The growing use of target-date funds (TDFs) remains the dominant investment-related trend in the defined contribution and individual retirement account markets, and REITs continued to be a critical component of TDFs in 2024.

Over the past two decades, a particularly noteworthy development in the asset allocation arena has been the significant increase in both the number of asset allocation products that now include a REIT allocation and the percentage of total assets allocated to REITs within these products. This is corroborated by our most recent analysis of the use of REITs within TDFs.

At year-end 2024, virtually all TDF fund providers had some allocation to REITs. Among the standout users of REITs in TDFs is Schwab, offering a TDF with a maximum REIT allocation along its glide path of close to 10%. In addition to Schwab, MFS, PGIM, BlackRock, Empower, and ClearTrack all offer TDFs with REIT allocations well above REIT stock market cap weighting.

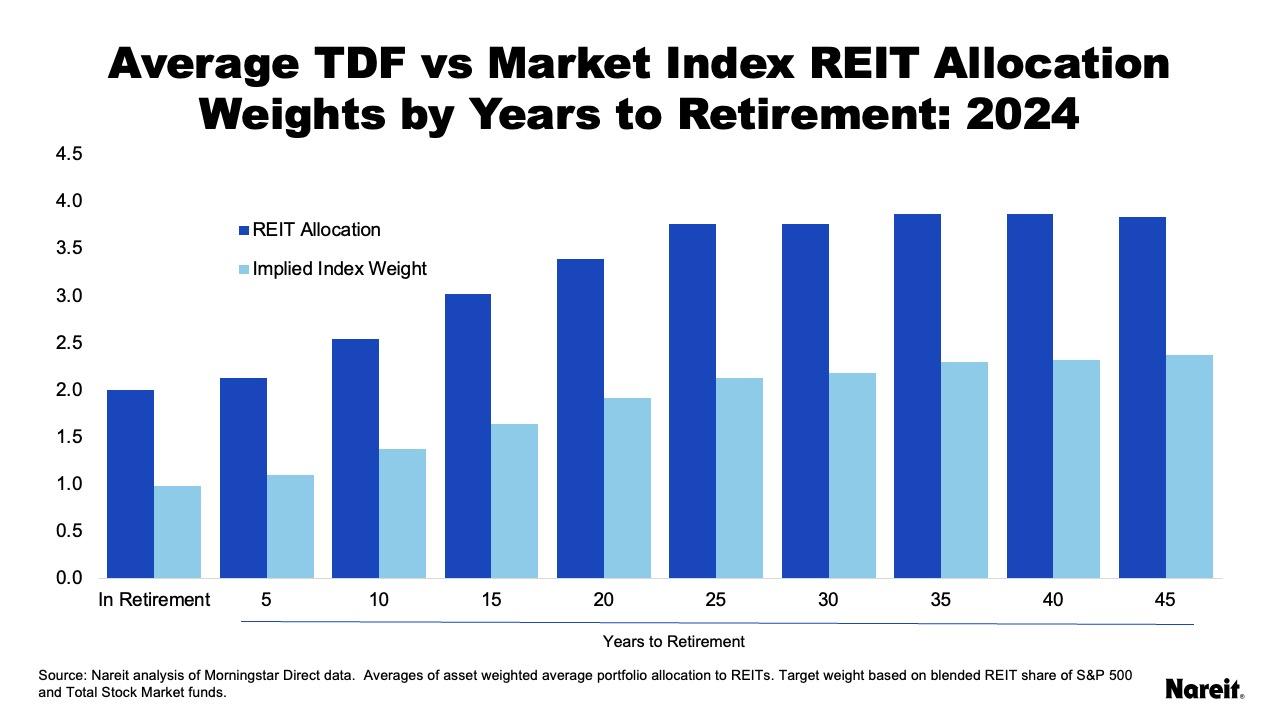

Looking across all cohorts of TDFs, REITs are part of the TDF strategy from the beginning of retirement saving through retirement. The chart above shows the asset weighted average of REITs along the glide path across providers. Following the same trend as total equity investments, TDFs reduce their holdings in REITs as retirement becomes imminent. However, REITs still play a significant role in retirement income, moving from an estimated peak of 3.9% with 40 years to retirement to 2% for funds in retirement, a reduction of less than two percentage points.

