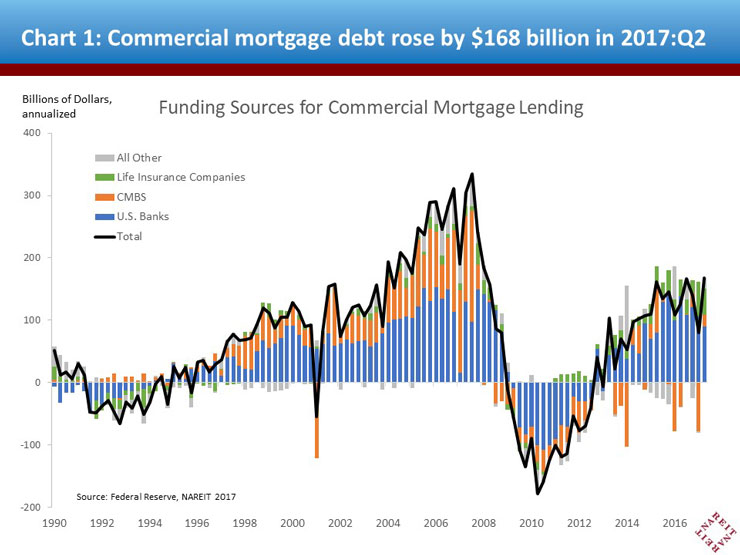

Two of the warning signs of a late-cycle real estate market are if rapid growth of mortgage debt leads to high leverage and precarious financial positions of investors in commercial real estate, and if debt-financed transactions fuel unsustainable property price increases. Recent data on commercial mortgage lending from the Fed’s Financial Accounts of the United States show an increase of $168 billion (at an annual rate) in the second quarter, the largest increase in commercial mortgage debt since the first quarter of 2008 (chart below, black line). Taken at face value, debt growth reaching a new high for the cycle warrants careful attention.

A broader historical perspective, however, suggests that the recent pickup in lending is still far from an “overheating” pace. Indeed, while growth of mortgage debt in the spring was the fastest to date in this real estate cycle, debt growth was only half the pace prior to the financial crisis, when lending peaked at an annualized $334.1 billion in 2007:Q3.

Commercial mortgage lending over the past two years has been provided by a broadening set of sources. Commercial banks have been the mainstay of lending, providing more than three-quarters of the total increase in commercial mortgages since 2013. In the second quarter, however, the bank share slipped to just over half (blue bars). The CMBS market provided a modest amount of credit in the second quarter, following several quarters where maturities of CMBS issued prior to the financial crisis exceeded issuance of new CMBS (orange bars). It is an encouraging sign for commercial real estate that net CMBS issuance has turned positive, as the market is moving past refinancing the “wall of maturities” issued 10 years earlier.

Life insurance companies have been another growing source of funding in the commercial mortgage market. Net lending by insurers was $42.3 billion (annual rate) in the second quarter (green bars). Total commercial mortgage loans at life insurance companies are up 10 percent over the past year, a growth rate this sector has not seen since the 1980s. Just as too much debt growth can be problematic for the real estate sector if it leads to overheating, too little debt can starve property markets from the financing they need for normal investment and development purposes. The broadening of lending flows to include greater participation from life insurers and CMBS issuance is a sign of a healthy lending market.

Balance sheets have benefitted from the restrained pace of borrowing during the current cycle. Leverage, measured as the ratio of total debt to book assets of nonfinancial noncorporate businesses (which include most private investors in commercial real estate), stood at 27.0 percent in the second quarter, according to balance sheet data in the Financial Accounts. This book leverage ratio is 6.0 percentage points below the peak in 2009, and the ratio of mortgage debt to book assets is 4.4 percentage points below its prior cycle peak. This sector includes many firms in businesses not related to real estate, and their more limited use of mortgage debt pulls down the reported overall leverage for the sector. The main driver of debt ratios for total noncorporate businesses, however, is mortgage debt on commercial properties. These book value ratios, furthermore, understate the improvement in overall balance sheet positions, as the growth in commercial property prices has generally outpaced growth in mortgage debt outstanding, sometimes by 10 percentage points or more (Chart below, orange line). A mark-to-market measure of total assets and these balance sheet ratios would show even greater reductions in leverage since prior to the finanical crisis.

Lending in the multifamily mortgage market has eased slightly. Multifamily mortgage loans rose at a $93.1 billion annual rate in the second quarter, roughly in line with the pace in the first quarter. For the first half of the year, multifamily lending was running 16.1 percent below the pace over the prior four quarters. Transactions in the apartment market have slowed a bit this year, and lending has followed suit. GSE mortgage pools provided about half the net increase in funding for the multifamily mortgage market in the second quarter, with commercial banks and life insurers accounting for most of the rest of the lending.