Job growth in January was a robust 467,000, a strong gain in total employment that is even more remarkable considering the challenges caused by the omicron wave of the pandemic. The January jobs report includes additional information demonstrating the momentum the job market has had in recent months. In particular, the annual benchmark revision showed that job gains averaged 575,000 per month in the second half of 2021, a slight acceleration from the 535,000 monthly average during the first half of the year.

Solid macroeconomic fundamentals, including the headline jobs figures, are good news for commercial real estate and REITs, as a growing economy generates increased demand for leased commercial space. The jobs report includes details on employment by industry sector that has additional information about the outlook for different real estate property types:

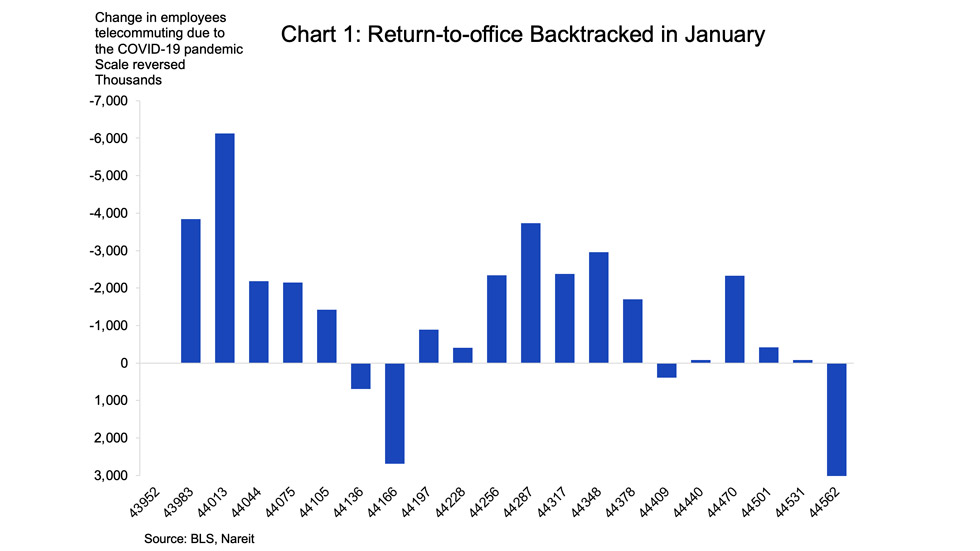

Office markets: The return-to-office is an important factor in the outlook for office real estate (although in the longer run, the peak space needs for team days when most workers are in the office will be the main driver of market demand, not the medium-term path getting to that point). In the early months of the pandemic, 46 million employees were working from home, leaving many office buildings nearly empty during the work week. There has been a steady return-to-office, however, with an average 3.3 million workers returning to the office each month from June 2020 through Dec. 2021.

In Jan. 2022, however, the return-to-office backtracked, as 6.2 million employees went back to working from home. This suggests that the return-to-office may take a bit longer than previously anticipated, at least until the current wave of the pandemic subsides further. It is encouraging to note, however, that while each of the past waves of the pandemic resulted in a slowing or partial reversal of the return-to-office, workers came back again as each wave passed.

Retail properties: Brick-and-mortar retail sales have been facing competition from e-commerce for most of the past decade, and these pressures intensified as many shops and malls shut completely during the initial lockdown phase of the pandemic. Brick-and-mortar retail has had a surprisingly strong rebound as the economy reopened, however, as many consumers still prefer the in-person shopping experience for certain types of purchases.

Employment figures for the retail trade industry sector “General merchandise stores” confirm the recent strength of the retail property sector. This is an important signal, as these are the employees working in the stores that are the tenants in malls and shopping centers. From Mar. 2016 through Feb. 2020 employment in retail general merchandise stores declined 185,000 as many retailers closed stores or, in a number of cases, shut their doors completely. This represents a 5.8% decline in employment in these stores, in contrast to the 6.2% increase in total nonfarm payrolls over this period.

Retail employment has rebounded over the past two years, though, as many stores have hired more workers during the reopening. Employment at general merchandise stores rose 195,000 from Feb. 2020 through Jan. 2022, an increase of 6.5%, and is now back above the earlier peak in 2016. This increase is all the more noteworthy given that total payroll employment is down 1.9% over this period. The recent monthly increases in retail employment suggests that brick-and-mortar retail is continuing to grow.

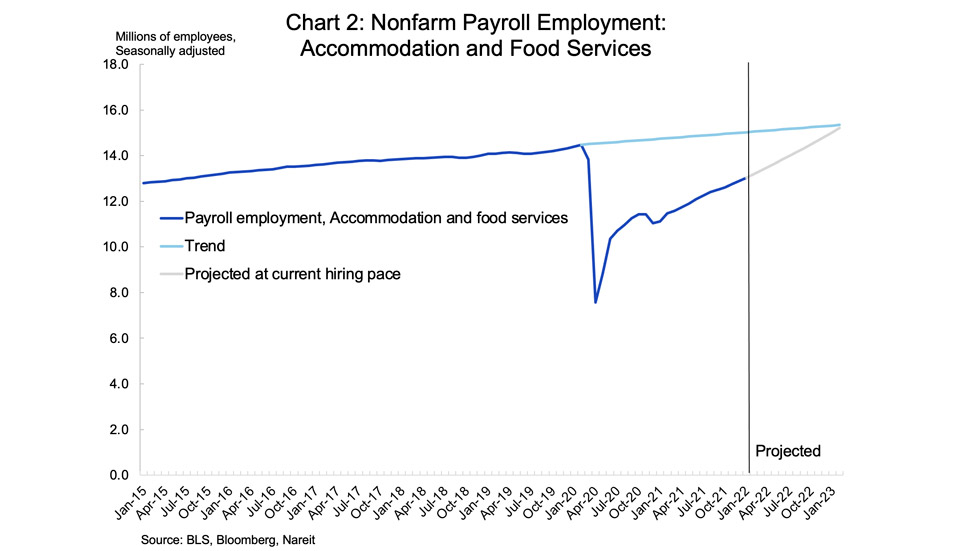

Accommodation and food services. Total employment in accommodation and food services—hotels, restaurants, and bars—fell nearly 50% in the early months of the pandemic, plunging from 14.5 million in Feb. 2020 to 7.6 million just two months later. Labor turnover has been high in these sectors during the reopening, as the JOLTS report shows a record number of employees have been quitting each month.

Employment trends in this sector demonstrate, however, that a steady recovery is underway here as well. Total employment in accommodation and food services has risen 5.5 million from the low point early in the pandemic, reversing more than three-quarters of the initial decline. Moreover, if job growth continues at the current hiring rate, employment in this sector will return to the pre-pandemic trend by Jan. 2023.