REITs posted positive returns to begin 2025 as the FTSE Nareit All Equity REITs Index rose 1.0% in January. The broader stock market outperformed, with the Russell 1000 gaining 3.2% and the Dow Jones U.S. Total Stock Market rising 3.1%. As was broadly expected, the Federal Reserve left rates unchanged in January, noting that inflation remains “somewhat elevated” alongside strength in the broader economy and labor market.

The yield on the 10-year Treasury declined 7 basis points in January, ending the month at 4.55% after hitting an intra-month high of 4.79%. As of Jan. 31, the dividend yield on the FTSE Nareit All Equity REITs index was 3.93% and the FTSE Nareit Mortgage REITs Index yielded 12.05%, compared to 1.19% for the S&P 500.

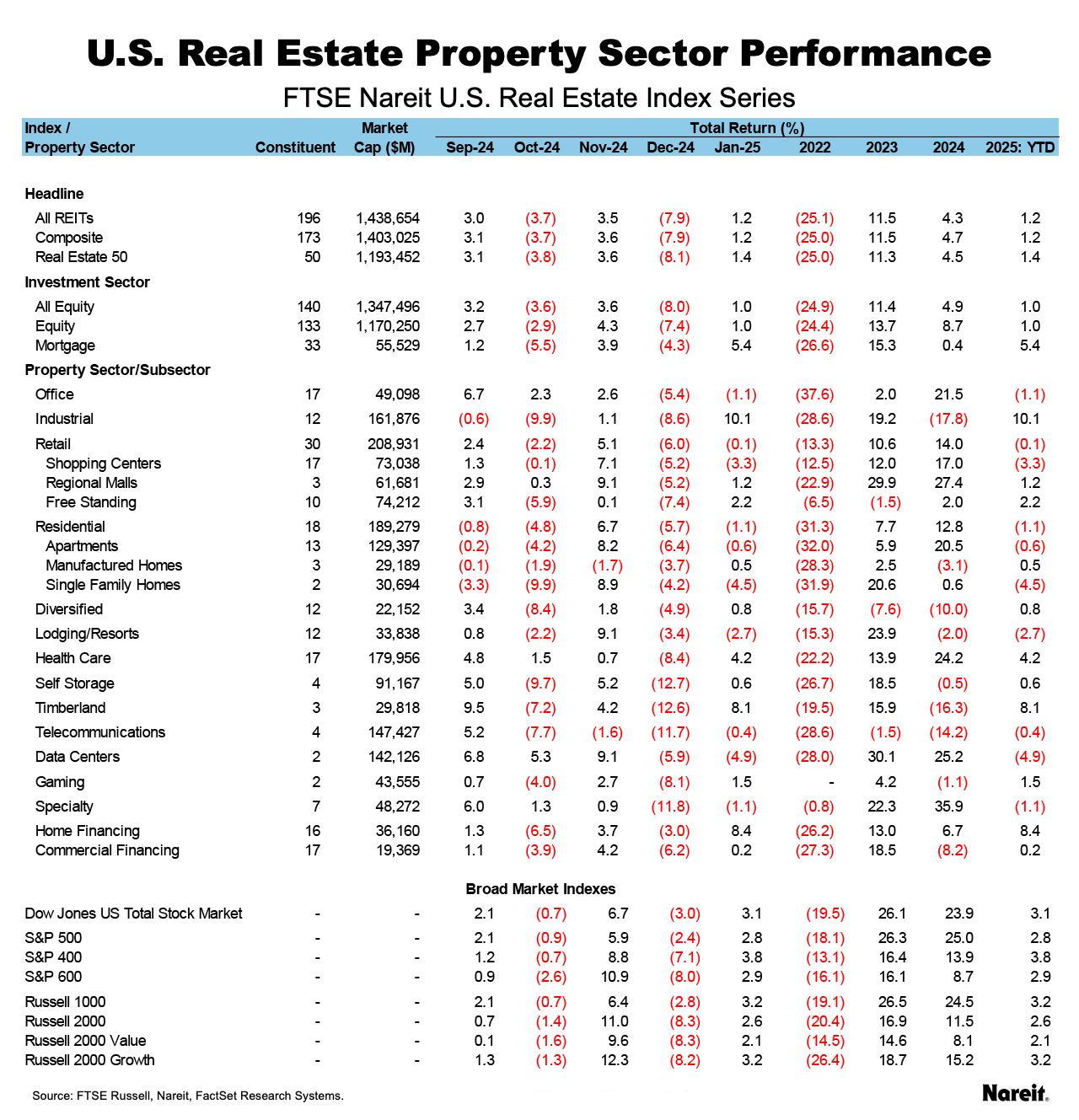

As shown in the table above, the yield on the 10-year Treasury rose 93 basis points from September to January. During this time, REITs fell 8.0% while the Russell 1000 rose 8.5%. Since October 2023, when the 10-year Treasury peaked at 4.98%, the All Equity REITs index has returned 29.4% while the Russell 1000 is up 44.4%.

January property sector performance was led by industrial, timberland, and health care, with respective returns of 11.1%, 8.1%, and 4.2%. Data centers lagged with a total return of -4.9%, followed by lodging/resorts at -2.7%, and specialty at -1.1%.

The FTSE Nareit Mortgage REITs Index rose 5.4% in January. Home financing rose 8.4% for the month while commercial financing was up 0.2%.