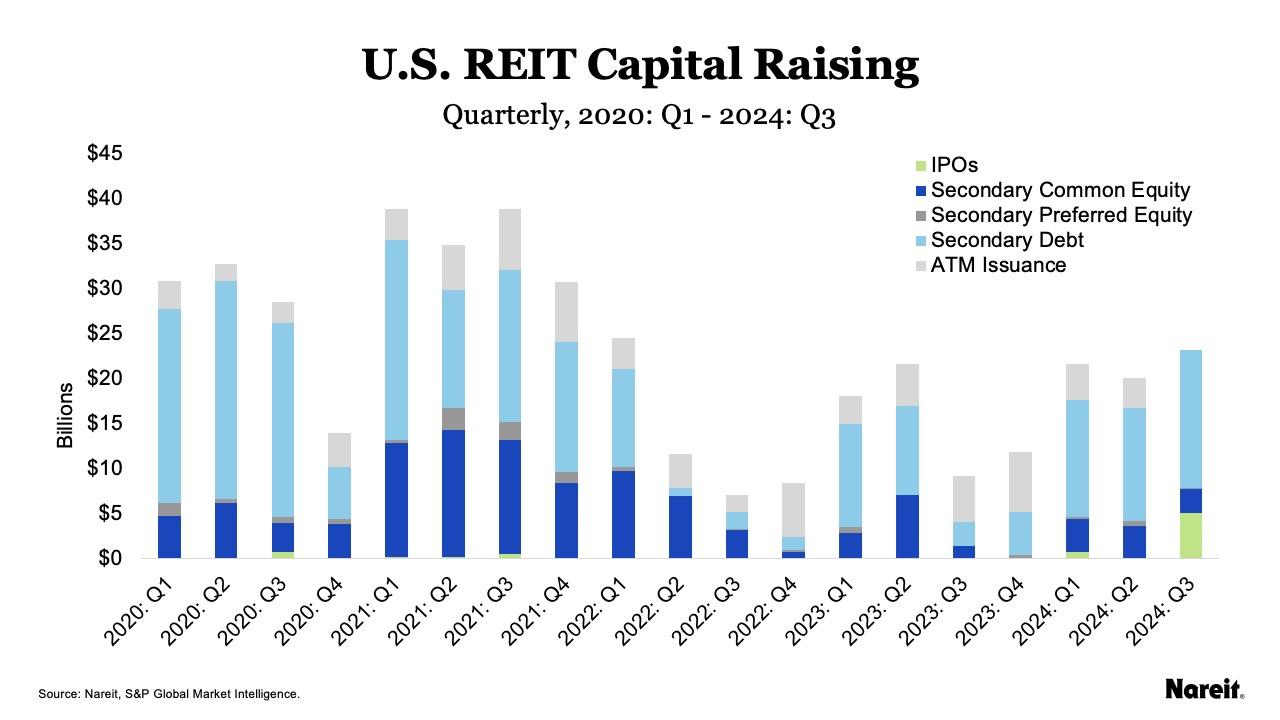

U.S. REITs raised $23.3 billion from secondary debt and equity offerings in the third quarter of 2024; $15.4 billion came from debt, $5.1 billion was raised in one IPO, and $2.8 billion came from secondary common and preferred equity offerings. The July IPO remains both the largest IPO of 2024 and the largest REIT IPO ever. Nareit’s historical capital offerings summary can be found here.

