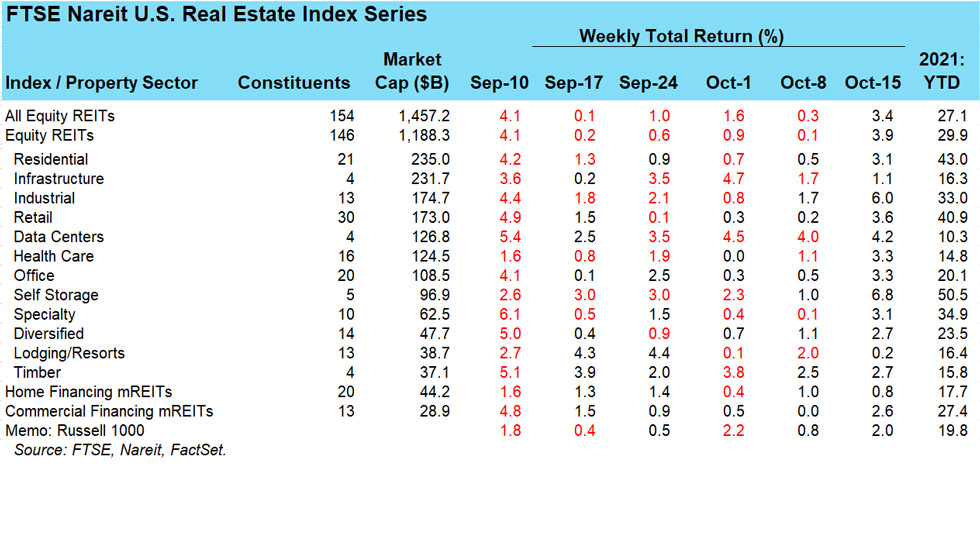

A robust rebound lifted share prices of REITs last week, with a total return of 3.4% on the FTSE Nareit All Equity REITs Index. Last week’s gain, which came after five consecutive weeks of downward moves, brought year-to-date returns to 27.1%. Broader markets were also up, with a 2.0% return on the Russell 1000 and 1.8% increase in the S&P 500. The Russell 1000 and S&P 500 continue to lag REITs so far this year, with year-to-date returns of 19.8% and 20.4%, respectively.

Every REIT property sector rose last week. The largest increases were in the self storage and industrial sectors, with returns of 6.8% and 6.0%, respectively. Six other property sectors had returns of 3.0% or more: data centers, retail, health care, office, residential, and specialty.

This week’s 3.1% return by residential REITs together with a 0.5% increase last week lifted their market capitalization to $235.0 billion, making residential the largest property sector by market cap. Infrastructure REITs are a close second, with $231.7 billion in market cap.

Mortgage REITs rose last week with a 0.8% return for home financing mREITs and a 2.6% return for commercial financing mREITs.