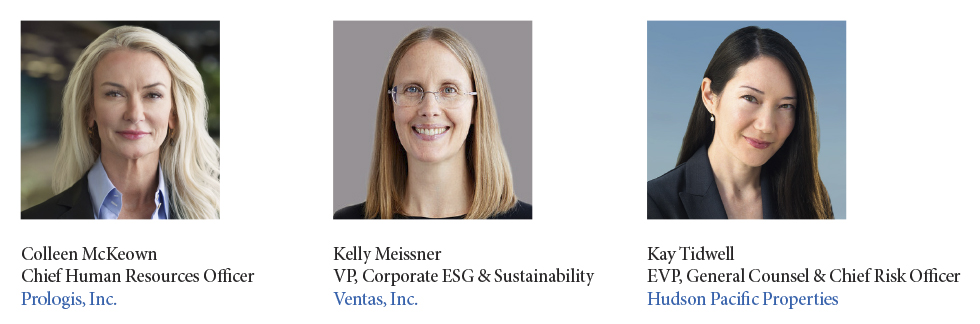

Colleen McKeown

Chief Human Resources Officer

Prologis, Inc.

Cultivating an inclusive and diverse culture is critical to the future of real estate. It’s a key driver of innovation and it’s the right thing to do for our employees and communities. This can take many more forms, from ensuring that our businesses represent the communities in which we operate to opening up more opportunities for people of diverse backgrounds to enter real estate.

At Prologis, we work hard to recruit and retain a talented and diverse employee population. This includes our High Potential Employees (HiPE) rotational program that exposes recent graduate level-degreed hires to key areas of commercial real estate.

In addition, we contribute toward scholarships at our targeted schools and through ULI to encourage people of diverse backgrounds to pursue a degree in real estate or related disciplines. There is still more work to be done, but we remain focused on our goals of supporting our people and fostering a culture of belonging where everyone can advance and thrive.”

Kelly Meissner

VP, Corporate ESG & Sustainability

Ventas, Inc.

The major focus in 2022 for environmental sustainability can be summed up in two D’s: Data and Decarbonization.

It is incumbent on every REIT to collect, assess, and transparently report on their environmental data. Collecting energy, emissions, water, and waste data for your portfolio, including for triple net-leased assets to the extent possible, will help you address your environmental impact and identify cost savings opportunities. Tenant engagement is key, so explain the importance of collecting this data and incorporate utility data requirements into leases, and management agreements. It’s also critical to dedicate internal and/or external resources to collect, scrub, analyze and report on this data.

Pressure to decarbonize is coming from many angles. Energy efficiency is the first step and is an ongoing process as technology evolves. The second critical component is renewable energy. Determine how electricity is procured for your assets (it may be through your tenants) and work with those stakeholders to assess renewable energy opportunities.”

Kay Tidwell

EVP, General Counsel & Chief Risk Officer

Hudson Pacific Properties

The SEC’s new mandate of a universal proxy card in public solicitations involving contested director elections is top of mind. It will be critical for REITs to take a close look at their advanced notice bylaws to ensure they effectively protect the director election process.

The climate crisis has led to shareholder demands for transparency and consistent metrics for quantifying emissions. Climate change disclosure is a top priority for the SEC, and is particularly important for REITs given the real estate industry generates about 40% of all global carbon emissions.

At Hudson Pacific, we address ESG holistically through our Better Blueprint™ corporate responsibility program, which envisions vibrant urban spaces built for the long term and designed around sustainability, health, and equity. As the focus on diversity and inclusion policies strengthens, shareholders want greater disclosure of diversity metrics. This was borne out in Nasdaq’s recently enhanced board diversity disclosure requirements, and this disclosure trend may ultimately extend to the entire workforce.”