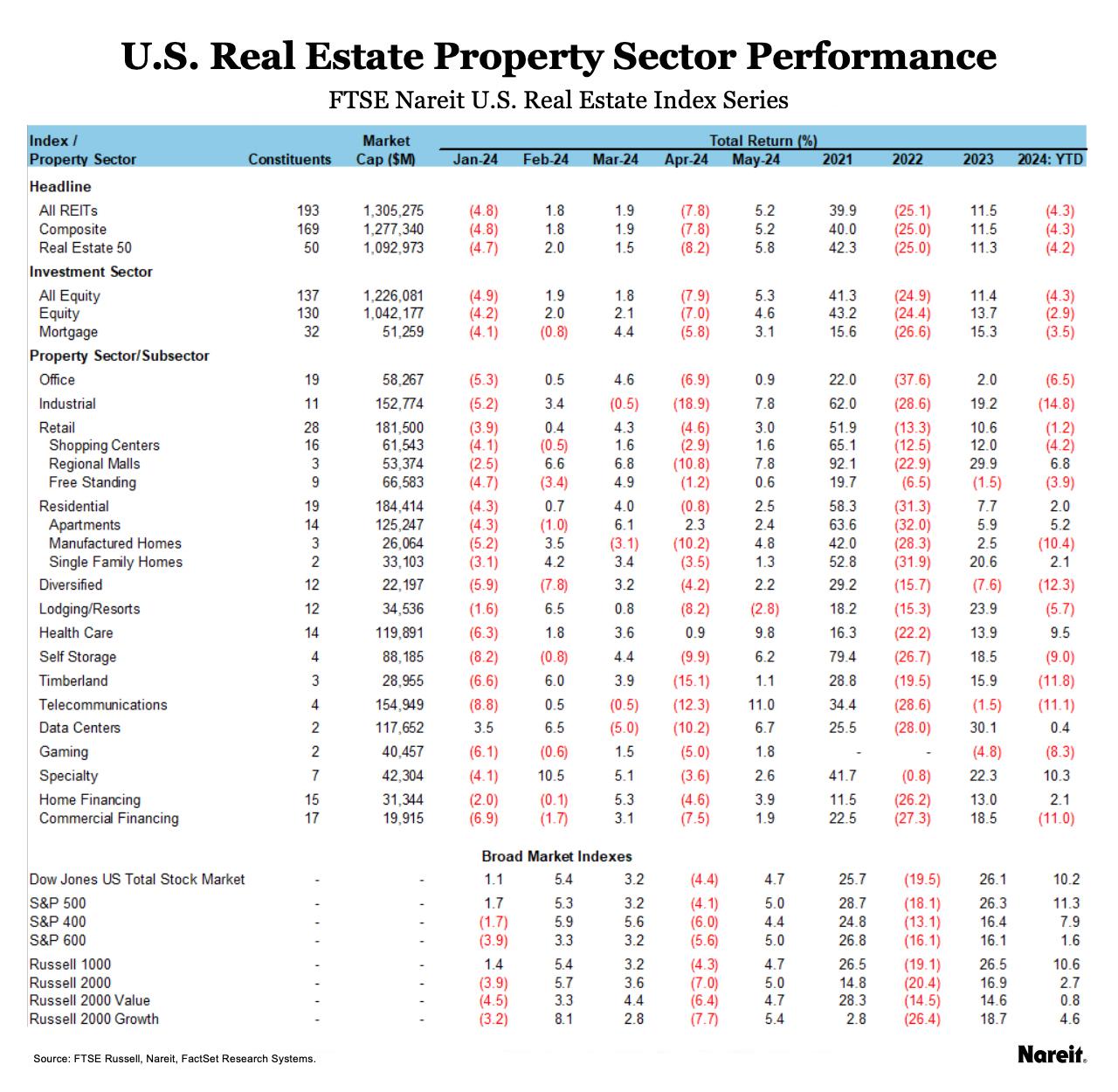

The FTSE Nareit All Equity REITs Index posted a total return of 5.3% in May, marking the strongest monthly performance of 2024 and outperforming broader equity markets. The Russell 1000 and Dow Jones U.S. Total Stock Market both rose 4.7%. Through June 12, the All Equity REITs rose 0.5%, while the Russell 1000 was up 2.6% and the Dow Jones U.S. Total Stock Market was up 2.5%. Inflationary measures remain higher than the Federal Reserve’s target, leading most investors to expect that if there are rate cuts this year, they will occur toward the end of the year.

