Health Care Showing Signs of Recovery

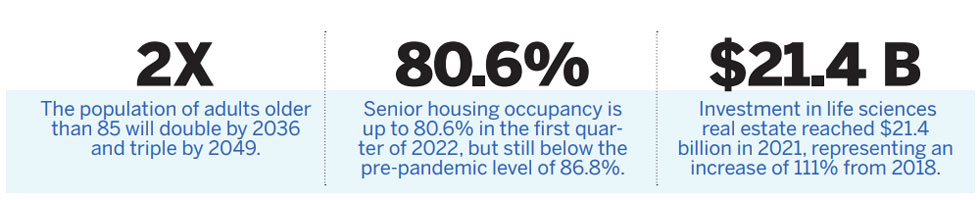

The health care property sector provides real estate that houses seniors and provides medical care for people of all ages, and lab space for medical developments. The health care sector was hit hard by the pandemic, as senior housing occupancy rates fell and some medical offices were forced to stop procedures while costs for COVID-control increased.

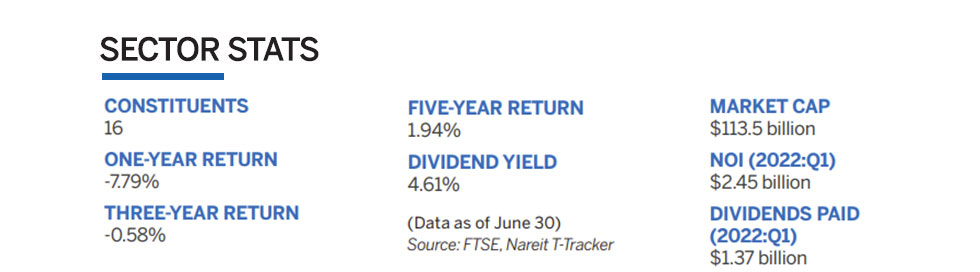

Despite challenges, the latest earnings reports show signs of recovery. In the first quarter of 2022, health care FFO was less than a percentage point below its pre-pandemic level from the fourth quarter of 2019. Yearover-year same store net-operating income in the first quarter was up 6.1%, positive for the first time since third quarter 2019. Health care REIT stocks had a total return of 16.3% in 2021, and in 2022 are one of the best performing sectors with a total return of -10.2% through June 30.

Health care REITs own more than 2,500 senior housing properties, including both assisted living and independent living communities; more than 1,200 skilled nursing facilities; 2,500 medical offices; and more than 200 life science spaces.

Demographics support continued demand for senior housing, as baby boomers age. Medical offices have had robust recovery after initial shutdowns from social distancing measures, and lab spaces are experiencing tremendous growth in the past several years.