This case study was published in the 2023 REIT Industry ESG Report, which details the REIT and publicly traded real estate industry's environmental, social, and governance (ESG) performance and features 20 case studies showcasing REIT leadership and ESG innovation from a variety of sectors. The report serves as a practical tool for shareholders and stakeholders to assess the scale and impact of the REIT industry's ESG commitments and initiatives. Applicable footnotes and/or citations for this case study are available in the full report.

Healthpeak Properties, Inc. began linking executive compensation to sustainability performance in 2021 by adopting an ESG performance metric that accounts for a portion of its annual executive cash bonus program. The practice entered its third year in 2023, underscoring the company’s commitment to accountability for sustainability performance at the executive level.

Healthpeak was an early adopter of a formalized sustainability program among REITs. Recognizing the importance of integrating ESG goals into its overall business strategy, Healthpeak’s Compensation and Human Capital Committee of its Board of Directors incorporated the ESG performance metric as part of the annual executive cash bonus program for key executives, including Healthpeak’s CEO, CFO, and COO.

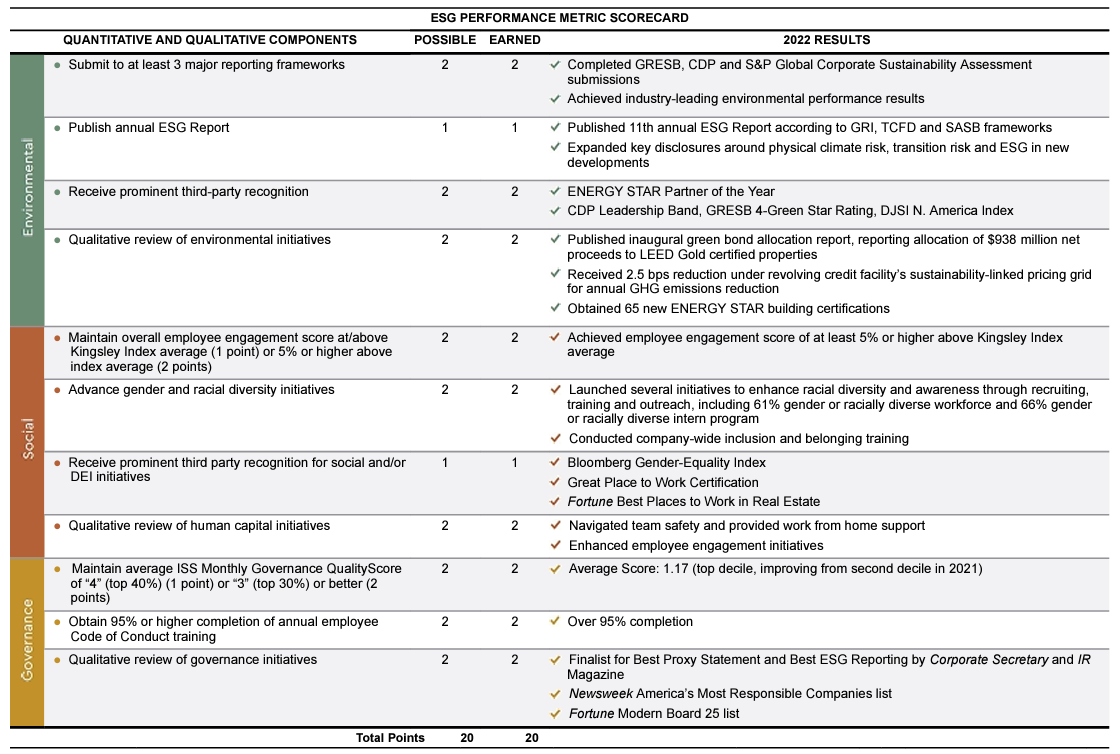

The ESG performance metric accounts for 15% of executives’ overall target-level bonus and is made up of both quantitative and qualitative factors. Recognizing the challenge posed in establishing objective targets that could be measured in a one-year term, Healthpeak’s Compensation and Human Capital Committee focused on factors that the executives could meaningfully and realistically impact in a one-year term and that were significant to the company’s overall ESG strategy, including transparent environmental disclosure; diversity, equity, and inclusion; employee satisfaction; and sound corporate governance. Healthpeak’s comprehensive ESG Performance Metric Scorecard details can be found in itsProxy Statementand includes all components included in the executive cash bonus program.*

For 2023, Healthpeak has enhanced its environmental factors to include key performance indicators relating to building performance and certifications, as well as developing an actionable sustainability strategy.

As more businesses consider how to link executive compensation to ESG performance, Healthpeak is taking a unique approach by including a mix of qualitative and quantitative criteria across the company’s key ESG initiatives. Healthpeak has received positive feedback from its investors and looks forward to continuously improving its program to encourage and incentivize strong performance at the highest levels of the company.

Healthpeak Properties, Inc. is a fully integrated REIT and S&P® 500 company. Healthpeak owns, operates and develops high-quality real estated focused on the aging population and the desire for improved health.