In 2024, U.S. listed REITs distributed approximately $66 billion in dividends, as reflected in Nareit’s REIT Industry Tracker. The composition of dividends varies between REITs and over periods of time. REIT dividends can be categorized as ordinary income–taxed at the shareholder’s individual income tax rate, capital gains–taxed at the capital gains tax rates, and return of capital (ROC)–not immediately taxable, but reduce the taxpayer’s cost basis.

In addition to reporting the taxable breakdown of dividends, the project notes if a 1099 has been corrected, although this is exceedingly rare and no listed U.S. REITs have issued corrected 1099s in recent years.

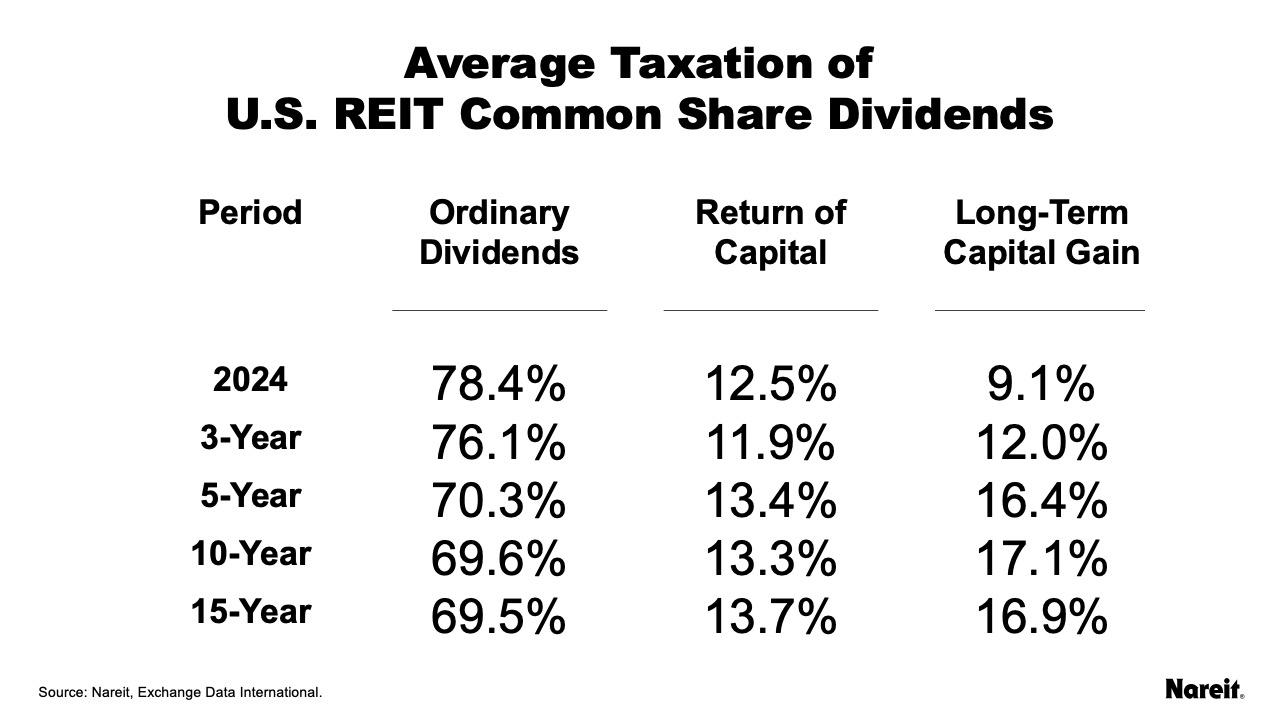

As shown in the above chart, 78% of REIT common share dividends were taxed as ordinary income, 9% as long-term capital gains, and 12% as return of capital in 2024. In the prior tax year, 79% of REIT common share dividends were taxed as ordinary income, 11% as long-term capital gains, and 9% as return of capital.

As the table above shows, a significant portion of REIT dividends can qualify as capital gains and as return of capital.

Background

To broaden REIT investment among both dedicated and generalist investors, Nareit began working with ICI and SIFMA 30 years ago to establish procedures to assist Nareit corporate members in the timely and accurate reporting of the taxable breakdown of their dividend distributions.

As the project has evolved, Nareit has created processes where the data can be sent directly to service providers, with these procedures aiming to streamline reporting of essential dividend distribution data while ensuring accuracy and timeliness. Nareit encourages members to submit their tax allocation data by the deadline requested by the brokerage community and is aware of very few amendments to 1099s over the years.

Details from Nareit’s Year-End Tax Reporting Project, including the taxability of individual REIT dividends, can be found here.

Nareit is aware of several third-party service providers, each unaffiliated with Nareit, that offer customers year-end REIT tax reporting on spreadsheets and other formats, including Broadridge, EDI, and Wall Street Concepts. This information about providers does not constitute endorsement or recommendation by Nareit. Nareit urges all potential users to verify and investigate potential data providers and related services. If your business provides a similar service to customers and would like us to list its information here, please use this online information form.