During the current lingering public-private real estate valuation dislocation, REIT implied cap rates have reacted to movements in the U.S. 10-year Treasury yield in meaningful ways. Private appraisal cap rates have been less responsive. Sector-specific differences between REIT implied and appraisal cap rates can capture the varying disparities found in market and appraisal-based real estate valuations.

In the fourth quarter of 2024, the public-private cap rate spreads for the office and retail sectors were 84 and 80 basis points, respectively. For property types that have garnered more investor attention, the spreads were considerably wider. The industrial gap was 169 basis points; it was 141 basis points for apartments.

Taking a closer look at the industrial and apartment sectors, it seems that private real estate appraisers and investment managers may be wearing blinders when it comes to the broader investment landscape. The industrial and apartment appraisal cap rates have been lower than and akin to the 10-year risk-free rate for the past 11 and 10 quarters, respectively. Limited transactions may have presented appraisal challenges, but these persistently low appraisal cap rates remain difficult to fathom, much less explain, as they fail to reflect capital market realities.

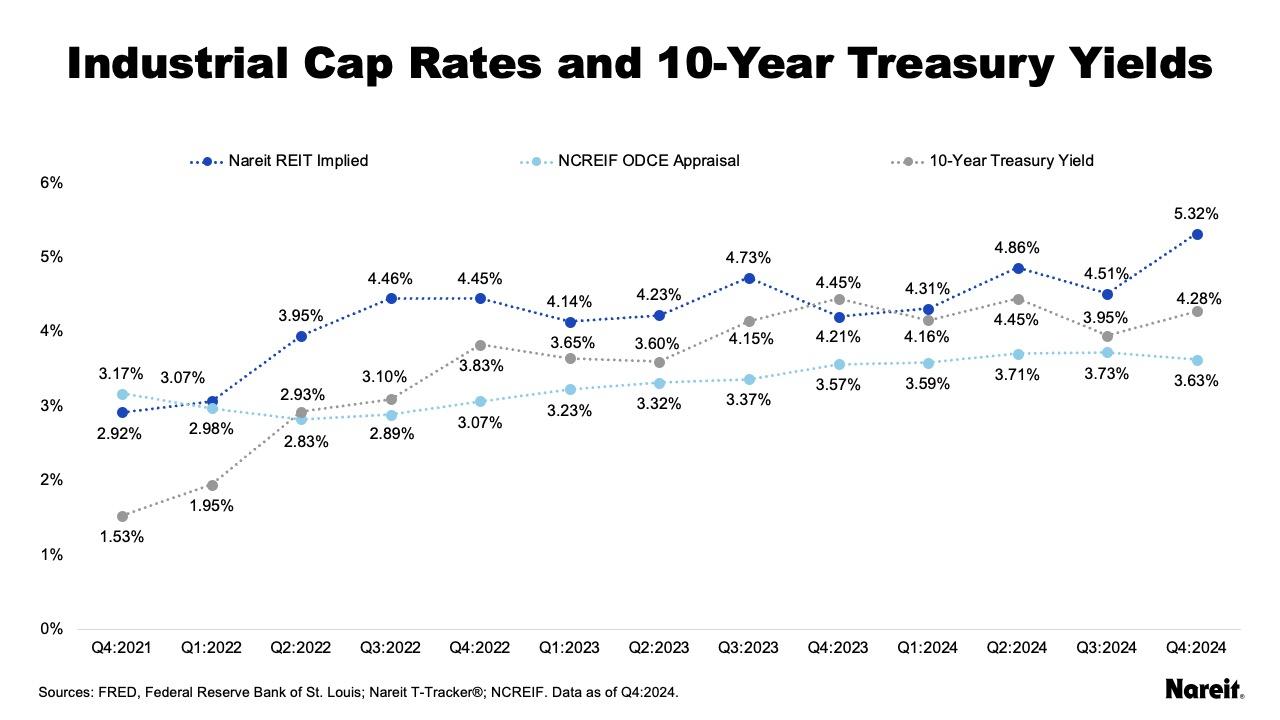

The chart above displays industrial REIT implied and private appraisal cap rates from the fourth quarter of 2021 to the fourth quarter of 2024 using data from Nareit’s REIT Industry Tracker and National Council of Real Estate Investment Fiduciaries (NCREIF) open end diversified core equity (ODCE) funds. It also shows average quarterly U.S. 10-year Treasury yields.

The industrial appraisal cap rate has been lower than the U.S. 10-year Treasury yield for the last 11 quarters; the difference has averaged -51 basis points. Over the same timeframe, the industrial REIT implied cap rate has generally maintained a positive spread over the risk-free rate, averaging 60 basis points. As of the fourth quarter of 2024, both samples of industrial properties had average occupancy rates greater than 95%, but the public and private cap rate spreads relative to the 10-year Treasury yield were 104 and -65 basis points, respectively.

