The spread of the coronavirus throughout the United States, and efforts to slow that spread, have caused an unprecedented sudden stop to business and consumer activities across the country. Global stock markets have fallen sharply in anticipation of lost revenues and falling asset values. Share prices of REITs moved down as well.

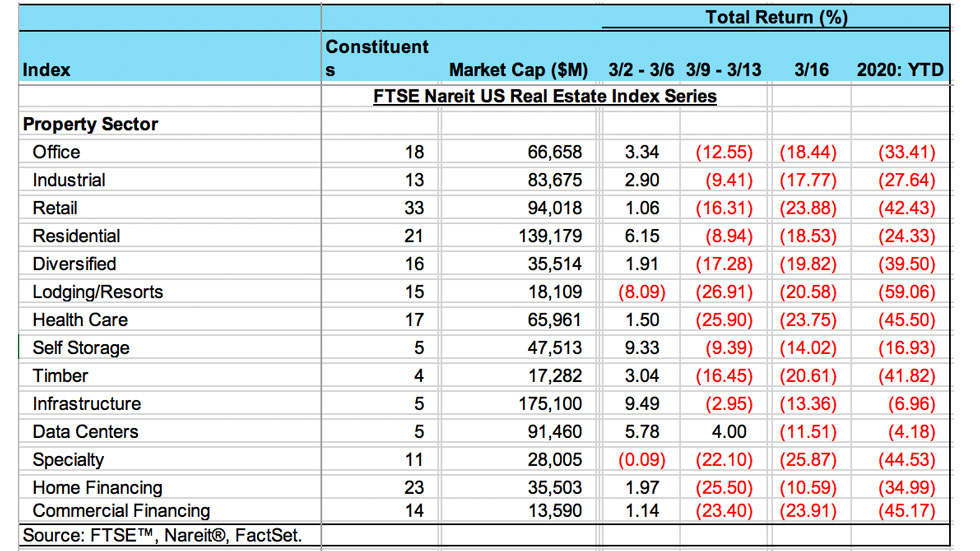

Different property sectors face different exposures to the crisis, however, and REIT returns reflect those differences. The table below reports weekly total returns by property sector for the first two weeks of March 2020, as the crisis intensified, as well as for Monday March 16, when global equity markets posted their steepest decline since 1987, and in the right-hand column, total returns year-to-date:

- Lodging and Resorts have been on the front line of the health crisis as businesses have turned out-of-town meetings into conference calls and consumers have postponed or canceled vacation travel. This sector has posted a total return of -59% YTD through March 16;

- Retail, Health Care, Timber, Specialty and Commercial Financing mREITs. REITs in this group of sectors have also had direct effects from the crisis, and have all had total returns YTD more negative than -40%. In the Retail sector, shoppers are avoiding bricks-and-mortar stores and restaurants are facing state imposed closures; Health Care REITs face tenant departures and a drop off in new tenants; Timber REITs may see less demand for lumber if homebuilding slows during the crisis; and Commercial Financing mREITs have exposures to mortgage delinquencies of any type of commercial property that is partially or completely shut down during the crisis. (Specialty REITs include a wide range of separate types of properties.)

- Office, Industrial, Residential, Diversified and Home Financing mREITs. These sectors face fewer direct effects from the crisis. Most have some protection against near-term market conditions due to the long-term leases with their tenants and the high quality of their properties and high credit quality of their tenant base. Nevertheless, these sectors have all posted YTD total returns between -20% and -40%. These declines reflect investor concerns about how the crisis may cause a recession as well as a general pullback from all risky assets.

- Self Storage, Infrastructure and Data Centers. These sectors are likely to be the least affected by the crisis, and indeed the Infrastructure (which own cell towers that transmit phone and data communications) and Data Centers (which own and operate high-tech facilities that house the servers for the Cloud) may have some upside from increased use of electronic communications as households and businesses avoid direct face-to-face interactions. These sectors had remained in positive territory YTD up to the double-digit drop on March 16.