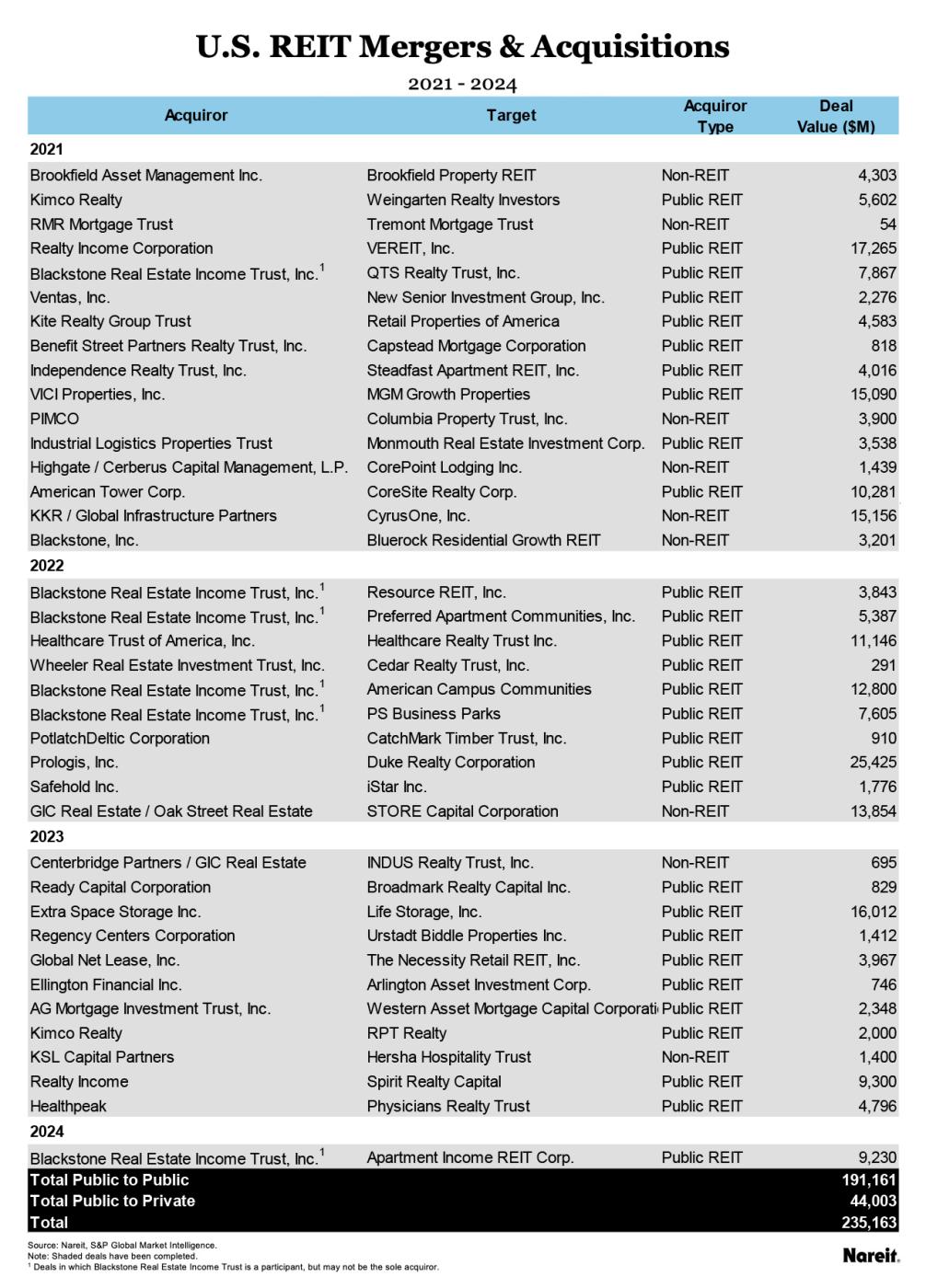

There were no mergers or acquisitions in the third quarter. M&A activity has been notably cool in 2024, with one deal completed for $9.2 billion. In 2023, $44 billion in acquisitions of publicly traded U.S. REITs was announced. Of the $272 billion in public REIT M&A from 2019–2024, 56% of the transaction value represents deals between listed REITs in the same property sector.

Robust Capital Raising Activity Shows REITs’ Access to Debt and Equity Markets

Equity issuance is $10.8 billion year-to-date, excluding at-the-market (ATM) offerings, with $9.9 billion coming from common equity and $921 million coming from preferred equity. As of the second quarter of 2024, REITs raised $7.4 through ATM offerings compared to $7.8 billion in the second quarter of 2023 and $19.6 billion for all of 2023.

The chart above details capital issuance from the first quarter of 2020 to the third quarter of 2024. Year-to-date, REITs have raised $40.8 billion through secondary debt offerings, which is significantly higher than the $23.9 billion raised during the same period in 2023. Notably, debt issuance rose 24% quarter-over-quarter for a total of $15.4 billion in the third quarter, compared to $2.7 billion in the third quarter of 2023. In the third quarter, the average yield to maturity for REIT unsecured debt offerings was 5.2% with an average spread to similarly dated treasuries of 1.4%.