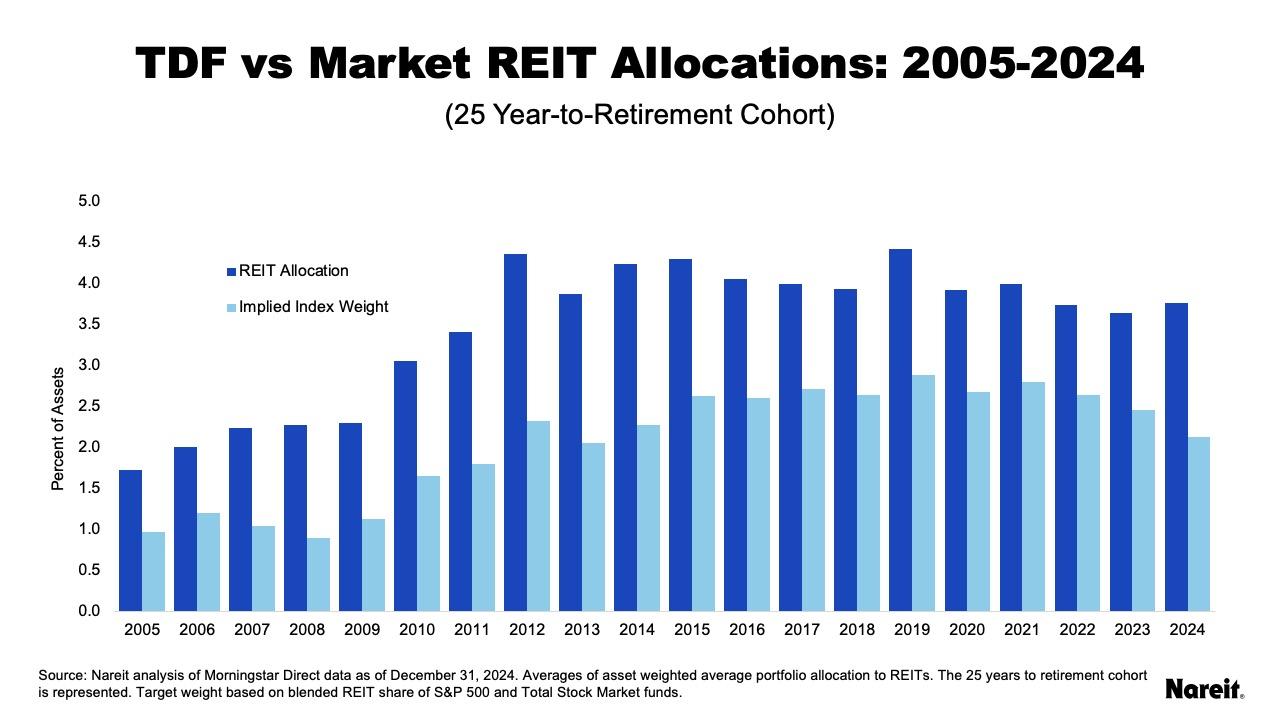

In 2005, the share of TDFs with REIT exposure was only 67%, while in 2024, virtually all of them invested in REITs. Looking over the past 20 years for TDFs with 25 years to retirement, the chart above shows that asset allocation product manufacturers have increased REIT allocations in these TDFs from an estimated average asset weighted portfolio of 1.7% in 2005 to just under 4% in 2024. A reported 61% of TDFs have a dedicated REIT sleeve within their asset allocation.

The chart also shows that since 2005, TDFs have kept their REIT allocations higher than the implied REIT index weight for the entire period. The REIT market weight is estimated by using the average share of REITs in funds benchmarked to the S&P 500 or Total Stock Market index and applying a blended weight from both benchmarks to each TDF fund to estimate an implied share of REITs based on their equity holdings. The chart shows TDF funds have held REITs above their implied index weight by more than one percentage point since 2007. In 2024, REIT allocations were 1.6 percentage points above their implied index weight.