In a recent market commentary Nareit released results from its membership survey about the impact the COVID-19 pandemic had on April rent collection. Since the survey, many REITs have publicly disclosed rent collections for April. Using the public data along with the privately collected Nareit data, this research note presents a fuller picture of the industry’s rent collection for April.

The survey included participation from 54 listed equity REITs representing 44% of the FTSE Nareit All Equity REIT total equity market capitalization. Adding the publicly disclosed data, there are now 70 REITs in the sample, representing $508 billion in equity market capitalization or 56% of the FTSE Nareit All Equity REIT total equity market capitalization. More importantly, we now can publish results for the manufactured home sector and the free standing retail sector.

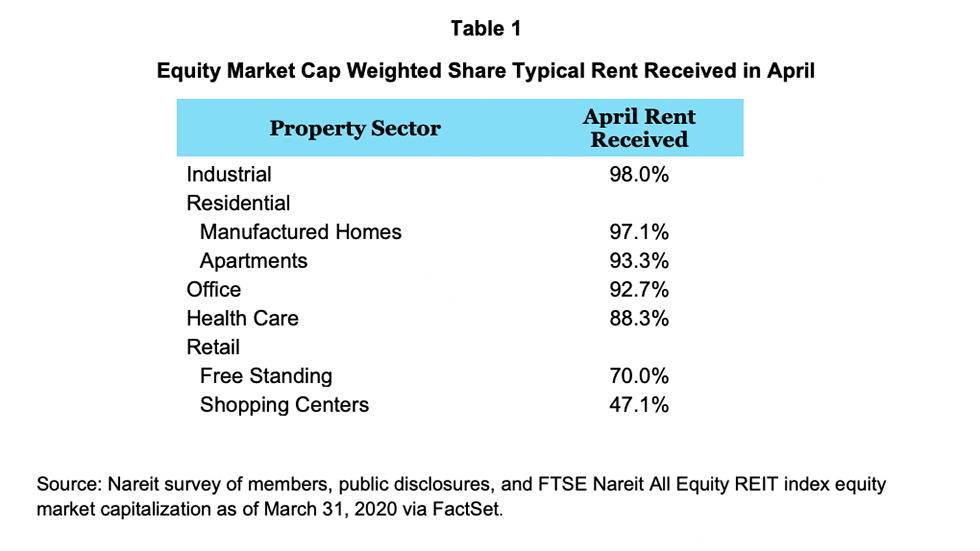

Table 1 shows the estimated REIT property sector or subsector rent collections in April as a share of their typical rent collections, weighted by REIT equity market capitalization. [1]

- Industrial was the strongest performing sector with 98% of typical April rents collected.

- Manufactured home REITs were able to collect an estimated 97% of their typical rents collected in April.

- Apartment collections were around 93%. This is consistent with the National Multifamily Housing Council estimate[2] of 95% of prior month’s rents collected in April as of April 22.

- The office sector’s April rent collections were relatively strong at 93% of typical rents, but the sector’s estimate disguises variation within the sector. For example, publicly disclosed April rents collected ranged from 69% to 99% of rent owed.

- The health care sector’s April rent collection was previously reported at 86% of typical rents and is now estimated at 88% due to additional reporting. The health sector results reflect a mix of business models, with medical office buildings experiencing declines in April rent payments while senior housing, skilled nursing, and hospital rent payments remained stable.

- In the retail sector, there are three sub sectors, shopping centers, regional malls, and free standing. The sample was not representative for regional malls so those results are not presented.

- The free standing subsector collected an estimated 70% of typical rents collected in April, a relatively strong performance for the retail sector. Many free-standing tenants are essential services like grocery stores, drug stores, or banks which are a stabilizing influence for the subsector.

- Shopping centers collected an estimated 47% of typical rents collected, on the higher end of analysts’ estimates that this sector would collect between 30 to 50% of normal rent collections. Tenants providing essential services in shopping centers acted as a buffer.

_______________________

[1] Several REITs both responded to the survey and have subsequently publicly disclosed their April rents; the survey data is used in this analysis. The survey asked respondents both the percent of rent collected this April and the percent of rent typically collected in the month of April. In public disclosures, some REITs only disclosed the percent of rent collected in April. In those cases, we assume typical rent collected is 100%. This assumption likely creates a small downward bias in the estimates as most REITs experience at least some delinquencies in the ordinary course of business.

[2] NMHC Rent Payment Tracker Finds Rent Payment Rate at 95% of Prior Month