There is no clear rationale or justification for why industrial appraisal cap rates have consistently been below the risk-free rate. Recognizing that the relationship between the industrial appraisal cap rate and 10-year Treasury yield is untenable, material write-downs are likely on the horizon for ODCE industrial properties.

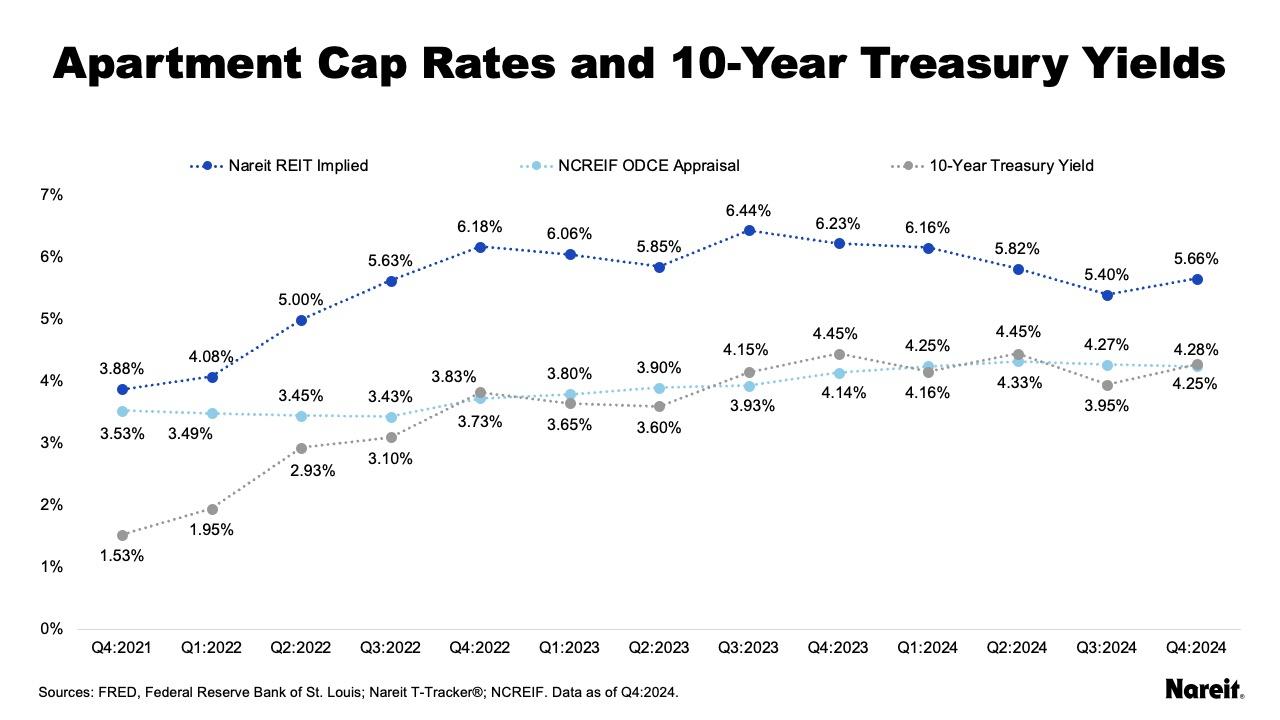

The chart above presents apartment REIT implied and private appraisal cap rates from the fourth quarter of 2021 to the fourth quarter of 2024 using data from Nareit’s REIT Industry Tracker and NCREIF ODCE funds. It also exhibits average quarterly U.S. 10-year Treasury yields.

Over the last 10 quarters, the apartment appraisal cap rate has remained in proximity to the U.S. 10-year Treasury yield; the difference has averaged just 4 basis points. In comparison, the apartment REIT implied cap rate has maintained an average spread of 198 basis points over the risk-free rate for the same time period. It is unclear why the relationship between the apartment appraisal cap rate and 10-year Treasury yield has persisted. It too is unsustainable and ODCE apartment properties are likely to experience future write-downs.

When it comes to private industrial and apartment valuations, it appears that appraisers and investment managers may be wearing blinders. Appraisal cap rates at or below the risk-free rate are difficult to justify, especially for prolonged periods of time. Some investors may appreciate the artificially inflated property values, but they provide a false sense of security. Realizing that capital market realities cannot be ignored forever, write-downs are likely forthcoming for ODCE industrial and apartment properties. While these potential declines likely diminish the attractiveness of private industrial and apartment investment, they may also increase the appeal of their REIT counterparts, as they more accurately reflect current market valuations.