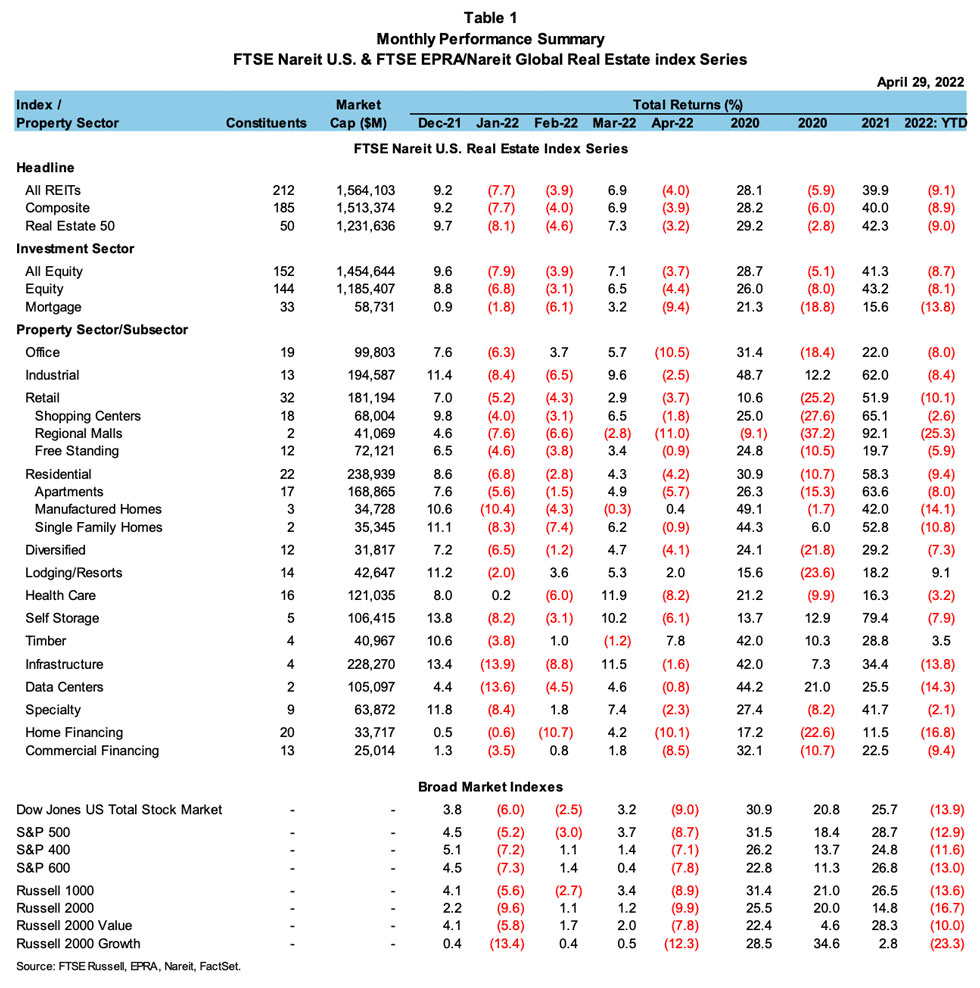

REITs were resilient in the face of broad market turbulence through most of April, only turning negative on April 29th as the broad market fell reacting to Amazon’s earnings miss and implications for consumer demand. Ultimately, REITs outperformed the broader stock market in April, posting a total return of -3.7% for the FTSE Nareit All Equity REITs index and -4.4% for the FTSE Nareit Equity REITs index. REIT and non-REIT returns were buffeted by investor expectations that the Federal Reserve has embarked on an extended period of monetary-policy tightening and inflationary pressures driven by supply chain woes will continue longer than previously forecast. Both factors have lowered expectations for economic growth and correspondingly corporate earnings.

Disappointing earnings from the some of the largest companies outside of the REIT space weighed heavily on REITs at the close of the month. Entering the final trading session of the month, the All Equity REITs index was up 1.1% in April and the industrial sector was up 5.1%. When Amazon released its earnings on April 28, Amazon’s CFO stated that "We have too much space right now versus our demand patterns." Amazon is one of the largest tenants of logistics-focused industrial REITs, and in response, industrial REITs fell 7.2% on April 29th, ending the month with a total return of -2.5% and the All Equity REITs index fell 4.8% with losses across all property sectors.

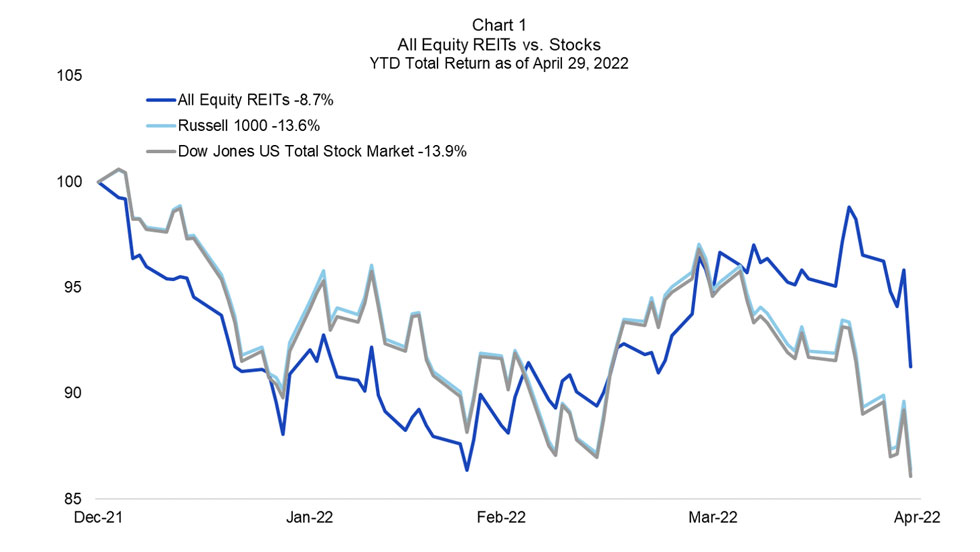

As chart 1 shows, broader markets were hit harder than REITs in April, with a total return of -9.0% for the Dow Jones U.S. Total Stock Market and -8.9% on the Russell 1000. Year-to-date, the Total Stock Market is down 13.9% and the Russell 1000 is down 13.6%. Since February 23, when Russia invaded Ukraine, the total return of FTSE Nareit All Equity REITs was 5.7%, versus -2.2% for the Russell 1000 and -2.4% for the Dow Jones U.S. Total Stock Market.

Only two property sectors were positive in April, with a total return of 7.8% for timber followed by lodging/resorts at 2.0%. The worst performing sectors for the month were office at -10.5%, health care at -8.2% and self storage at -6.1%. Mortgage REITs trailed Equity REITs in April with returns of -10.1% for home financing mREITs and -8.5% for commercial financing mREITs. On a year-to-date basis, only 27% of Equity REITs have posted positive total returns, and advancers led decliners for only two sectors: 87% of lodging/resorts and 56% of specialty REITs are positive for the year.