As of May 31, the dividend yield on the FTSE Nareit All Equity REITs index was 4.19% and the FTSE Nareit Mortgage REITs Index yielded 12.48%, compared to 1.32% for the S&P 500. The yield on the 10-Year Treasury fell 19 basis points to end the month at 4.49%.

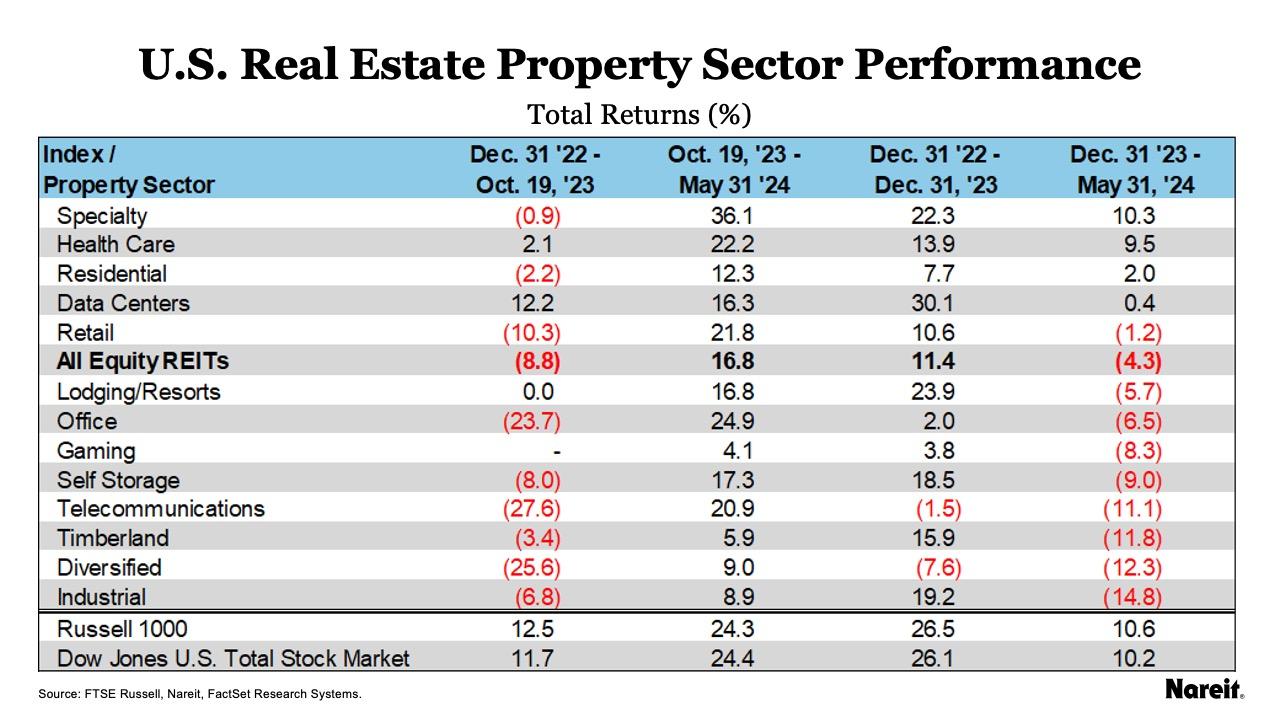

As shown in the above table, since Oct. 19, 2023, the All Equity REITs index is up 16.8%, and has reversed some losses earlier in the year to post a year-to-date total return of -4.3%. Since the middle of October 2023, the Dow Jones U.S. Total Stock Market is up 24.4%, and the Russell 1000 is up 24.3%. On a year-to-date basis, the Russell 1000 is up 10.6% and the Dow Jones U.S. Total Stock Market is up 10.2%.

Telecommunications led in May with a total return of 11.0%, followed by health care at 9.8% and industrial at 7.8%. At the sub-sector level, regional malls led with a return of 7.8%. Lagging sectors were timberland with a return of 1.1%, followed by office at 0.9%. Lodging/resorts was the only sector to post negative returns at -2.8%. On a year-to-date basis, specialty continues to lead with a return of 10.3%, followed by health care at 9.5%, and residential at 2.0%.

The FTSE Nareit Mortgage REITs Index rose 3.1% in May and is down 3.5% year-to-date. Home financing rose 3.9% and commercial financing was up 1.9%. Year-to-date, home financing is up 2.1%, while commercial financing has declined 11.0%.