M&A Activity Continues to Be Subdued in 2024

One deal has been announced and completed in 2024, with a value of $9.2 billion. This stands in contrast to 2023, which saw the announcement of 11 deals to acquire publicly-listed REITs. The total transaction value of those deals was $44 billion with 95% of the value reflecting acquisitions by listed REITs. In 2022, 10 deals to acquire publicly-listed U.S. REITs were announced, representing a total deal value of $83 billion.

The chart above shows M&A activity since 2021. Over the past three years, deals for 37 REITs were either announced or completed. Of the $225 billion represented by these acquisitions, 81% is attributed to acquisitions by other public REITs.

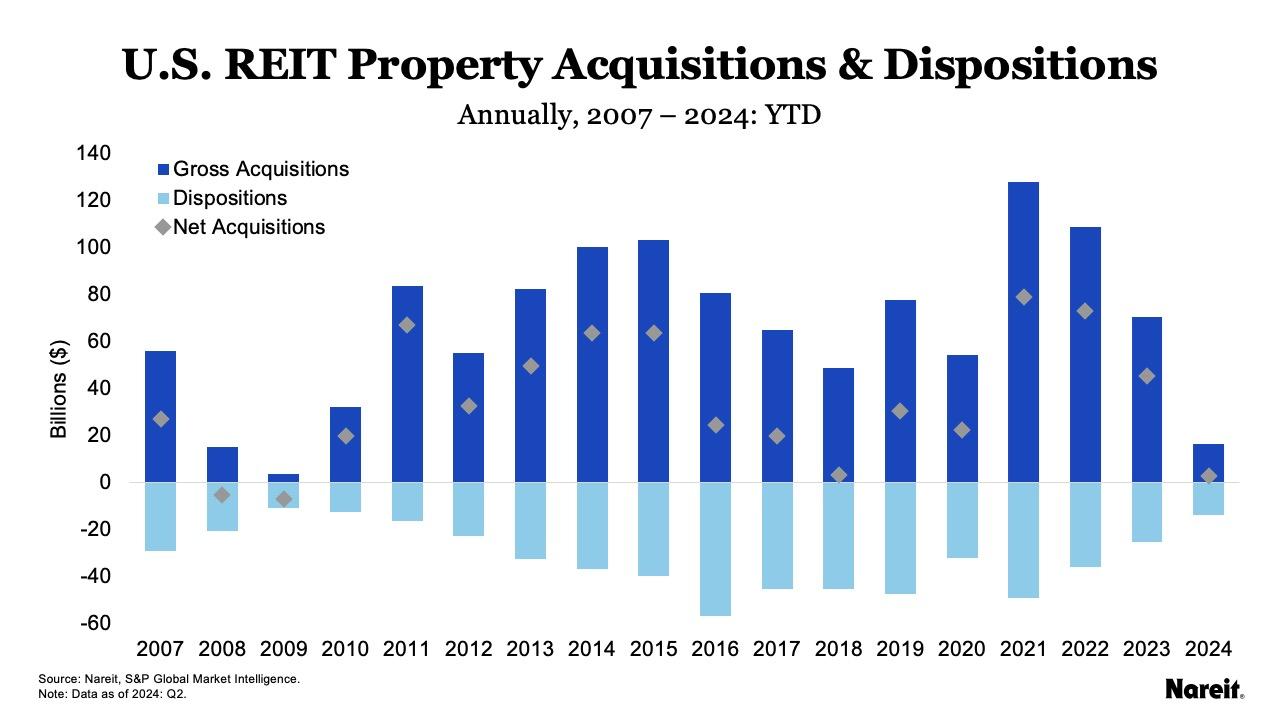

Property Transactions Are Muted

Property acquisitions for the second quarter of 2024 totaled $7.3 billion with $6.1 billion in dispositions compared to 2023, which saw $70.7 billion in acquisitions and $25.7 billion in dispositions.

The above chart shows property acquisitions and dispositions over the past 17 years with a notable decline in both activities since 2022. In the second quarter of 2024, health care, industrial, and retail led with acquisitions of $1.6 billion, $1.5 billion, and $1.0 billion, respectively. See Nareit’s quarterly performance tracker for further details.