The FTSE EPRA Nareit Global Extended Index Series (pdf) represents an expansion of real estate property sector coverage to pick up new and emergent sectors. This includes telecommunications and timberland, and additional securities beyond what is currently eligible for the FTSE EPRA Nareit Global Index Series, based on the membership of these companies in the FTSE Nareit All Equity REITs Index.

As of Dec. 31, 2024, the Developed Extended Index was made up of 374 companies with a combined market cap of $1.9 trillion compared to the Developed Index which was made up of 361 companies with a combined market cap of $1.7 trillion. From 2014 to 2024, the Developed Extended Index posted a 10-year compound annual total return of 3.8%, compared to 3.2% for the Developed Index.

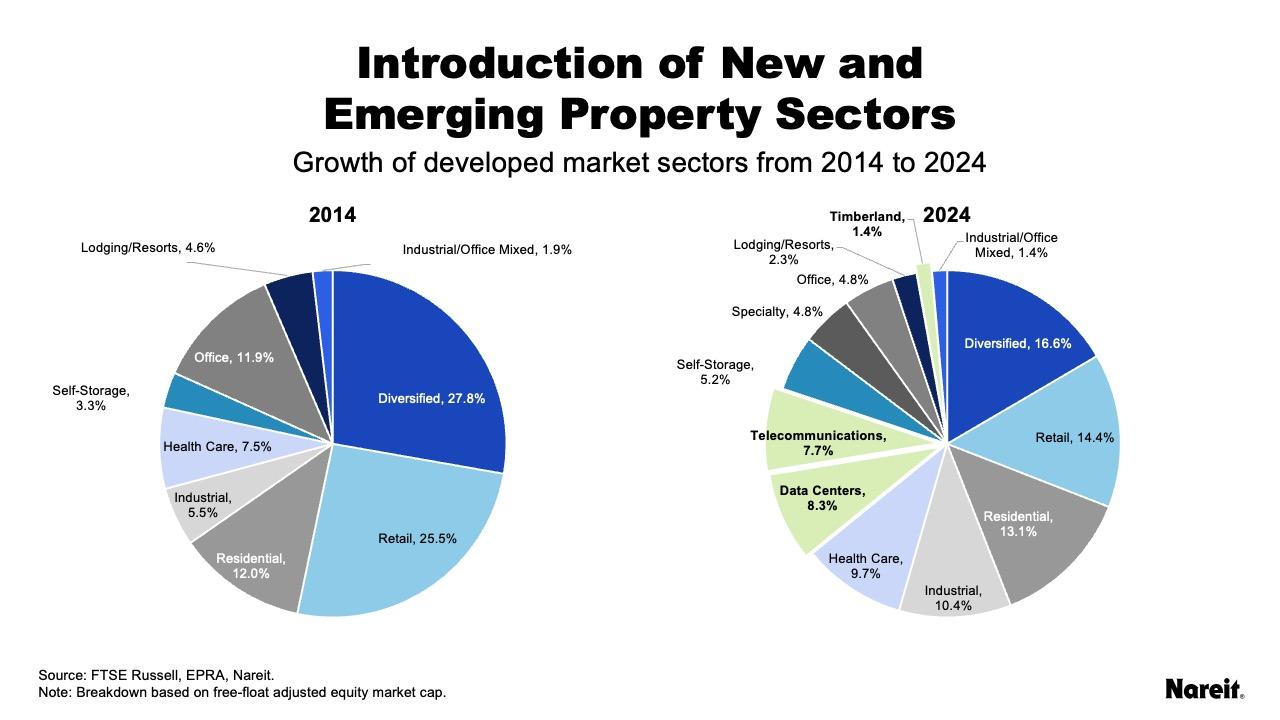

The FTSE EPRA Nareit global series is constantly adapting to the changing landscape of real estate investing. As shown above, property sectors outside of the traditional four property types and diversified now account for more than 39% of the market cap of investable developed markets as of Dec. 31, 2024. This compares with just over 15% as of year-end 2014. This growth was driven, in part, by the introduction of data centers and telecommunications, which make up 16% of the Developed Extended Index weight as of year-end.

FTSE EPRA Nareit Provides the Broadest Global Real Estate Coverage

The intention of the Extended indices is to offer exposure to new and emergent property sectors that diverge from traditional notions of real estate, such as telecommunications. An area of noted interest from global real estate investors has been the inclusion of global cell tower operators that operate businesses similar to U.S. telecommunications REITs.

Accordingly, at the 2024 fourth quarter review of the FTSE EPRA Nareit Global Real Estate Index Series it was announced that eligibility for inclusion in the Global Extended indices will be expanded to cover telecommunications services (ICB 15102015) companies that own cell tower infrastructure and operate it for external telecom operators. These companies must derive at least 75% of their revenues from rental activities and/or services provided to external telecom operators.

This methodology update reflects the goal of the index partners to maintain the broadest, most inclusive representation of the global real estate opportunity set, while maintaining the ability of clients to tailor exposure to fit their investing goals. Please contact FTSE Russell to inquire about subscribing to the FTSE EPRA Nareit Global Real Estate Index Series.