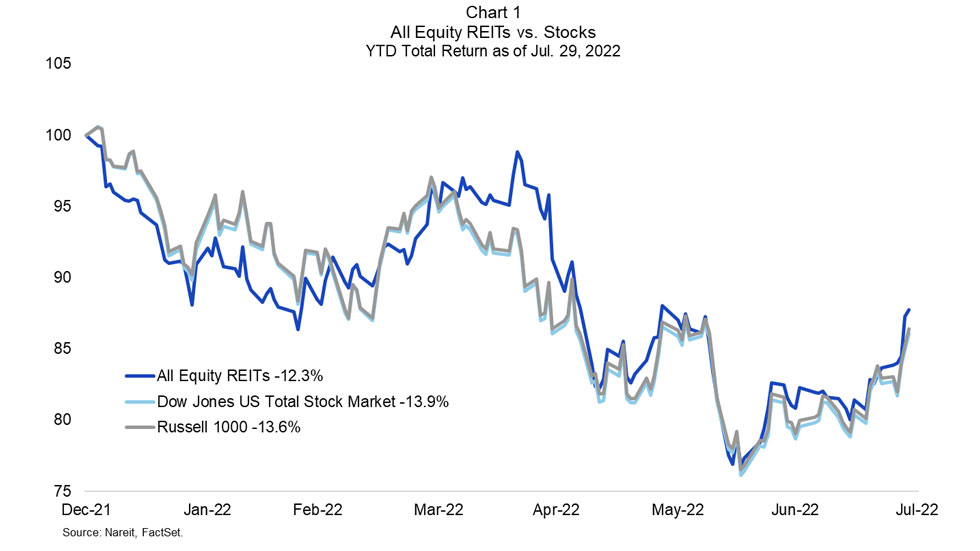

The FTSE Nareit All Equity REITs Index posted a total return of 8.6% and the FTSE Nareit Equity REITs Index rose 9.1% in July, their strongest monthly performance since December 2021. Broader markets performed strongly as well, as the Dow Jones U.S. Total Stock Market was up 9.4% and the Russell 1000 rose 9.3%. The rally came as the yield on the 10-year Treasury declined from 2.97% on June 30 to 2.64% at the end of July. Continued tightening of monetary policy was taken in stride by markets with guidance on future rate hikes left unspecified.

Chart 1 shows REITs outperforming broad market equities on a year-to-date basis through the end of July, with a total return of -12.3% for All Equity REITs, -13.6% for the Russell 1000, and -13.9% for the Dow Jones U.S. Total Stock Market. Since February 23, when Russia invaded Ukraine, the All Equity REITs index has returned -1.6%, versus -2.2% for the Russell 1000, and -2.4% for the Dow Jones U.S. Total Stock Market.

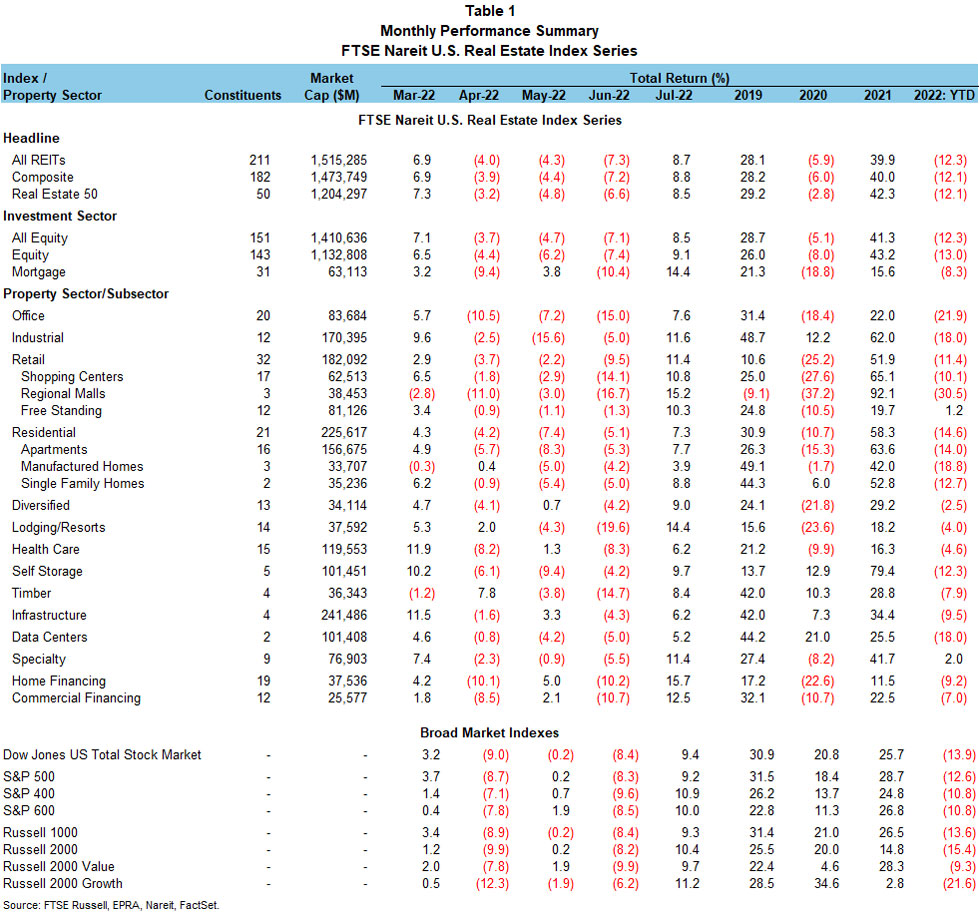

As shown in Table 1, all REIT sectors were positive in July, led by lodging/resorts at 14.4%, followed by industrial at 11.6%. Data centers lagged other sectors with a total return of 5.2%. Mortgage REITs posted a total return of 14.4% in July, with home financing mREITs returning 15.7% and commercial financing mREITs at 12.5%.